|

| By Marija Matic |

The crypto world is buzzing with excitement as Uniswap (UNI, “C”) dropped a bombshell recently …

The largest decentralized exchange (DEX) on the Ethereum (ETH, “B”) network just announced a three-month reward campaign, set to shower millions in UNI tokens across its newly launched Unichain.

This isn't just another liquidity mining opportunity; it's the veteran DEX's most ambitious play to reshape DeFi's landscape to date.

Uniswap's Bold Layer-2 Gambit

While other projects are still figuring out their scaling strategies, Uniswap has gone all-in. It has launched its own purpose-built Layer-2 blockchain.

But Unichain isn't just another L2. It’s a DeFi-focused powerhouse built on Optimism's Superchain technology.

And it’s already turning heads with its impressive stats.

In just a few weeks since launch, Unichain has attracted over 6 million wallets and has over 100 apps actively building in its ecosystem.

The rapid adoption isn't surprising when you consider what Unichain brings to the table: lightning-fast one-second block times (with plans to hit 200 milliseconds), and transactions that cost a penny. That’s 95% cheaper than the Ethereum mainnet.

On top of that, Uniswap prioritizes innovative chain-level features that make DeFi markets significantly more efficient. For example, Unichain allows applications to control how MEV profits are distributed. That makes for a more flexible and equitable ecosystem where these profits can flow back to users instead of being captured by validators.

The Reward Campaign That's Turning Heads

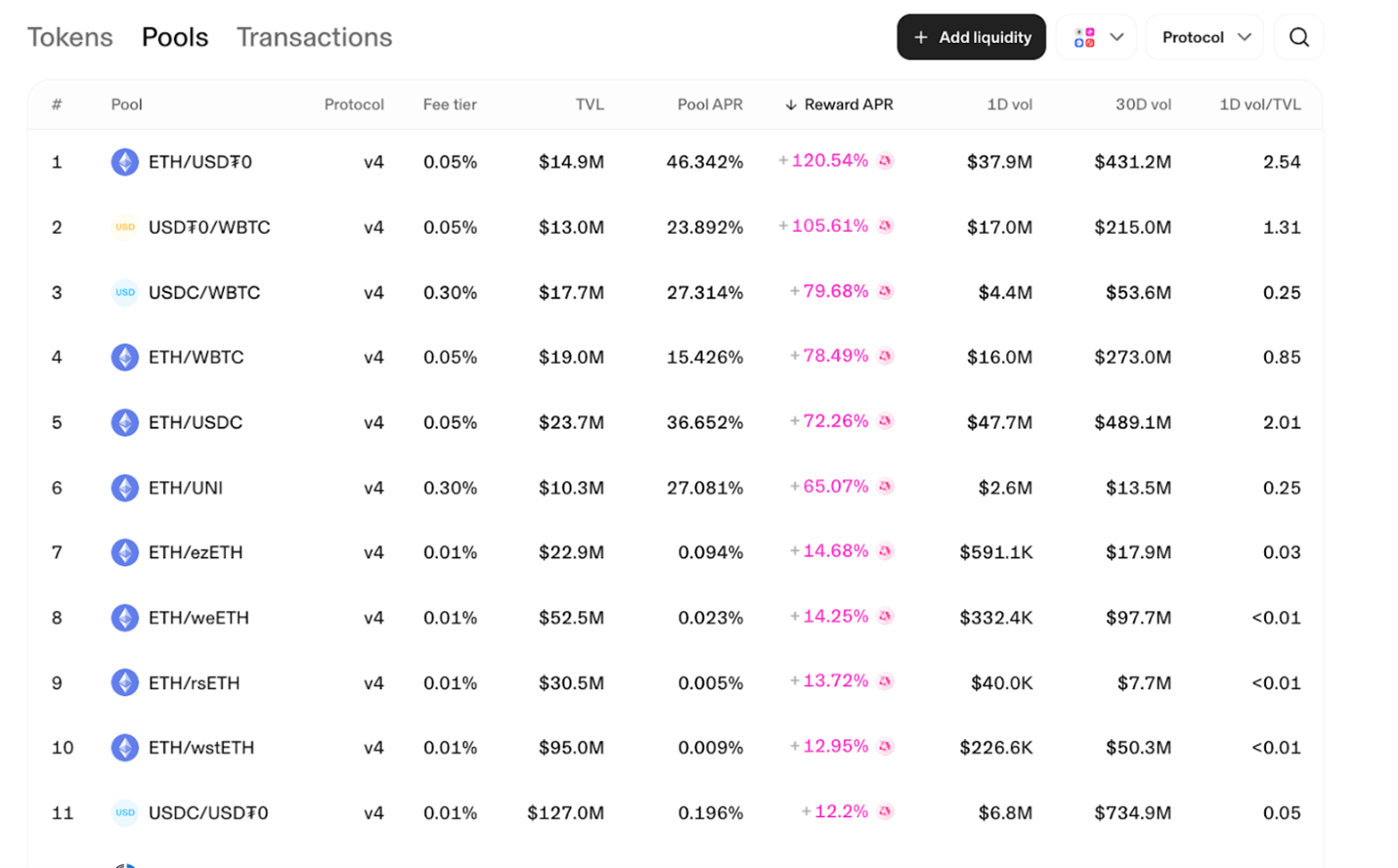

Uniswap isn't subtle about its ambitions. This latest campaign aims to bootstrap liquidity across Unichain by incentivizing 11 key pools with generous UNI token rewards.

