Trump’s Gold Tariffs Signal Capital Control Creep Continues

|

| By Bob Czeschin |

Gold is the world’s oldest money. So, the 39% tariff Trump just imposed on Swiss gold entering America — is really a tax on money.

It’s a common form of capital control. Moreover, this is not the Administration’s first step down this path.

As I explained last week, Trump’s "Big Beautiful Bill" imposes a new 1% tax on people inside the United States sending money abroad.

Trump’s Liberation Day tariff proclamation shifted the course of economic history in ways investors have yet to fully appreciate.

Over nearly eight decades prior to this event, average global tariffs fell a whopping 77%. Now, they’re going up again. A new cycle has begun.

Moreover, you cannot restrict the inbound flow of freely traded goods without also interfering with outbound money flows that pay for them.

That’s why tariffs have historically so often led to capital controls.

In 1930, the Smoot-Hawley Tariff Act hit thousands of U.S. imports. Britain and Germany reacted with controls blocking transfers of gold and currency, effectively killing domestic purchases of U.S. goods.

During Trump’s first term, the tariffs he slapped on Chinese imports cut deeply into China’s export revenues. Forcing Beijing to drastically tighten capital controls to protect the yuan and stop capital flight.

Now in Trump’s second term, as U.S. tariffs hit exporters worldwide, here comes the remittance tax … followed by tariffs on Swiss gold.

These are the first couple of baby steps — in a new progression of American capital controls.

Fear that one day you might be prevented from getting your savings to safety outside the country … is already a major worry for investors around the world — especially in countries like Argentina, China, Russia and Iran.

By contrast, America has historically favored open capital markets. The last meaningful capital control was the Kennedy-era “Interest Equalization Tax,” which punished U.S. investors for buying non-U.S. stocks and bonds.

But now, quietly and without fanfare … capital controls are creeping back into the United States. Far-sighted investors, take note.

Investment Implications

As individuals, we may be unable to influence decisions taken and policies crafted in Washington’s halls of power.

But as investors, we can do a lot.

For example, Trump’s 39% levy could significantly disrupt the triangular gold flows between London, New York and Switzerland. In turn, that would make markets less liquid and increase uncertainty.

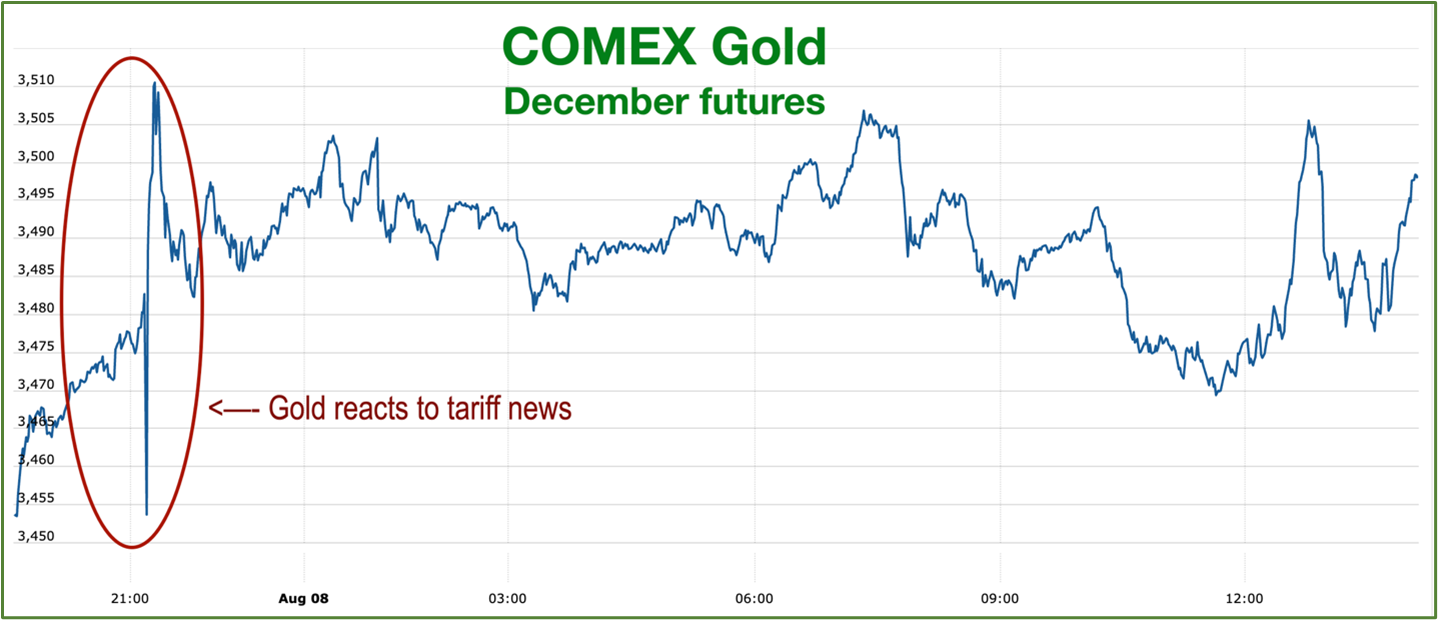

That’s likely why COMEX December futures spiked to all-time highs (above $3,510) when the tariff news hit.

Gold prices are already up 30% year-to-date. As capital controls cause more worry and concern, they’re likely going a lot higher.

If you want to participate in this move, my colleague Sean Brodrick over at Resource Trader has four red-hot gold stocks on his recommended list.

However, the purest way to fight back against encroaching capital controls is with Bitcoin (BTC, “A-”).

That’s because its decentralized nature puts it beyond the reach of any government to manipulate or control.

Accordingly, it’s no accident that folks in Argentina — with a long history of coping with draconian capital controls — have more crypto exchange accounts (per capita) than almost any other nation on earth.

If from today’s modest, innocuous beginnings, U.S. capital controls metastasize like federal income taxes … this could easily lift Bitcoin to heights undreamed of today.

So, if you’re experienced with crypto, you know what to do — sock some satoshis away today.

Better yet, do it at regular intervals to benefit from dollar-cost averaging.

If you’re relatively new to crypto and wouldn’t mind some help getting your feet wet, check out Weiss Crypto Investor.

Editor Juan Villaverde is a pioneer in predictive crypto model-building. His Crypto Timing Model has accurately called the highs and lows of the past three cycles. And in this newsletter, he shows how it can boost your buy-and-hold strategy.

Best,

Bob Czeschin