|

| By Bob Czeschin |

Most people alive today have only ever known a fiat money system.

You know, one where the volume of currency in circulation is controlled by a tiny monetary elite.

That’s because the dollar’s peg to gold ended in 1971.

This marked the last time a central bank could pay $35 to demand an ounce of gold from the U.S. Treasury.

To those of us with some gray in our hair, that may not sound so long ago. But we’ve already been in this new system for over half a century!

That’s why so many people today think money comes from government …

And that inflation is both natural and inescapable.

However, the last 54 years are not actually the norm.

For most of recorded history, the dominant currency has been a scarce, durable asset. Like gold or silver.

Rather, currency was exchangeable for a scarce, durable asset.

China’s Tang Dynasty, for example, pioneered issuing paper redeemable for gold to make the portability of currency easier.

This sparked a major upsurge in economic activity. After all, it made buying and selling so much easier.

But it also opened the door to fiat currency. Which is what’s left when the gold runs out …

And the paper currency goes back to being just paper.

A Monetary Law of Nature

But here’s the thing: Whenever a reserve currency departs from sound money principles, we see the same results …

Unchecked money printing and devaluation.

This happens every … single … time. No exceptions.

And it’s how currencies die.

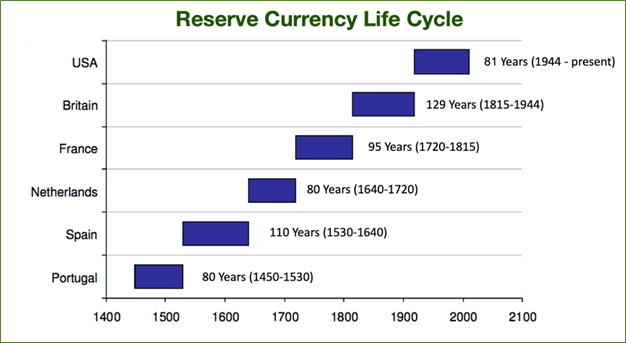

Since the year 1400, there have been six world reserve currencies:

- The Portuguese Real: After the fall of Constantinople in 1453 threatened Silk Road trading routes, Portugal became a trading empire. Which made its silver Real the world’s first international reserve currency.

- The Spanish Real: After Spain’s conquest of Portugal, the silver Spanish Real replaced the Portuguese Real as the dominant currency.

- Dutch Guilder: To finance the Thirty Years’ War, King Phillip II of Spain mixed in cheaper metals. This sent the value of the Spanish Real plummeting. And eventually, the Dutch defeated a militarily exhausted Spain. The spectacular rise of the Dutch East India Company fueled Holland’s ascent as a global trading power and made the silver Guilder the dominant currency of the 17th century.

- French Frank: After the Dutch, France rose to prominence under King Louis XIV. But the silver French Franc was eventually replaced by paper “Assignats” — printed in abundance to fund foreign adventures and royal extravagances. The devaluation this caused helped ignite the French revolution.

- British Pound. Victory at Waterloo and the advent of the Industrial Revolution helped make the British Pound the new world reserve currency. Bank of England-issued banknotes, fully backed by gold, established what we now call the Gold Standard.

But then WWI forced Britain to suspend the gold standard. And WWII put even further strain on the economy. With those pressures, the British Empire effectively bankrupt.

Each one of these reserve currencies lasted between 80 and 129 years.

That brings us to the current reserve currency: the U.S. dollar … which has already held its position for 81 years.

With the rest of the world in shambles, America emerged from World War II as an economic superpower built on sound money.

The 1944 Bretton Woods agreement (signed by 44 countries) pegged world currencies to the U.S. dollar — which was fully backed by gold.

But a couple decades later, balance-of-payments deficits resulted in so many dollars circulating abroad that a run on U.S. gold reserves developed.

Plus, the high cost of the Vietnam War threatened to cripple government finances.

So, in 1971, President Nixon abandoned the gold standard.

That halted gold outflows … and allowed Washington to simply print however many dollars it needed.

What happened next was totally predictable. Because it’s what always happens.

