These Coins Are Leading the Recovery with Impressive Gains

|

| By Marija Matic |

The cryptocurrency market has been a whirlwind of activity recently. After bottoming out at a five-month low of just above $49,500 on Aug. 5, Bitcoin (BTC, “A”) mounted a notable recovery, surging over 21% to exceed $60,000 by Aug. 9.

However, this rebound is still volatile. Bitcoin has already slipped below $60,000 again to touch an intraday low of $57,800 before going back to over $60,000 today.

Many altcoins — cryptos other than Bitcoin — are showing losses over thepast two weeks against the U.S. dollar.

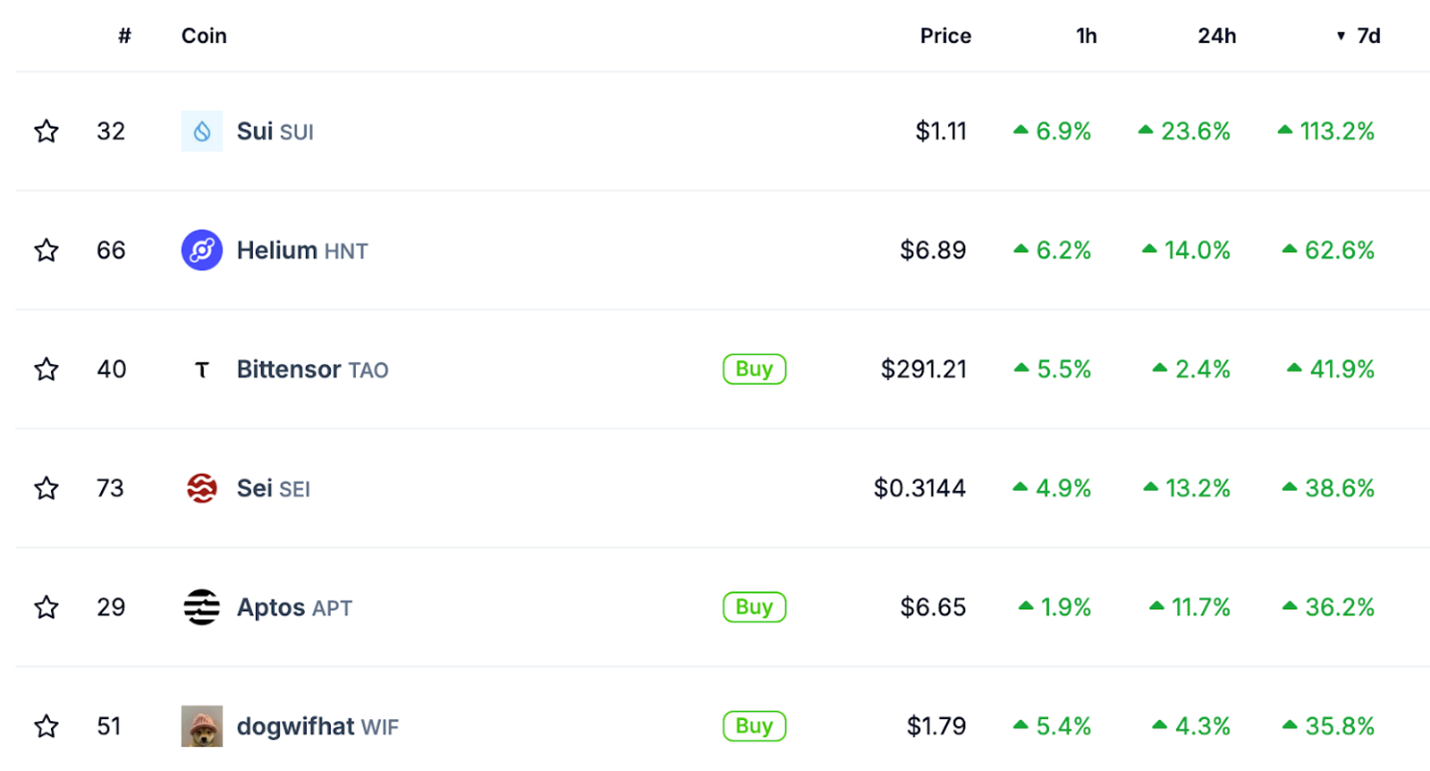

But despite the latest market turbulence, the top 100 altcoins have retained notable weekly gains.

Leading the pack is SUI (SUI, Not Yet Rated), a novel Layer-1 blockchain coin that has seen an impressive 113% seven-day increase.

On SUI’s heels are Helium (HNT, Not Yet Rated), a decentralized TelCo, and Bittensor (TAO, Not Yet Rated), a decentralized AI project. Both have also experienced significant gains of over 62% and 41%, respectively.

The price rally for SUI and TAO were fueled by Grayscale's launch of new investment trusts for these assets on Aug. 8. This move is viewed as a strong endorsement of their long-term potential, contributing to their sustained price increases.

Meanwhile, Helium is making strides in adoption as major U.S. carriers begin testing its network for traffic offloading, which could accelerate its growth.

Helium is a key player in the decentralized physical infrastructure, or DePIN space. My colleague Mark Gough recently covered this sector, calling it the “key to decentralized everything.”

According to a Messari report, the DePIN narrative encompasses over 650 projects with a current market cap exceeding $22 billion.

