|

| By Juan Villaverde |

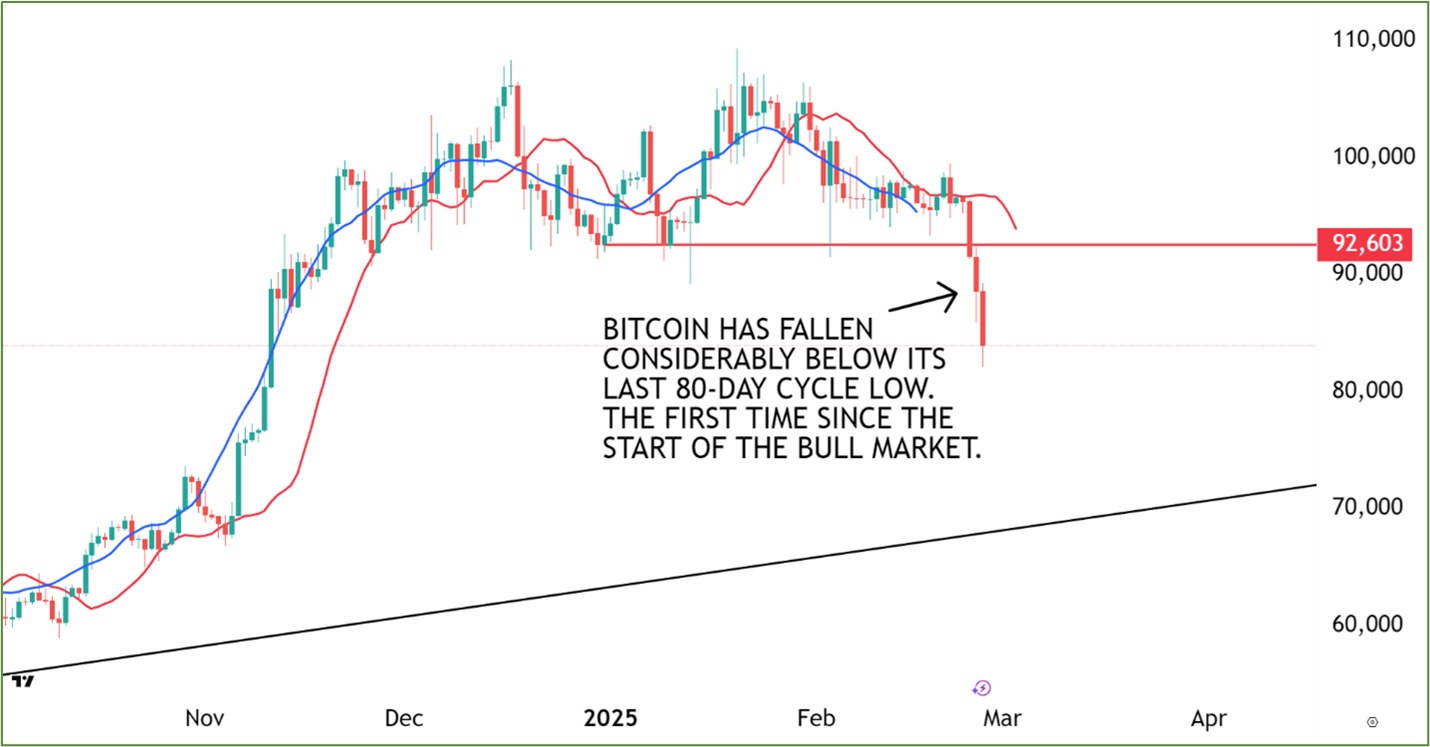

Bitcoin (BTC, “A”) has fallen below a key support level this week.

According to my Crypto Timing Model, this price action reveals that the market established a significant top between December and January.

Does this mean the bull market is over?

No!

Each bull market is made up of three 320-day cycles. And so far, we’ve only seen two.

With the latest cycle top in, that means we’re wrapping up the second cycle … and have one more bullish rally ahead.

First, however, we’ll need BTC to find a low. Not only will that mark the start of the next cycle. It’ll also give BTC firm ground to rally.

My model initially showed $92,000 as that downside support.

But with BTC breaking below this level with confidence … it looks like we’ll have to wait longer and will likely see more downside volatility over the coming weeks.

In fact, this correction will likely resemble the one that took place March to September of last year — after which, prices went up again.

Accordingly, we should see signs of recovery in the second quarter. Though how high prices will go remains to be seen.

In the meantime, it is critical that you remain vigilant. Because when sentiment shifts and pulls prices down, we may start to see more …

Real World Signs of This Shift

The memecoin-related scam involving Argentine President Javier Milei was just the start.

Last week, for example, we saw the largest-ever crypto exchange hack against one of the world’s biggest offshore exchanges: Bybit.

