The Hidden Message Inside Gold & Bitcoin’s New Highs

|

| By Bob Czeschin |

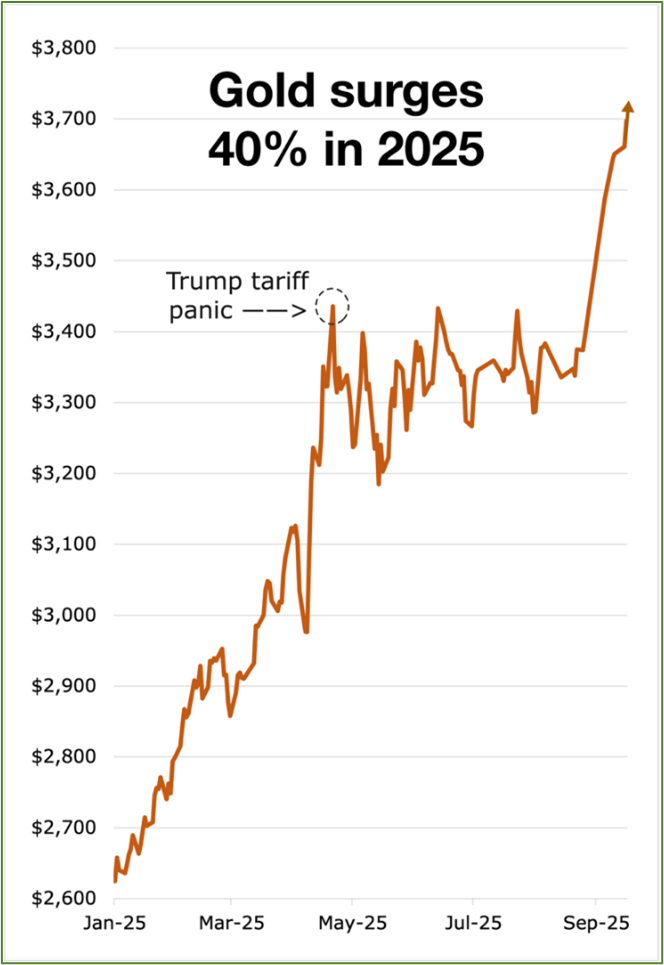

Gold has been on a tear in 2025.

The high-water mark it made back in April was especially memorable. Because it occurred as Trump’s tariffs first set off alarm bells around the world.

But now, that’s firmly in the rear-view mirror.

Now, gold is about to pass another critical milestone as it sits just below $4,000 following weeks of rising prices.

When adjusted for inflation, this is a historic new high. One that goes all the way back to Jan. 21, 1980, when prices hit $850 — roughly $3,590 in today's dollars.

Back then, three factors conspired to create a near-perfect storm for exploding gold prices:

1. Geopolitical crises.

On a dark December night in 1979, a team of Soviet Spetsnaz (the Russian equivalent of USA’s SEAL Team Six) quietly infiltrated the Presidential Palace in Kabul.

They shot the Afghan president and installed a Kremlin-compliant patsy in his place. And within hours, legions of Soviet T-62 tanks rumbled across the border, occupying vast swathes of Afghanistan.

International outrage was swift and loud.

Countries airlifted military aid to Afghan resistance fighters, initially armed only with World War I-vintage rifles. The turning point was the arrival of shoulder fired Stinger missiles from America … which suddenly gave mujahideen on horseback power to blast Soviet gunships out of the sky.

2. A falling U.S. dollar.

After street demonstrators in Teheran seized U.S. Embassy personnel as hostages, U.S. President Jimmy Carter froze Iran’s U.S. dollar accounts worldwide.

That made a bunch of other countries nervous about owning U.S. assets. And pushed some to bolt for the exits before the same thing happened to them.

Their selling weakened the greenback on world foreign exchange markets.

3. Stubbornly high inflation.

Oil production came to a halt, costing millions of barrels a day, when Iraq and Iran — both major oil exporters — attacked each other in a fight to the death.

The resulting supply shock caused oil prices to roughly quadruple.

Oil is the world’s number 1 transportation fuel. And in an era of global supply chains, sharply higher transport costs raise the cost of virtually everything produced or manufactured.

