|

| By Chris Graebe |

Last week, I broke down why I wouldn’t touch SpaceX’s tokenized shares.

There were just too many red flags for me.

No matter if you’re looking at the latest crypto launch or a startup with serious potential, you should never ignore those kinds of warning signs.

But what about the green flags?

Well, my colleague Marija Matic laid out some crypto metrics investors should look for.

But, as lead crypto analyst Juan Villaverde pointed out recently, the sort of crazy gains early crypto investors could target are growing increasingly rare.

That’s why today, I want to share my top three startup “green flags”.

Why?

Because I just found a mythical creature in the pre-IPO world: A company that triggers all three green flags and zero red ones.

Successful deals in this sector offered returns as high as 900% … 19,942%, 53,423% and more.

Now those are returns that can rival what early Bitcoin (BTC, “A-”) adopters were able to claim!

Let’s get started …

Green Flag 1: The Founder Still Owns a Big Chunk

Just like in crypto, who is behind a project is just as important as the project itself.

In crypto, decentralized ownership indicates stronger tokenomics.

In startups, however, I want to see the exact opposite.

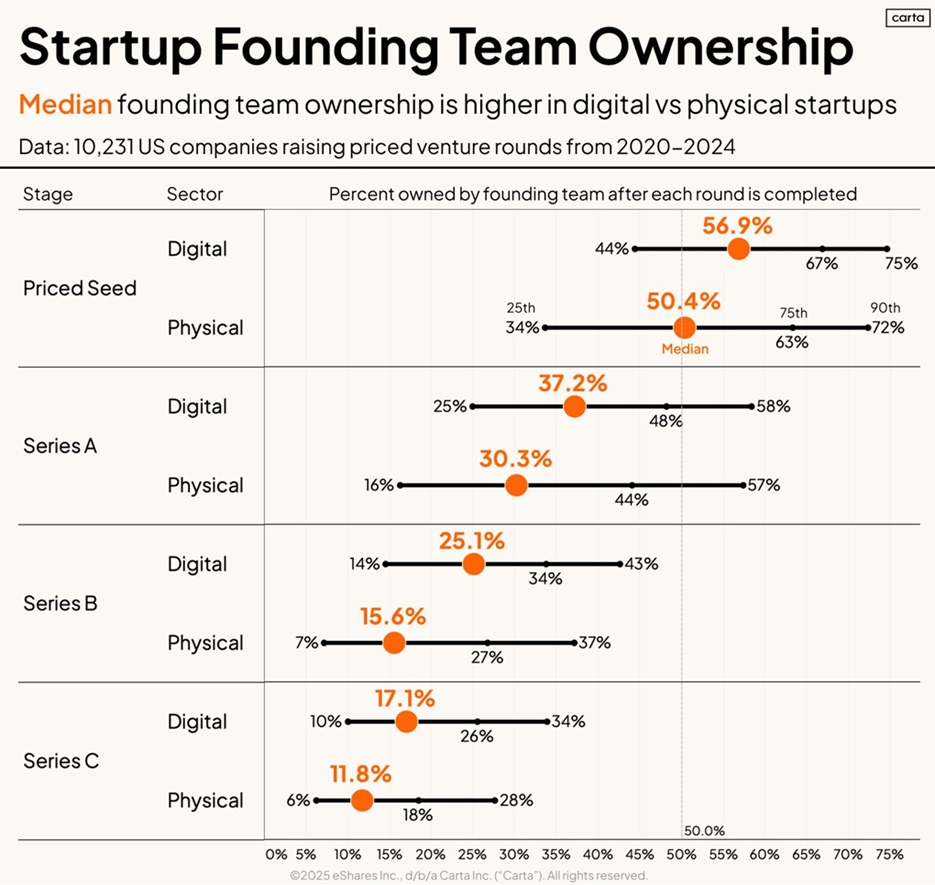

I like to see a founder who still owns 50% or more of the company after raising significant capital ($5 million to $30 million).

This is more than just “skin in the game.” It reveals a few key strengths, such as …

- They raised money the smart way, not necessarily the fast way.

- The founder was able to protect their vision from early dilution.

- And they’re still hungry because their financial upside is very real.

Too many early stage companies have cap tables (which show their ownership structure) where the founders already look like minor shareholders.

That’s not a bet I want to make.

If the upside for them isn’t that exciting, they more than likely won’t strive to deliver life-changing returns to investors they attract during their crowdfunding round(s).

Green Flag 2: Quiet Traction, No Flashy Funnels

In crypto, hype that sends a memecoin shooting to the moon … can dissipate on a whim.

That’s why it’s important to determine if a project has real adoption via on-chain metrics such as total value locked (TVL) and daily transaction volume.

The same is true for pre-IPO opportunities.

A startup with 100,000 followers on social media and no revenue?

I’m probably going to pass on that.

A company that’s quietly doing $500,000 or more in annual sales with zero ad spend? Now you’re talking!

Because organic traction — word-of-mouth, inbound growth, product-led referrals, etc. — is a huge green flag.

It signals the company has found a solid product-market fit, enjoyed some efficient growth and earned customer love.

Think of it this way …

If they can scale without paid marketing, imagine what happens when they do start spending.

Green Flag 3: Smart Money, Early & Quiet

Not all capital is equal.

When I see a founder has raised a big chunk of capital from a big batch of small checks, I pay attention.

That signals a group of high-conviction early stage investors is on board.

Especially if those small checks come from funds or syndicates with a history of spotting breakout companies.

To be clear, I don’t look for the big names.

Rather, I want to see the consistent winners.

The ones who got in early on companies like Stripe, Figma or Rippling before anyone knew the name.

If those folks are writing checks early again? That’s a signal worth watching.

The Payoff

This is the kind of lens I use when searching for potential Deal Hunter’s Alliance deals.

In my cross-country scouting, I dig into all three of these signals and more.

I recently went on such a trip. And, as I teased earlier, I found exactly what I was looking for!

But as you might suspect, when I decide to let the cat out of the bag on what it is, the deal can fill up fast.

In as little as seven hours!

If you want to be one of the first to hear about it, I suggest you watch my latest Private Investment Summit.

Best,

Chris Graebe