The Fed’s Balancing Act Is Bound to Collapse

|

| By Juan Villaverde |

Have you heard that Fitch Ratings downgraded the U.S. credit rating from “AAA” to “AA+”?

That shouldn’t be surprising considering that, as one federal budget expert told CNN, the U.S. is “the only developed nation in the world that talks openly about default.”

In your personal finances, if you default on a loan, you’re perceived as less creditworthy, so your rating suffers. If you want to borrow money, you will be charged a higher interest rate which will, in turn, cost you more in the long run.

And yet, the pundit parade is writing off the U.S.’s downgrade as “irrelevant,” using the lack of direct impact as proof.

But just because the news didn’t hit hard doesn’t mean it isn't flashing a neon sign that something isn’t right here.

And it’s the very fact that pundits don’t care that’s causing us alarm.

See, the U.S. needs to borrow money to pay off its debt — i.e., previously borrowed money. In practice, this strategy is like opening a new credit card to pay off your last one. You know, like trying to douse a fire with gasoline.

But it’s not just the debt that’s a problem. It’s the not-insignificant interest on that debt we have to pay, as well. In fact, the U.S. government is now shelling out more on interest than it does on its own defense.

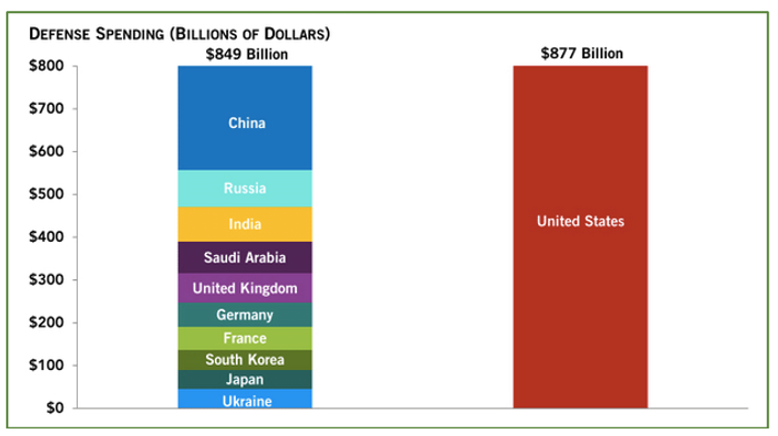

Considering the U.S. spends more on its military than the next 10 countries do on theirs combined, that’s a pretty heavy interest payment!

The U.S. being downgraded by Fitch announced to everyone that we’re not as creditworthy as we used to be. In theory, this should impact our ability to borrow money and increase future interest payments.

So, why isn’t the announcement a bigger deal?

Because this is all part of the magic trick, the casting of an illusion of stability.

It starts with the god-like prowess of the money printer. See, nations that print their own currency have virtually zero nominal default risk. That’s why for decades, with a significant ramping up in the past few years, the U.S. Federal Reserve has turned the printing press on high to meet the demand.

The catch of this strategy is that flooding the market devalues the dollar and sparks inflation.

And that’s why this spectacle turns from a magic trick into a balancing act as it plays the Fed’s two mandates against each other.

The first mandate is to control inflation by means of raising interest rates.

The second mandate is to protect the solvency of the U.S. government … which is thrown into jeopardy if the easy money gets cut off to fight inflation.

Once inflation becomes too big of a problem, the Fed will shut off the printers and raise rates, tightening liquidity and putting the U.S. government in a tight spot.

To help maintain balance, Treasury Secretary Janet Yellen recently began favoring issuance of short-duration Treasury bills over longer maturities.

You see, about $2 trillion is sitting idle in the Fed's reverse repo facility. Created during the Fed's previous monetary spree, this cash cushion hasn't been utilized. Now, it's being tapped into by issuing short-term Treasurys, acting as a sort of "delayed QE."

However, this tactic has obvious limits. Indeed, Yellen’s borrowing agenda for the second half of the year nearly taps out the reserve. Accordingly, the countdown has now begun for the introduction of freshly minted money into the system.

Ultimately, the Federal Reserve — and other central banks — will do whatever necessary to keep their hopelessly addicted, borrow-and-spend governments solvent as long as possible.

In the end, that will mean endlessly printing money until its value goes to zero, the final fate of all paper currencies.

But a funny thing happened on the way to the apocalypse: the advent of the cryptocurrency revolution. Bitcoin offers an incarnation of money beyond the reach of governments or central banks to corrupt.

Put some of your savings in it. And watch it multiply as more and more ordinary people flock to crypto as a safe haven from the confines of the doomed legacy financial system.

|

Alex Benfield’s Notable News, Notes and Tweets

- As a surprise to no one, the Securities and Exchange Commission is appealing the decision in the Ripple (XRP, “B”) case.

- Given the recent developments around the new PayPal (PYPL) stablecoin, the introduction of the eye-scanning Worldcoin (WLD, Not Yet Rated) and the numerous exchange-traded fund applications, crypto personality Scott Melker sees many bullish headwinds for Ethereum (ETH, “B”).

- We haven’t talked about Bitcoin (BTC, "A-") mining in a while, but the State of Texas is now incentivizing Bitcoin mining using the energy from excess flared gas through tax exemptions.

- Alex Benfield recently recorded a deep dive interview on the BlackRock Bitcoin ETF applications with Jessica Borg.

What’s Next

The traditional banking systems are performing an impressive high-stakes tightrope walk, balancing precariously between seemingly reckless choices and the ever-looming shadow of debt.

With central banks strategically playing their cards and governments following suit, it's the everyday Jane and Joe who will feel the tight squeeze.

Outside the circus tent stands the emerging world of crypto, bursting with new possibilities for those looking for innovative opportunities.

Yes, the space is still volatile and growing. But it shines with promise and potential, suggesting a viable path for those keen on diversifying or seeking refuge from traditional financial tempests.

If that sounds appealing to you, I suggest you continue checking in with Weiss Crypto Daily as we break down the broad trends and headlines influencing the market.

I also encourage you to review our Weiss crypto ratings to see where your favorite assets stand.

Finally, if you’re looking for more in-depth analysis and guidance, I suggest you look through our products and services.

Always remember, in the world of finance, change is not just inevitable, it's the driving force. Embrace it, anticipate it and be ready to adapt.

Best,

Juan