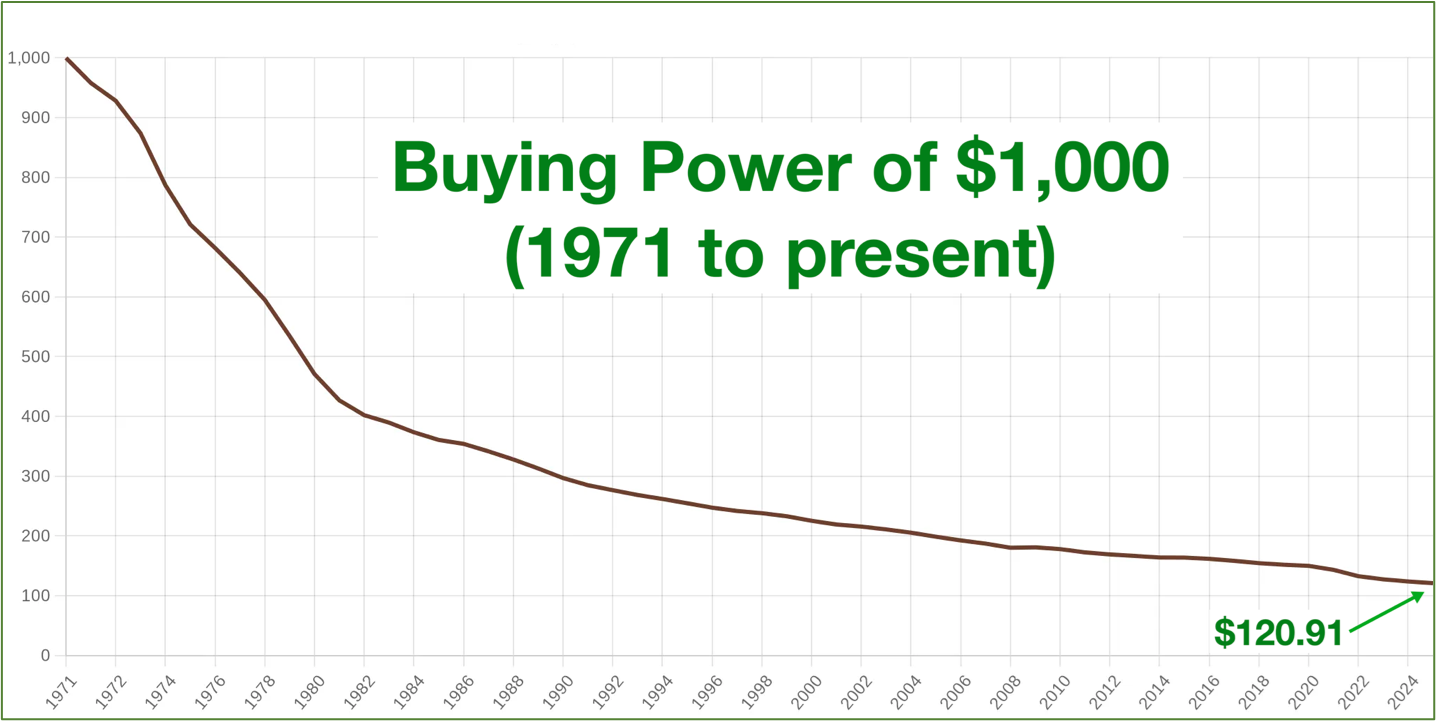

The dollar plunged! In this case, it fell a whopping 87.8%.

That’s right, $1,000 worth of purchasing power in 1971 has fallen to a meager $120.91 today.

The dollar’s purchasing power cratered 88% since 1971. Source: OfficialData.org

We’ve seen this movie before.

In Portugal, Spain, Holland and Britain.

A once-robust reserve currency backed by sound money morphs into fiat in reaction to black swan events before it finally collapses.

The U.S. dollar is on the same path as all its predecessors. I don’t expect to see a different outcome this time.

The question then becomes, what will replace the dollar?

As Satoshi Nakamoto — the anonymous creator of Bitcoin — put it: The root problem with conventional currency is the trust required to make it work.

The central bank must be trusted not to debase the currency.

But the history of fiat currencies is full of breaches of that trust.

That’s why, in my mind, the most likely successor to the dollar as a reserve currency is Bitcoin.

BTC is trustless and decentralized.

Because all transactions on the blockchain are transparent, verifiable and immutable … countries do not even have to trust each other to transact in Bitcoin.

That also means no country can prevent another from using it.

This robust neutrality makes it especially attractive to countries that have been targets of sanctions. Or fear they could become targets.

I’m not alone in my assessment.

Because of these qualities — and because it offers a safe-haven store of value akin to gold — governments are already accumulating and using BTC.

- U.S.: At Bitcoin2025 in Las Vegas, Wyoming senator Cynthia Lummis said that she and Commerce Secretary Howard Lutnick had just been given the green light by President Trump to acquire Bitcoin for the Strategic Bitcoin Reserve project if it’s cost-neutral or cost-positive.

- And on the state level, Utah, Florida, Colorado and Louisiana all accept — or are considering accepting — Bitcoin payments for taxes and fees.

- Brazil: Rio de Janeiro has held 1% of its treasury reserves in Bitcoin since 2023.

- El Salvador: This country was the first to accept Bitcoin as legal tender back in 2021.

- Switzerland: The Swiss canton Zug and city of Lugano both hold Bitcoin and accept it in payment for certain taxes and fees.

- Argentina and Paraguay: Both countries have experimented using Bitcoin to pay for bilateral trade.

Looking ahead, what do you suppose will happen when a major central bank — say, the Bank of Japan, the Swiss National Bank, or the Bank of Russia — makes the first public announcement they are holding Bitcoin?

Remember, only 21 million Bitcoin can ever be created.

Such an announcement could easily set off a global race.

The goal? To accumulate Bitcoin in the name of national and economic security.

And that could send prices to the moon … and beyond.

If you’re looking for exposure before that happens, savvy investors should look for pullbacks for better entry levels.

Best,

Bob Czeschin

P.S. Sean Brodrick called gold’s rise to $3,200 nearly to the day.

Now, he says the weaker greenback is helping to create a situation similar to the gold bull market of the 1970s.

One that can get gold to $6,900 … and, for those who watch his brand-new presentation … hand savvy investors the opportunity to 1,000x their gold returns.