To be clear, the Bybit exploit was not a scam. Nor is it a sign crypto is fundamentally insecure.

For starters, the exchange is solvent. It has already secured the necessary funds to make its customers whole. Nobody — except Bybit itself — lost a dime.

I spent hours analyzing this case. What shocked me most was the level of ignorance on social media.

Many compared this incident to FTX. Which is utter nonsense!

FTX was a scam. Insiders gambled away — that is, stole — customers' money. And used it to pay for lavish expenses, political handouts and high-risk venture capital investments.

Bybit, by contrast, was a victim of a cyberattack so sophisticated, it seemed to come straight out of a James Bond movie.

Yet, throughout the crisis, Bybit’s management team never lost control. They were transparent about what happened. They communicated what they knew in real time and kept their millions of clients informed about how they planned to handle the situation.

And, most impressively, they ensured the exchange continued to operate normally throughout the entire debacle, which unfolded mostly on Friday.

I would be skeptical about all this had I not experienced it, myself — as a Bybit customer.

Customer service responded to all my concerns. They processed my withdrawal requests — albeit with significant delays. And market operations continued as usual the whole time.

If you didn’t see the uproar on social media, you wouldn’t have known that they had just lost $1.5 billion worth of Ethereum (ETH, “B+”) — about 8% of total customer funds.

And yet, the exchange remains solvent. They can handle this crisis.

How do I know this?

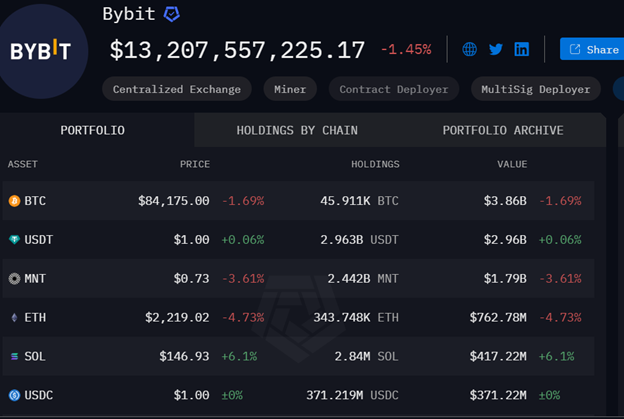

Well, after the FTX collapse, all reputable exchanges committed to submitting “proof of reserves.” This means they publicly reveal the wallets holding their crypto assets.

So, you can see Bybit’s reserves yourself.

Before Friday’s hack, the exchange held over $20 billion in customer assets. After the hack? About $10 billion — before recovering to over $12 billion. Despite 50% of funds leaving the exchange, operations continued without major disruptions.

That’s a solvent business.

As for the lost funds — approximately 400,000 ETH and staked ETH derivatives — Bybit secured a loan for that amount within hours of discovering the breach.

Their reserves confirm they already have the funds to reimburse everyone.

As a relatively new exchange, I initially doubted Bybit had been in business long enough to be convincingly battle-tested. But the superb way management handled this massive setback was practically a case study in crisis leadership.

The professionalism I saw reassured me that Bybit is indeed a safe place to do business.

What This Means for Crypto’s Security

Bybit’s assailants were North Korea’s Lazarus Group — a state-sponsored hacking organization with ample resources for a highly coordinated and sophisticated attack.

It is unclear how they accessed Bybit’s internal systems. But they certainly seemed intimately familiar with them. Because they successfully hacked a smart contract — a nearly impossible feat requiring multiple signers (for a multi-signature wallet).

How difficult is this to pull off?

Put it this way: It very likely required North Korean agents to disguise themselves as regular developers to infiltrate Bybit.

Like I said, something straight out of a James Bond movie.

So, whether you consider crypto safe is a matter of perspective. But in my view, this industry is just undergoing growing pains.

There are ways to prevent hacks like this. However, they require significant infrastructure upgrades. Which will come eventually.

Consider this: In past years, even much smaller breaches resulted in ordinary users losing lots of money. By contrast, in 2025, the industry has developed enough infrastructure to ensure customers didn’t lose a penny.

That’s progress!

The worst consequence of the biggest hack in history was … merely that the affected exchange had to borrow $1.5 billion worth of crypto. An amount readily available from its many partners, and a debt they can and will repay over time.

Compare that to the 2014 Mt. Gox hack, which accounted for the bulk of crypto trading at the time. The breach was so severe that it threatened to collapse the entire crypto industry.

Things are improving — it just takes time.

This is why patience is the better part of valor … and insanely vital when it comes to navigating the crypto space.

So, stay vigilant and patient. The bull is on pause for now … but it won’t be long before it starts to run again.

Best,

Juan Villaverde