The Megatrend So Intense, It Can Fuel BTC Growth for Decades

|

| By Bob Czeschin |

Many of the greatest fortunes ever accumulated by investors share a single characteristic: They involved investing on the right side of an emerging mega-trend that went on to change the world.

Think back to when online retail made its debut … when Amazon was a struggling bookseller, losing money for nine consecutive years.

Or Apple, when Steve Jobs re-imagined what people experience using a cellphone.

Or Google, in the early days of internet search.

These companies boast $2-$3 trillion market caps today. Investors who bought shares in the early days — and held on — have become fabulously wealthy.

So, what investible megatrends today have similar wealth creation power going forward?

Many are obscure. Others are hard to recognize in their nascent stages.

One, however, is hiding in plain sight:

Modern governments are trapped in an ever-deepening cycle of debt. Which can only be accommodated by systematic debasement of their currency.

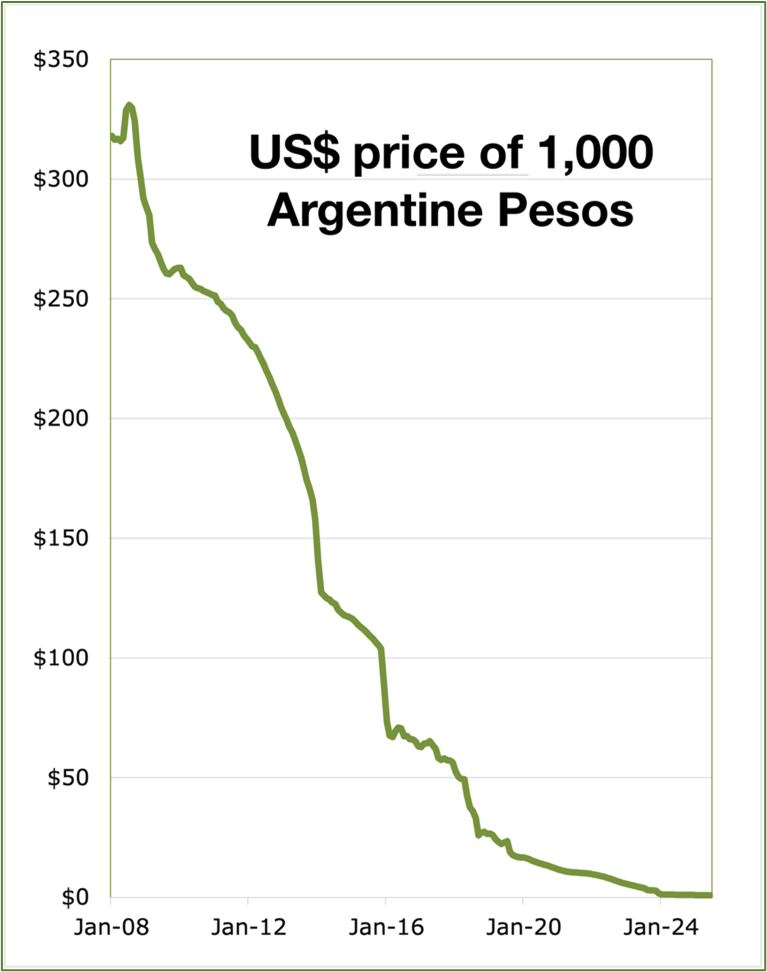

Weiss Crypto Portfolio Editor Juan Villaverde recalls the formative years he spent living in Argentina, a nation famous for two things: The Tango and hyper-inflation.

There, he saw the ever-deepening cycle of debt play out in real time:

- Record-high government budget deficits,

- Surging prices and

- Policymakers who refused to cut spending, choosing instead to run the money-printing presses day and night.

Result: the Argentine peso cratered.

And citizens paid the price as the buying power of their savings evaporated. The anguish and despair this caused among ordinary people was epic.

Fast forward to America in 2025, and we see the same old runaway freight train. Flashing by with gathering speed are bigger deficits and more money printing.

Together, they create an urgent need for a financial lifeboat — as the U.S. dollar hurtles toward a fate not unlike the hapless Argentine peso.

In reality, the recently enacted Big Beautiful Bill is a big, beautiful debt bomb.

Even before it was passed, America was already facing a $1.9 trillion annual deficit (about 6% of GDP). Plus, accumulated debts of $35 trillion.

Pile on another $5 trillion from the bill … and the trajectory is set. Trillion-plus deficits as far ahead as the eye can see.

Forget empty promises about “fiscal responsibility.” When push comes to shove, deficits are funded by creating more currency. Either directly via the Fed, or indirectly via banks, under Fed guidance.

What does this imply? Simple.

Currency debasement is not just a risk. Or a theory. It is the inevitable outcome.

Governments will continue to finance their deficits by printing money —one way or another.

Between 2008 and 2014, the Fed increased the monetary base nearly fivefold. Another round came in 2020 in reaction to pandemic panic — with trillions more printed in a matter of months.

Moreover, the shrinking value of paper currency is effectively a slow-motion tax that most people fail to recognize.

But your government knows this. And frankly, prefers it that way.

Printing money to cover spending is far less politically risky than overtly raising taxes. Safer to have inflation, or taxation by stealth.

In the grand sweep of history, this cycle of debt leading to debasement has only ever ended one way: with destruction of the currency.

Sometimes it’s gradual (a few percent a year). Other times, it’s rapid (as in a currency crisis). But it’s never benign. Because in the end, someone always pays.

Typically, it’s the saver, the pensioner, the wage-earner whose income doesn’t keep up with rising prices. But in fact, we all pay — when our dollars buy less house, less education, less everything than they did a decade ago.

Faced with this stark reality, how do you protect yourself?

Bitcoin: A Natural Beneficiary of Debasement

Bitcoin’s (BTC, “A-”) monetary policy is the polar opposite of any fiat regime. Because there can never be more than 21 million BTC.

In a world where every major currency is being systematically diluted, Bitcoin’s supply is mathematically capped. So, on a long-term time horizon, the fiat price of 1 BTC has nowhere to go but up.

Look, I’ll be the first to acknowledge Bitcoin is famously volatile. It’s not a straight line up — far from it. We’ve seen brutal bear markets along the way.

But zoom out far enough, you see something extraordinary taking shape.

Bitcoin’s price path resolves into what looks very much like a perpetual bull market. Every cycle, Bitcoin’s lows are higher in dollar terms.

That’s because the dollar itself is losing value. And because Bitcoin combines the scarcity of hard assets with the epic growth potential of paradigm-shifting new technology.

So, for investors, it offers both offense (upside potential) and defense (wealth protection).

A life raft that not only stays afloat, but actually catches the wind and moves you forward.

So, make sure you have some meaningful exposure to Bitcoin (and other high-quality crypto projects).

Or, if you are looking to outperform Bitcoin and are willing to dive deeper into the crypto market, you may want to sign up for our urgent crypto briefing.

Our research shows that, behind the scenes, money is actually moving OUT of Bitcoin … and INTO smaller cryptos.

And not just trivial amounts.

We've tracked Wall Street giants like BlackRock and Fidelity moving hundreds of millions of dollars into these opportunities.

And on Tuesday, Sept. 2, crypto expert Mark Gough will walk our founder, Dr. Martin Weiss, through his analysis to highlight three coins he believes will leave Bitcoin in the dust in the coming rally.

To hear about them for yourself, just save your seat here.

In the meantime, it’s important to recognize the historic times we’re living in. Government debasement is a runaway freight train no one can stop.

But as individuals, we are not chained to the tracks. Take heart that you can see the writing on the wall — when so many others can’t.

Best,

Bob Czeschin