The Revenge of the Memecoin Is Playing Out on Bitcoin

|

| By Marija Matic |

While most talking heads are focusing on the still-brewing banking crisis — with 50% of U.S. banks facing potential solvency issues — Bitcoin (BTC, “A-”) is having some drama of its own.

The network is clogged, fees are high and exchanges have been pausing withdrawals.

Why?

In short, Bitcoin became a new destination for memecoins.

How?

Well, first, a new token standard on Bitcoin has emerged in March. Now, tokens can be built on Bitcoin network, in a similar way they can be built on the Ethereum (ETH, "B") network.

That opened the floodgates for a slew of new tokens — over 14,000 — to be created on Bitcoin.

Most of these new tokens, created in just the past few days, are memecoins. There is also a rotation happening by memecoin traders and builders, as users are moving them from Ethereum to the Bitcoin network.

All this new activity meant transactions spiked as well … and the network couldn’t handle the increased volume.

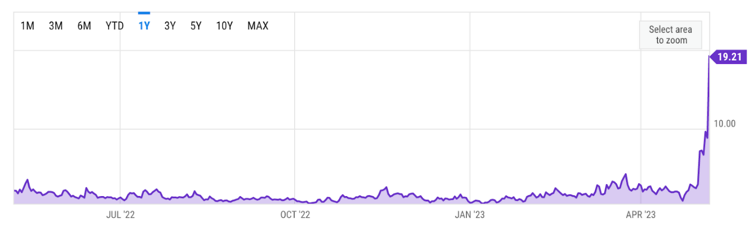

Soon, fees started to rise and mempool — a waiting room for transactions that haven’t been confirmed by miners yet — puffed up. Increased demand on miners pushed the BTC transaction fee to $20.

Source: ycharts.

Click here to see full-sized image.

In response to the impressive spike, Binance — the largest centralized exchange by trading volume — closed withdrawals as it had to update its system to adjust fees.

Panicked users saw this and thought Binance was trying to scam them. In fear, they started selling BTC hard and withdrawing money from an exchange. After withdrawals were reopened, the fear had spread, pushing others to withdraw even more BTC in panic.

Binance outflow data confirms the largest withdrawal in its history: Over 162,000 BTC has left the exchange, valued at over $4.6 billion.

In a nutshell, Binance users dumped the BTC price because they didn’t understand what was happening.

And in this confusion, they solidified their losses. That’s why it’s so important to fight fear, uncertainty and doubt with research and hard data … no matter if that means reviewing on-chain metrics and researching for yourself or checking in here at Weiss Crypto Daily for the latest market updates.

There is a silver lining, however. The failure of this stress test has prompted Binance to accelerate its move to Bitcoin’s Layer-2, Lightning Network, as announced today.

Remember, Layer-2 networks are blockchains built on top of a base layer, in this case Bitcoin, to help improve scalability. This should help manage spikes in transaction volume while still keeping fees and the mempool low.

And while users balked at that spiked transaction rates, miners celebrated as they were able to earn 18x more than they did confirming transactions just one month ago on April 8.

Where Bitcoin Stands Now

The panic-fueled selling has pushed Bitcoin’s price to $27,300, which is below its 50-day exponential moving average at $27,924 (blue line):

BTC has been trading above this level for almost two months. A daily close above it would be a welcome sight to ward off any near-term bearishness.

Despite the red candles above, not much has changed overall. Bitcoin is still in the same trading channel (between purple lines). As such, the medium-term outlook for Bitcoin hasn’t changed yet.

Ethereum is also seeing record levels of activity, probably due to the memecoin rotation to the Bitcoin network. Network fees there are also very high, with ETH transfers costing $5.12 and transfers of ERC20 tokens on Ethereum network — like Tether (USDT, Stablecoin) — costing $13.3 at the time of writing:

Layer-2 scaling solutions are rising in popularity and are expected to address congestion and scalability. Anticipated updates make them even more attractive.

If so, Layer-2 solutions may offer solid opportunities in the next bull run and is a sector to keep your eye on.

Notable News, Notes & Tweets

- 722 U.S. banks reported unrealized losses exceeding 50% of capital at the end of the third quarter of 2022.

- Binance restarts withdrawals of Bitcoin after a second halt.

- Bhutan has secretly mined Bitcoin in the Himalayas for years … and did so sustainably!

What’s Next

Keep an eye on your calendar. Consumer Price Index data is expected to be released on May 10, which can bring lots of volatility to the markets.

Many assets — both TradFi and crypto — are resting at or near support levels. If data comes in hotter than expected, those supports may not hold.

No one wants a repeat of the unprecedented surge in transaction rates or the panic that ballooned out of it. And with another potential volatility catalyst on the horizon, the market is also attempting to determine the most effective course of action to address the aftermath.

This topic is complex, however. So, we’ll keep you posted as new ideas and proposals are put forth and tested.

The looming shadow of volatility is something that many crypto investors have gotten used to. Indeed, many welcome volatility as it can often bring opportunity.

But that kind of strategy doesn’t work for everyone. If you don’t have a tolerance for crypto-level volatility or have the time to watch the markets consistently but still want to go for opportunities only found in DeFi, I suggest you check out my colleague Chris Coney’s Superyield Conference tomorrow, May 9, at 2 p.m. Eastern.

In it, he’ll explain his strategy that allows you to go for DeFi yields in any market — bear, neutral or bullish — all while minimizing exposure to market volatility.

And he’s not scrounging for pennies with this strategy either. One of his more “conservative” positions using only stablecoins leveraged to the U.S. dollar recently yielded 18% — or double the yield from junk bonds!

The conference is free to attend. But be sure to save your seat today to be able to join tomorrow.

Best,

Marija