These carefully selected pools primarily involve the crypto heavyweights: ETH, Bitcoin (BTC, “A-”) and UNI, as well as stablecoins USD Coin (USDC) and Tether (USDT), the latter specifically on the LayerZero network.

For yield hunters, the numbers are mouth-watering.

Pools pairing USDT0 — Tether on LayerZero network — with BTC and ETH are currently showing triple-digit reward APRs. And that's on top of the regular pool revenue!

And as you can see below, even the least volatile pools in the program are offering double-digit returns …

Of course, these eye-popping APRs aren't set in stone.

While the weekly UNI token distribution per pool remains fixed, your slice of the pie will change whenever liquidity enters or exits the pools.

Also, the campaign prioritizes concentrated liquidity provision, meaning you might need to actively manage your position for optimal returns.

Despite these variables, the opportunity remains exceptionally lucrative compared to most DeFi yields available today. Particularly for those who move quickly. Before more liquidity floods in.

Breaking the Mold: UNI Staking Powers the Chain

Beyond just incentivizing liquidity, Unichain introduces a fundamental innovation in how Layer-2 networks approach security and tokenomics. In a bold departure from industry norms, Unichain's validators stake UNI tokens to decentralize and secure critical parts of the network infrastructure.

This design creates significant additional utility for the UNI token and represents a fascinating power shift in the ecosystem.

Effectively, Uniswap has reclaimed some value capture from ETH and redirected it to UNI, potentially setting a precedent that other major DeFi protocols might follow.

While this realignment benefits UNI holders, it doesn't completely sideline ETH. The ETH on the Unichain network is still used for transaction fees to maintain an important role in the ecosystem. Though these fees don't directly benefit ETH stakers, they help preserve ongoing demand for ETH within Unichain's rapidly growing landscape.

This balanced approach — leveraging UNI for security while maintaining ETH for transactions — showcases Uniswap's strategic vision for creating value for both their token holders and the broader Ethereum ecosystem they're built upon.

Get in on the Action

For savvy DeFi participants, Unichain presents multiple paths to potential profits.

We’ve already covered the impressive opportunities available in liquidity mining. These are some of the juiciest APRs in DeFi right now, especially in the USDT0 pairs where returns are reaching triple digits.

And ETH holders are particularly well-served, with ETH/wrapped ETH pairs delivering impressive 12%+ yields — a compelling option for those looking to compound their holdings.

Ready to dive in?

Getting funds onto Unichain is refreshingly straightforward. The simplest route is swapping through the Uniswap interface:

- Connect your software wallet — like MetaMask — to Uniswap.

- Select ETH as input token on Ethereum network.

- Select ETH as output token on Unichain network.

- Complete the swap to bridge your funds.

This new network maintains familiarity by using ETH on Unichain as its native token for transaction fees.

When it comes to wallets, one can use Unichain on MetaMask or other Ethereum-based wallets, after adding this info to “Add Network” section of the wallet:

- Chain Name: Unichain Mainnet

- Chain ID: 130

- RPC URL: mainnet.unichain. org

- Currency Symbol: ETH

- Block Explorer: https://uniscan.xyz

But if liquidity providing isn’t your strategy of choice, there are two other ways Unichain can work for you.

1. UNI Token Value

While distributing UNI as rewards creates some selling pressure during the three-month campaign, the validator staking requirement creates opposing demand by locking tokens.

This dual dynamic could benefit long-term UNI holders if Unichain captures significant market share. That’s because the staking utility will eventually outlive temporary reward-based selling.

2. Arbitrage Opportunities and DeFi Savings

Unichain's seamless connection to other L2s will open up interesting arbitrage possibilities across the fragmented Ethereum scaling landscape … if you know how to benefit from it.

And while it might not sound sexy, saving 95% on transaction fees means traders and liquidity providers keep significantly more of their profits.

For active DeFi users, these savings compound dramatically over time.

As the DeFi landscape continues to evolve, Unichain represents one of the most intriguing developments of 2025. By combining Uniswap's battle-tested DEX technology with a purpose-built L2 optimized for DeFi, it has created something that could potentially reshape how we think about decentralized finance.

The generous rewards currently on offer might just be the beginning of Uniswap’s return to the center of the DeFi universe.

Best,

Marija Matić