So, persistent, stubborn inflation ensued.

Does any of this sound familiar?

It should. Because fast forward to the present, and we see the same three factors are again fueling a bull run in gold.

- Geopolitical crises. This time, the Russians invade Ukraine. And after three bloody years of fighting, Russian dead and wounded already exceed 1,000,000. That’s 15 times the casualties they suffered in Afghanistan. With no end in sight.

-

A falling U.S. dollar. In the 1970s, Jimmy Carter froze Iran’s dollar accounts. In 2022, the Biden Administration did the same thing to Russia’s U.S. dollar accounts.

And market reaction was the same.

Investors around the world suddenly realized they too could lose their dollar accounts if Uncle Sam ever got pissed at them.

Naturally, many sought to slash their dollar holdings before the roof caved in. And their selling weakened U.S. currency on world markets.

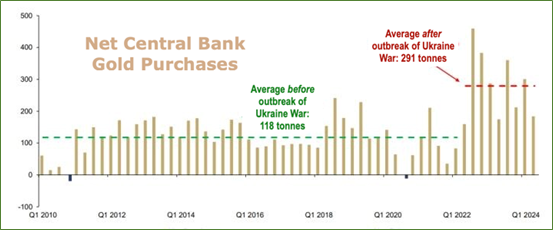

For nations, the easiest way to quietly diversify reserves away from dollars is to exchange them for gold.

And sure enough, the statistics bear this out. After the Ukraine War broke out, average gold bought by central banks shot up by 138%!

-

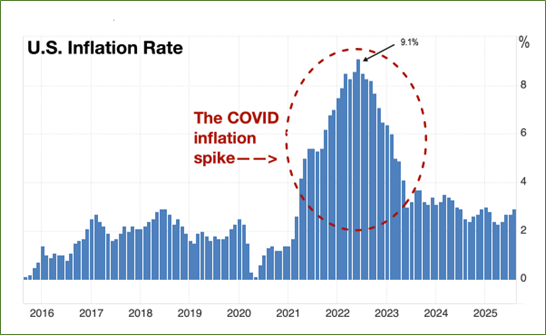

Stubbornly high inflation. In the 2020s, COVID ignited the biggest money-printing orgy the world has ever witnessed.

In America alone, pandemic-related spending topped $5.2 trillion, funded mostly by Treasury borrowing freshly printed money from the Fed. One reliable measure of the scale of money printing is the Fed’s balance sheet — which ballooned to $8.9 trillion in 2023.

Money printing on such a scale is impossible without lighting a fire under inflation.

From a pre-pandemic rate well under 2%, inflation roared up 4x, peaking at 9.1%. The most recent reading on core inflation was 3.1% — still more than 50% above the Fed’s 2% target level.

As a world-famous inflation hedge, gold naturally benefits in such a financial climate as this.

Gold’s Message Today

The message gold’s sending today is simple: It could be the 1970s all over again.

Because just as it did then, we now have a geopolitical crisis, a falling dollar and stubborn inflation.

And all are lifting gold to new, all-time, inflation-adjusted highs.

Gold went from about $108 (in 1976) to $850 (in January 1980). That’s nearly an 8x gain.

Compare that to the current rally, which began amid pandemic panic in late 2022 (at about $1,650). Now, gold is knocking on the door of $4,000 and has traded as high as $3,770 — which is about a 142% gain.

But while gold may be the easiest escape route for central banks, this isn’t the 1970s. And there’s another option you may want to consider for your portfolio: digital gold.

Bitcoin (BTC, “A-”) has been on a tear over the past week, hitting a new all-time high just yesterday.

Why? It’s buoyed by these very same macroeconomic forces.

And according to cycles expert Juan Villaverde, there’s more upside in store. In fact, in his crypto briefing this afternoon, Juan dove into what Version 2.0 of his Crypto Timing Model sees ahead for the market’s medium-term outlook.

And he revealed three coins he believes can outperform Bitcoin this cycle.

With more ahead, and knowing how fast the crypto market can move, I suggest you watch this briefing now.

Before Bitcoin resumes its run.

Best,

Bob Czeschin