There’s a Little-Known Bullish-for-Crypto Item in the Big Beautiful Bill

|

| By Bob Czeschin |

Buried among the 870 pages of Trump’s "Big Beautiful Bill" was a little-noticed provision.

One that could potentially be quite bullish for crypto.

Signed into law by President Trump on July 4, it imposes a new 1% tax on people inside the U.S. who send money abroad.

This includes everyone: citizens, green-card holders, non-immigrant visa holders and even undocumented immigrants.

And it applies to money orders, bank drafts, cashiers’ checks, traveler’s checks, as well as cash sent via Western Union, MoneyGram or similar services.

This is a big deal.

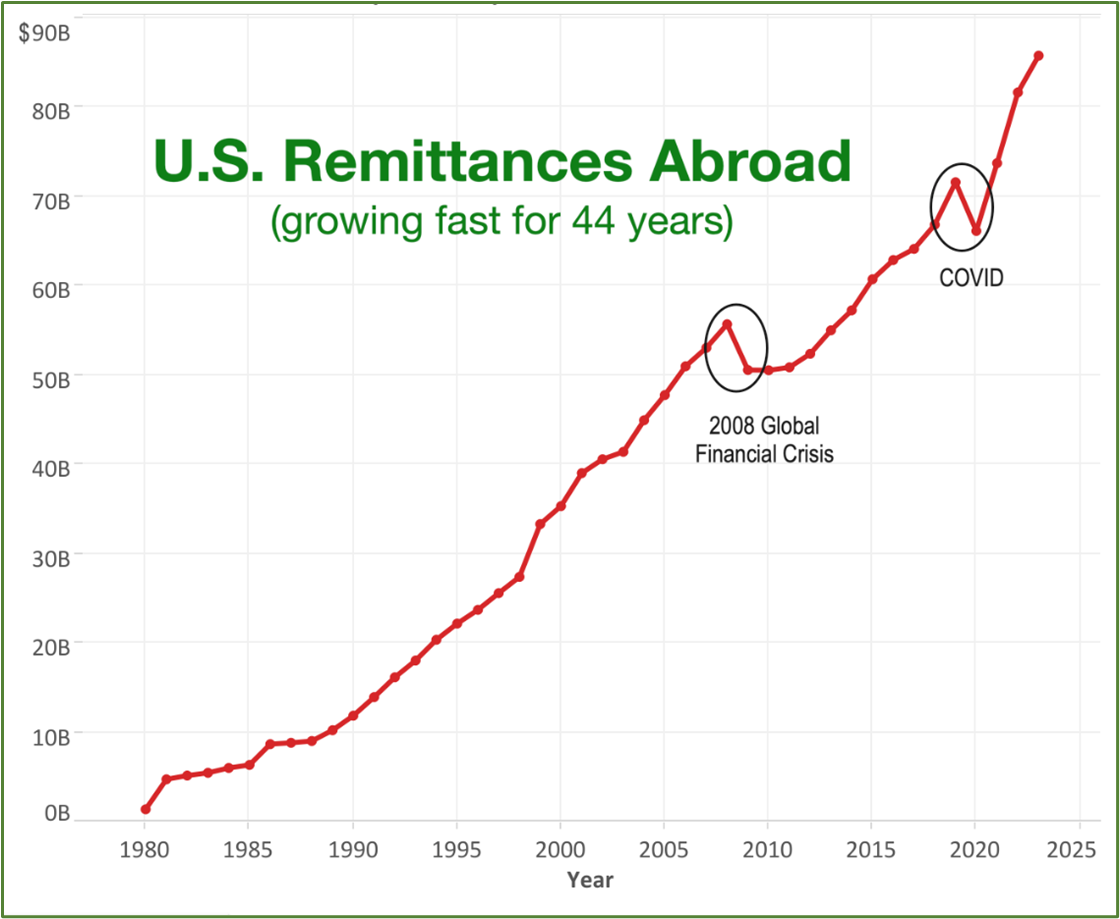

Because folks in the U.S. send nearly $90 billion abroad annually.

And that’s not just thanks to the ultra-wealthy. The U.S. has more people who send more money to family members and friends abroad than any country on earth.

Moreover, these remittances have been growing steadily for 44 straight years. In fact, they’ve been interrupted briefly only twice — once by the 2008 global financial crisis and once by the COVID pandemic.

International wire transfers are specifically exempted from the new remittance tax. But those are expensive — typically running $35 to $50 per transaction plus maybe another $10 in receiving bank fees.

On a $10,000 transaction, that’s a 0.6% transaction cost, which is acceptable.

But on a $500 transfer, it’s an extortionate 12%. And the vast majority of family remittances are for small amounts.

Fear that you might be prevented from getting your savings to safety outside the country … is already the major driver of crypto adoption in places like Argentina, China, Russia and Iran.

And now … it’s poking its nose under the tent — so to speak — in America.

Fortunately, there is still a way to avoid the new taxes: crypto.

