This Surprising Force Could Help Bitcoin Break Out

|

| By Juan Villaverde |

Global markets — including crypto — were rocked by further geopolitical tension this week.

News that Iran had struck deep into Israel and breached its famed Iron Dome anti-missile defenses predictably sent the markets into a tailspin.

Equally unsurprising is the way everyone has seemingly become a geopolitical expert overnight, predicting exactly how the markets would react.

Now, don’t get me wrong. War is an absolute tragedy. Every life lost to it is condemnable.

But we need to separate emotion from reality when it comes to global and crypto markets. Tensions in the Middle East will likely persist, and they could escalate further.

However, this is not the factor that will drive crypto markets over the next six to 12 months.

So, what will?

I’ve given you the answer before, but it bears repeating: Global liquidity.

Just take a look at the global M2:

Global M2 broadly measures how much money is available in the global economy.

And after years of consolidation, global M2 is now breaking out to new all-time highs, having gained momentum in recent months.

This surge in global liquidity, fueled by central bank money printing, is the single most important driver of crypto prices.

Frankly, it’s the single most important driver of most asset classes worldwide. But what makes this especially bullish for crypto is that it's happening on the back of central bank stimulus, which the crypto markets are particularly sensitive to.

Just last week, I touched on China’s recent move to inject stimulus into their deflationary economy. But even I underestimated the scale of what they’re doing now.

Last week, the People’s Bank of China printed over $100 billion.

Yes, that’s billion, with a “b.”

But it’s not just the size of the stimulus that has markets buzzing — it’s the breadth.

Under the guidance of the PBoC, the Chinese government has pledged to buy stocks directly to prop up their stock market and allow regional governments to purchase unsold properties to support the real estate market.

China is going all in. And it’s not just about what they’ve done so far.

The focus is also on what it promises for the future. For example, the PBoC is even considering direct cash payments to households.

Will these measures fix China’s collapsing housing market?

No.

Will it reverse the deflation triggered by that collapse?

Not likely.

But will it prop up risk assets — not just in China, but globally?

Absolutely!

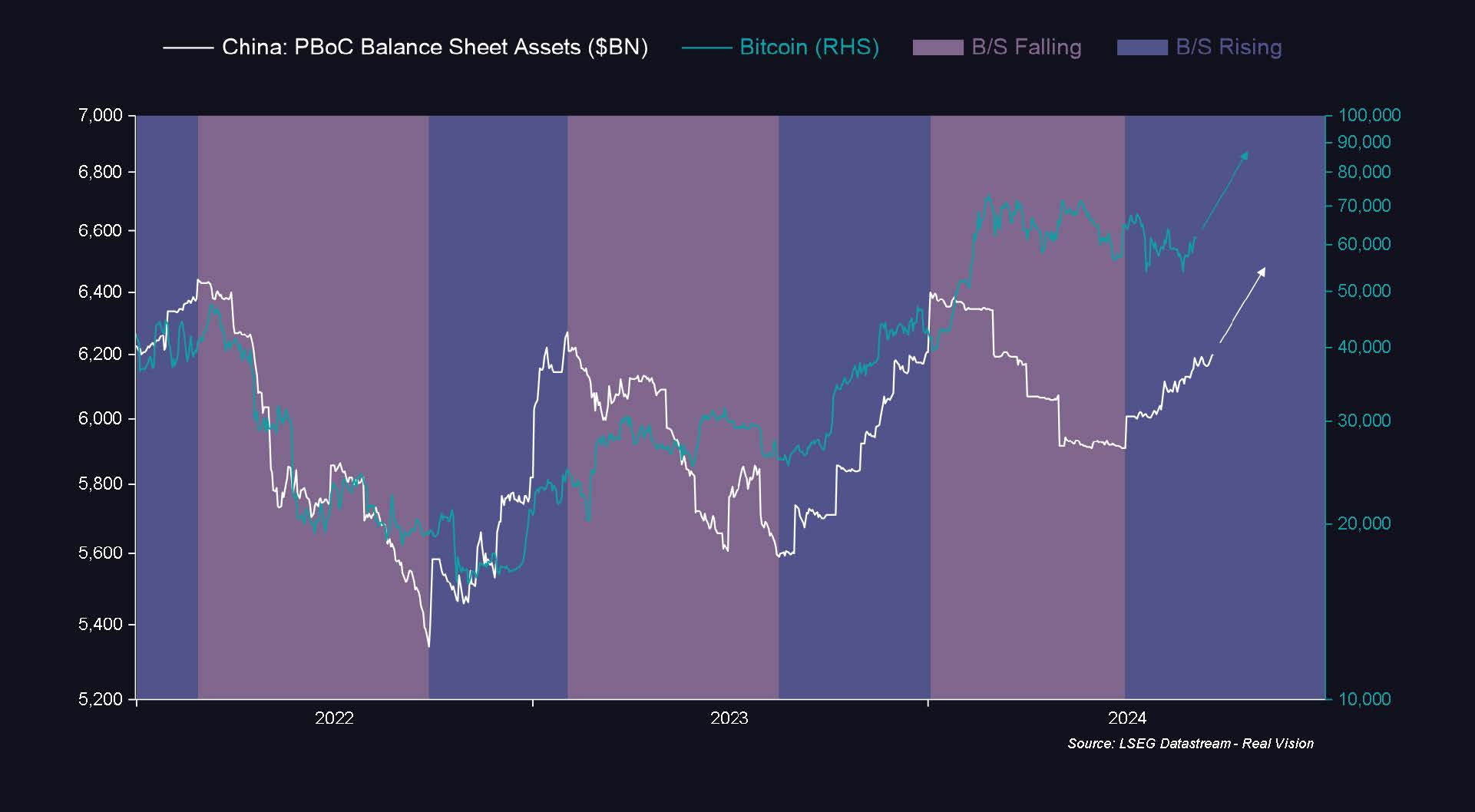

You don’t need to take my word for it, either. Here’s how Bitcoin (BTC, “A”) has responded to the PBoC’s insane money printing:

The correlation is clear: When China prints money, some of it finds its way into crypto markets.

When China stops, the flow of money into crypto dries up.

It’s the clearest example of just how influential China’s monetary policy is on Bitcoin and other crypto assets.

Bitcoin has been stuck in a range for a while. But when the PBoC ramps up its printing presses again, that won’t last much longer.

So don’t be disheartened by the doom-and-gloom headlines. We all know bad news sells.

But the real story is that good news makes money. And the steady increase of global liquidity driven by central banks, falls into this second category.

That means now is not the time to panic.

Crypto is getting ready to break out. And when it does, no geopolitical event will be able to stop it.

Keep checking in with us here at Weiss Crypto Daily as we get closer to the breakout. Our team of experts, myself included, will make sure you get the timeliest market updates as soon as possible.

And, if you’re interested in learning more about what to do after the big rally, I have the ticket for you. Literally.

Our exclusive Weiss Investment Summit is a unique opportunity to meet with our experts — including myself, Dr. Martin Weiss and Marija Matić — in person.

We will reveal how the incoming administration will impact the crypto world. And we will share actionable ideas you won’t get anywhere outside of the Summit.

It will take place May 4-6, 2025, at the luxurious Boca Raton resort.

If you’re interested, I suggest saving your seat sooner rather than later. Just click here to register.

We’ve just opened the doors and seats are already filling up. Once those are reserved, the doors are closed until 2026.

I hope to see you there!

Best,

Juan Villaverde