Spotlight Back on Binance as CZ Makes His Comeback

|

| By Marija Matic |

The founder of Binance — the largest centralized crypto exchange by trading volume — was found guilty of violating U.S. anti-laundering regulations. That and failing to establish and enforce adequate “know-your-customer” protocols on Binance for U.S. residents.

Regulatory struggles were why Binance had to partner with a U.S.-based company. Binance.us is compliant with U.S. regulations and accessible in most U.S. states, with some restrictions.

However, the U.S. version has challenges of its own.

- It supports fewer crypto

- Trading volume is negligible and

- It does not offer the same advanced trading tools that its overseas users enjoy.

Those are a story for another day.

As for CZ, he was made to pay a $50 million fine for the federal violations. He was also forced to step down from his position as CEO of Binance and step into federal custody for three months.

With his release, investors have begun to speculate big things might be in store for BNB (BNB, “C+”), which acts as a utility token for the Binance Smart Chain ecosystem.

That’s mostly for two reasons.

First, his cooperation with authorities showcases his resilience in the face of regulatory challenges.

CZ’s relatively smooth navigation through regulatory struggles is seen as a victory for the crypto community. This gives a confidence boost to BNB.

After all, it lost its CEO and had to pay $4.3 billion in penalties — separate from CZ’s personal $50 million fine — Binance continues to thrive. CZ’s company has surpassed 230 million users globally.

Second is that CZ remains a key player in crypto. He still holds a majority stake in Binance and boasts a net worth of around $60 billion.

But even someone as influential and important as CZ isn’t solely responsible for the fate of a crypto project.

Indeed, there are three other strengths supporting BNB. And they have been hard at work for a while — well before and throughout CZ’s imprisonment.

Those are …

-

Undeniable Utility: As the utility token for the Binance Smart Chain ecosystem, BNB fuels the blockchain.

Users need it to pay for transaction fees when interacting with decentralized applications (dApps) on BSC. Additionally, BNB holders enjoy discounts on trading fees on Binance, the world's leading centralized exchange.

-

Solid Usage Metrics: While BSC's total value locked peaked at $21 billion in 2021 — when competition for cheap transactions was minimal — its current TVL stands at a respectable $4.85 billion. That is enough to keep BCS as the fourth-largest blockchain by TVL in the market.

Additionally, daily transaction volume hovers around a healthy $700 million.

While there are hundreds of apps on BSC, much of the activity continues to be centered on the decentralized exchange PancakeSwap and lending platform Venus. Together, the two dApps boast a TVL of $3.32 billion.

With roughly one million daily active users, BSC trails only Solana (SOL, “B”) and Tron (TRX, “B-”). This solidifies BNB's position in the top five largest cryptocurrencies by active users.

-

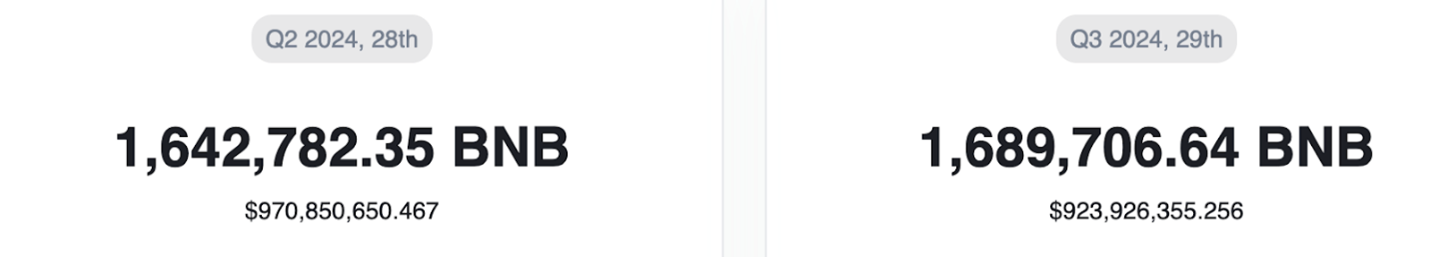

A Powerful Deflationary Mechanism: BNB has quarterly coin burns. These permanently remove a significant amount from circulation.

This process aims to gradually reduce the total supply to 100 million BNB, making it highly deflationary. In July 2024, a staggering $970 million worth of BNB was burned, and another $923 million is expected this October.

BNB quarterly burn stats: bnbburn.info. Click here to see full-sized image.

BNB quarterly burn stats: bnbburn.info. Click here to see full-sized image.Furthermore, BSC utilizes a real-time burning mechanism where a portion of transaction fees are burned with each block of transactions.

This has already resulted in $137 million in burns, with $372,698 burned just last week.

So far, these efforts have effectively reduced BNB's supply from 202 million to under 146 million coins. This helps to ease selling pressure and contributes to its strong performance.

This favorable tokenomics might explain why Solana — which has been the runaway darling this bull cycle — hasn't surpassed BNB for the fourth spot yet.

With its aggressive deflationary approach, robust user engagement, healthy price action and the added confidence boost from CZ's return, BNB is a compelling large-cap cryptocurrency.

And that take is supported by its recent price action. Its year-over-year performance stands at an impressive 167% gain.

And BNB even hit a new all-time high at $717 this past June, before correcting with the broad market.

Investors looking for large-cap opportunities may want to consider BNB for their portfolios.

Best,

Marija Matić