That’s right — cryptos are specifically exempted from remittance tax.

I predict this is going to result in wholesale adoption of crypto — Bitcoin (BTC, “A-”) and stablecoins in particular — by the remittance community in the United States.

And by extension, virtually everyone abroad they send money to.

Many will download and open crypto exchange accounts directly. And to protect their businesses, I expect Western Union and Moneygram to roll out new remittance tax-exempt stablecoin-based transfer services.

Either way, millions of new customers and tens of millions of new transactions are likely to come pouring into crypto … as the remittance tax comes into effect on Jan. 1, 2026.

Mass adoption of crypto for remittances will also have significant collateral effects. The vast majority of remittances received gets spent on basic necessities — things like food, shelter, medicine, cell-phone subscriptions and kids’ tuition.

Which means we’ll likely see competitive pressures lead vendors of these goods and services to begin accepting crypto directly to pay for purchases.

Thus, another wave of crypto adoption could emerge.

World’s Most-Held Paper Cash … Displaced by Crypto

Surging adoption by remittance payers and receivers could easily bring more institutional investors into crypto.

Particularly those who see growing real-world use cases as a bullish sign.

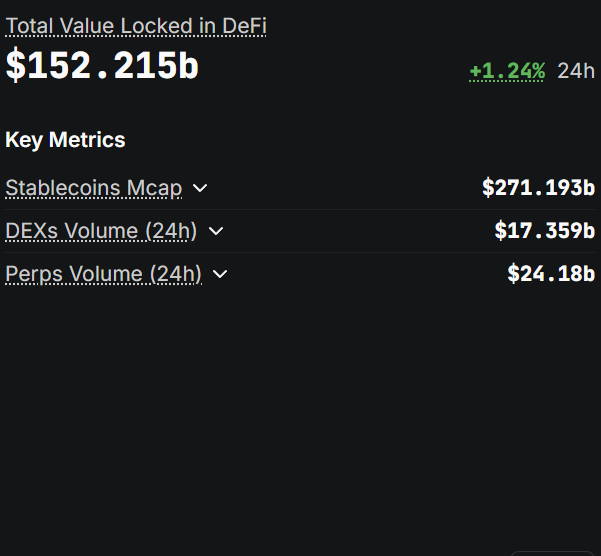

Stablecoins’ combined market cap has already gone from under $500 million in 2019 to $271 billion today. That’s roughly a 300% a year growth. Remittance-related adoption could easily help keep this amazing growth going — if not accelerate it further.

Beyond remittances, however, another potentially far more powerful bullish-for-crypto force is quietly gathering strength.

And it’s something nobody is talking about.

When Trump shifted America to a tariff-centric economic policy, he released an evil genie that had been locked up for 77 years.

Between 1948 — when the General Agreement on Trade and Tariffs took effect — and Trump’s Liberation Day proclamation, average global tariffs fell 77.3%.

Now, they’re going up again.

But here’s the thing: You cannot restrict the flow of freely traded goods without also impacting the money flows that pay for them.

That’s why tariffs have historically so often led to capital controls.

- The Smoot-Hawley Tariff Act of 1930 hit thousands of U.S. imports. Britain and Germany reacted with measures choking off transfers of gold and currency, effectively killing domestic purchases of U.S. goods.

- Argentina has often turned to tariffs to protect domestic industry. But this, along with fiscal deficits, resulted in repeated currency crises. So, Buenos Aires used strict capital controls to prevent a run on the peso.

- During Trump’s first term, the tariffs he slapped on Chinese imports cut deeply into China’s export revenues. This caused Beijing to drastically tighten capital controls to protect the yuan and stop capital flight.

- Now in Trump’s second term, as U.S. tariffs hit exporters worldwide, here comes the remittance tax. The first baby step in a likely new progression of American capital controls.

Think 1% is trivial? In the larger scheme of things, it may indeed seem so.

But the rate was 2% and 3.5% at various stages of the House and Senate legislative debates — 1% was just where it landed when the bill finally got to Trump’s desk to be signed into law.

When the U.S.’s federal income tax came into effect in 1913, boosters promised the top rate would be only a modest 7%. Since then, the top marginal rate has gone as high as a whopping 94% (in 1944).

Once a tax is established in law, enlarging its scope, or raising the rate, is easily done. Indeed, you might say both are practically inevitable.

Capital controls are the evil genie Trump released. And with worldwide tariffs getting a new lease on life, he’s not going back into his bottle anytime soon!

This is yet another bullish catalyst for Bitcoin.

Bitcoin’s decentralized nature famously puts it beyond the reach of any government to manipulate or control.

If from today’s modest, innocuous beginnings, U.S. capital controls metastasize like income taxes … well, this could usher in the biggest bull market yet seen in Bitcoin.

So, be sure to have some BTC socked away among your savings. Just in case.

Not only could you make a lot of money. Someday, they could be your financial lifeline.

Best,

Bob Czeschin