And Helium adoption in particular has ballooned in the past year. It grew from fewer than 1,000 on its unlimited mobile plan a year ago to 108,561 today.

This surge, along with healthy pre-payments for mobile services, indicates robust revenue generation and strong customer retention. By expanding the reach with existing mobile carriers, Helium is clearing its road to accelerating adoption.

The resurgence in cryptocurrency prices has been notably supported by stablecoin inflows to crypto exchanges, signaling increased demand for digital assets.

Institutions have been actively purchasing Tether (USDT, Stablecoin) from Tether’s Treasury, driving this trend. Indeed, over 1.3 billion USDT have been transferred to exchanges since the market crash on Aug. 5!

The LookOnChain data shows that this behavior resumed today, with Cumberland acquiring $75 million worth of USDT from Tether's Treasury and transferring it to exchanges, further fueling market activity and highlighting a strong institutional interest in cryptocurrencies.

And that’s not the only development bolstering market optimism. Several have made themselves known over past few days and introduced positive momentum and new opportunities in the crypto space, including …

-

FTX’s $12.7 Billion Settlement: A U.S. court has mandated that the failed FTX exchange pay $12.7 billion to customers affected by its late 2022 collapse. This includes $8.7 billion in restitution and $4 billion in disgorgement aimed at compensating customers affected by the collapse.

Customers will receive 100% recovery on their claims against the company, based on the value of their accounts at the time it filed for bankruptcy. This marks a crucial step toward resolving the fallout from FTX’s downfall by making customers whole, with the final approval of the bankruptcy plan expected on Oct. 3.

-

Bitcoin Exodus from Exchanges: Approximately 28,000 BTC, valued at $1.7 billion, was withdrawn from crypto exchanges last week in a massive exodus.

This withdrawal, the largest of the year, reflects a strategic move by major investors to secure their assets off centralized platforms. The action likely indicates either anticipation of future price increases or a renewed confidence in Bitcoin's long-term potential. The reduced liquidity on exchanges can lead to bullish conditions for Bitcoin.

-

Russia’s Crypto Mining Legislation: Russia has made headlines by legalizing cryptocurrency mining. The new law allows companies and registered individual entrepreneurs to mine digital assets, with energy consumption restrictions placed on unregistered individuals.

This move aims to enhance Russia’s hashrate and could offer new economic opportunities as the country seeks to mitigate the impact of sanctions.

-

Brazil’s Solana ETF Approval: Brazil has made a significant advance by approving its first Solana (SOL, “B+”) ETF. This represents a major step forward by offering institutional investors a regulated and streamlined way to invest in Solana. The approval not only highlights Brazil’s ambition to lead in regulated crypto investments but also underscores the growing institutional interest in Solana.

If Solana's market capitalization and liquidity continue to grow, it could pave the way for similar ETFs in the U.S., further embedding it into mainstream financial markets.

Apart from these bullish developments, Token Terminal believes that BlackRock (BLK) is likely to launch its own blockchain, similar to Coinbase’s Base network, which is built as an Ethereum Layer-2.

This would allow BlackRock to concentrate the recordkeeping of its holdings across asset classes — currently at $10 trillion assets under management — to a single, global, interoperable and transparent ledger.

With all these developments under the hood, no wonder that the leading cryptocurrencies, such as Ethereum and Bitcoin, are showing resilience.

But even though the select few projects have been rallying, we may not be done with the volatility. In the near term, the outlook for overall crypto market might be tied to upcoming U.S. economic indicators.

The inflation reports — including the July Producer Price Index (PPI) on Tuesday and the Consumer Price Index (CPI) on Wednesday — along with retail sales figures and other economic metrics, will be pivotal in shaping market expectations.

These reports are anticipated to provide insights into inflationary pressures and consumer spending trends, which could influence Federal Reserve monetary policy. In short, they will give us a clue as to how quickly and deeply the U.S. central bank will cut interest rates.

If everything is ok, the market might price in fewer rate cuts for the year. The not-so-hard landing could lead to a more stable economic environment for cryptocurrencies, potentially impacting Bitcoin’s price action positively.

Bitcoin needs to maintain the psychologically important $60,000 threshold, as the market participants are keenly watching for signs of a sustained recovery to restore the bullish narrative for all cryptos.

I’ll be keeping a close eye on that important level. And will keep you posted if and when these macro factors shake up the market. So, check back in with your next Weiss Crypto Daily update for more tomorrow.

Best,

Marija Matić

P.S. If this market volatility is too much to keep up with, then don’t be discouraged. There are still ways to invest without needing to worry about every market storm. And my colleague and startup investing specialist Chris Graebe has found an out-of-this-world opportunity that fits that bill.

And I mean that literally. Chris is looking to the stars and has found a company using tech so far advanced, Elon Musk could see his entire space empire destroyed overnight. McKinsey & Co. values this opportunity at over $1.4 trillion.

And soon, Weiss Members like you can claim an early stake in the company supercharging this trend … BEFORE it ever goes public.

Chris will be giving you the details in his Summer 2024 Private Investment Summit TOMORROW, Aug. 13, at 2 p.m. Eastern.

It’s completely free to attend. All you have to do is click here tomorrow at 2 p.m. Eastern.