The Yen’s Connection to This Crypto Correction

|

| By Juan Villaverde |

This week's dramatic decline still looms over the market like a dark shadow.

Despite previous warnings that the market was ripe for a correction and the 80-day cycle had turned down at the end of July, the depth of the downturn still caught many by surprise.

Crypto cycles — like the ones my Crypto Timing Model tracks — are handy for predicting market directions. But they falter when it comes to the scale of those shifts, especially when geopolitical actors throw their weight around.

We saw as much in early July, when the market's reaction was amplified by U.S. election season antics.

Fast forward to August, and we've seen one of the sharpest crashes in recent memory. And once again, a macroeconomic factor is at the heart of the latest bout of volatility.

This time, it was instigated by none other than the Bank of Japan … and softer than expected U.S. jobs data.

To understand this unraveling, we must step back to 2021. That was when inflation began to rear its ugly head, prompting central banks worldwide to hike interest rates to combat it.

Bank of Japan was an exception back then. It refused to follow suit and continued to maintain near-zero rates. This created a massive dislocation in global markets.

As a consequence, Western financial institutions flocked to Tokyo to borrow cheap yen. And then used it to buy everything from Japanese and U.S. stocks to corporate bonds.

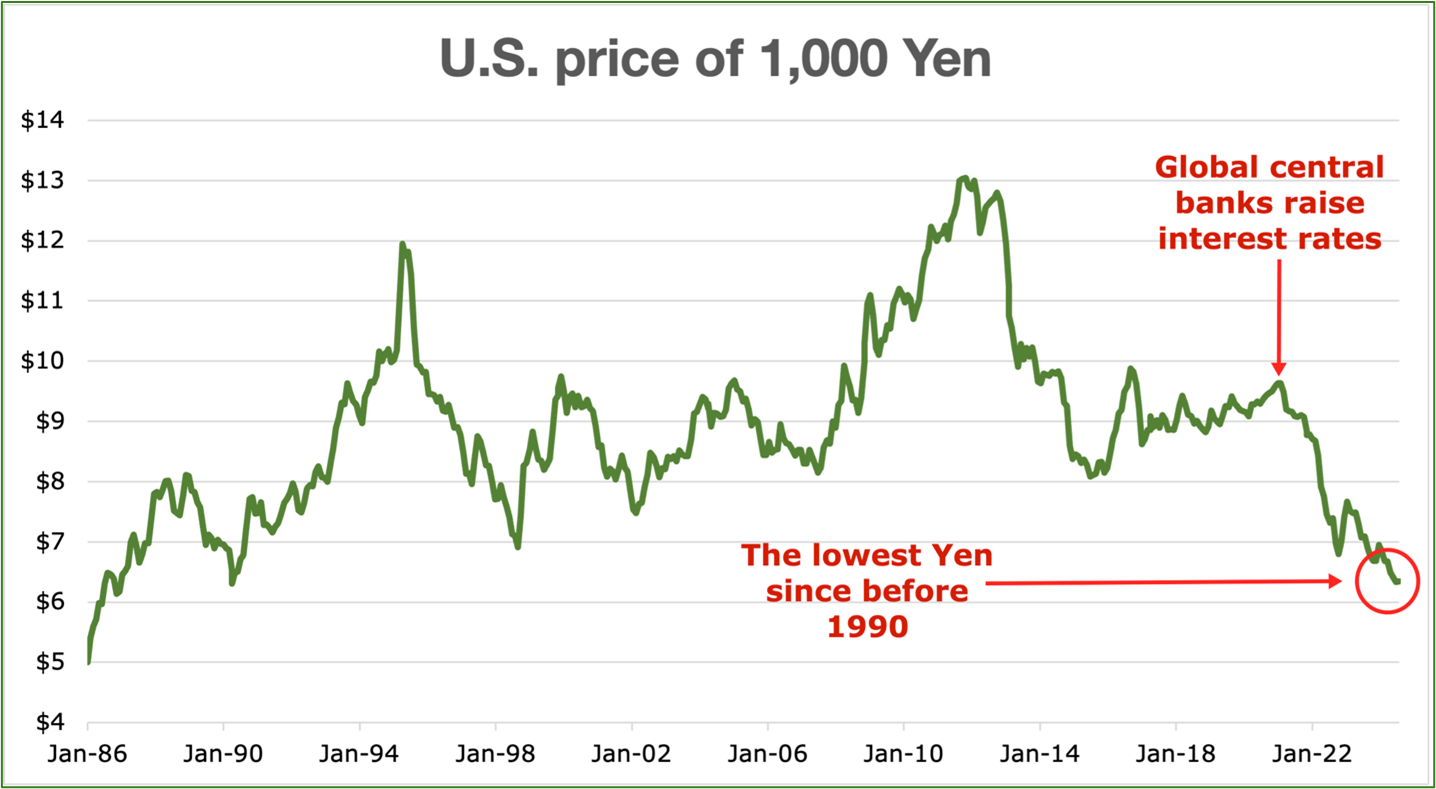

Known as the "yen carry trade," this strategy relied on borrowing yen at near-zero interest, buying higher-yielding currencies and assets and profiting from the rate differential. This caused the yen to nose-dive to levels not seen since the 1980s:

At first, Japan wasn’t too concerned about the yen's plunge.

But as inflation made everything from sushi to sake more expensive, the political impact couldn't be ignored anymore.

See, Japan imports most of its energy. And a weakening yen meant rising energy costs for ordinary Japanese.

So, to support the yen, the Japan’s Ministry of Finance started intervening in the currency markets — mildly at first, then more aggressively. Earlier this year, the Bank of Japan stepped in to join the fight.

Last week, the BOJ hiked rates for the second time in many years.

Further complicating matters, U.S. jobs data came in weaker than expected, leading markets to anticipate that the Fed might cut rates in September.

This development disrupted the carry trade. The yen's appeal lay in its low rates, and the U.S. in its high rates. But if both trends reverse, the trade falls apart. Investors who borrowed yen to buy assets need to sell those assets and repay their loans.

That caused prices of just about anything previously purchased with borrowed yen — tech stocks, corporate bonds, gold even crypto — to collapse.

This week’s crash in investment markets was a direct result of this global financial recalibration — driven by shifts in the yen’s value and broader economic adjustments.

The pressing question now is whether the selling is over, or if there’s more turmoil to come. This sudden shift in the global economic landscape has undoubtedly rattled markets.

But chances are the worst is in the past.

The recovery we’ve seen in Bitcoin later in the week — bouncing from $50,000 — to $60,000 as I write, is a hopeful sign that last Monday was a critical 80-day-cycle low in cryptocurrency markets.

But we need to wait a bit longer to confirm that. After all, in this climate, there could be another shoe waiting to drop.

That’s why I am paying especially close attention to global economic indicators and central bank actions.

Assessing them will be critical going forward, in anticipating the next moves in the crypto market.

If you’re interested in learning more about how I apply this information to my long-term “buy-and-hold” strategy, I suggest you check out my Weiss Crypto Investor newsletter.

Best,

Juan