|

| By Marija Matic |

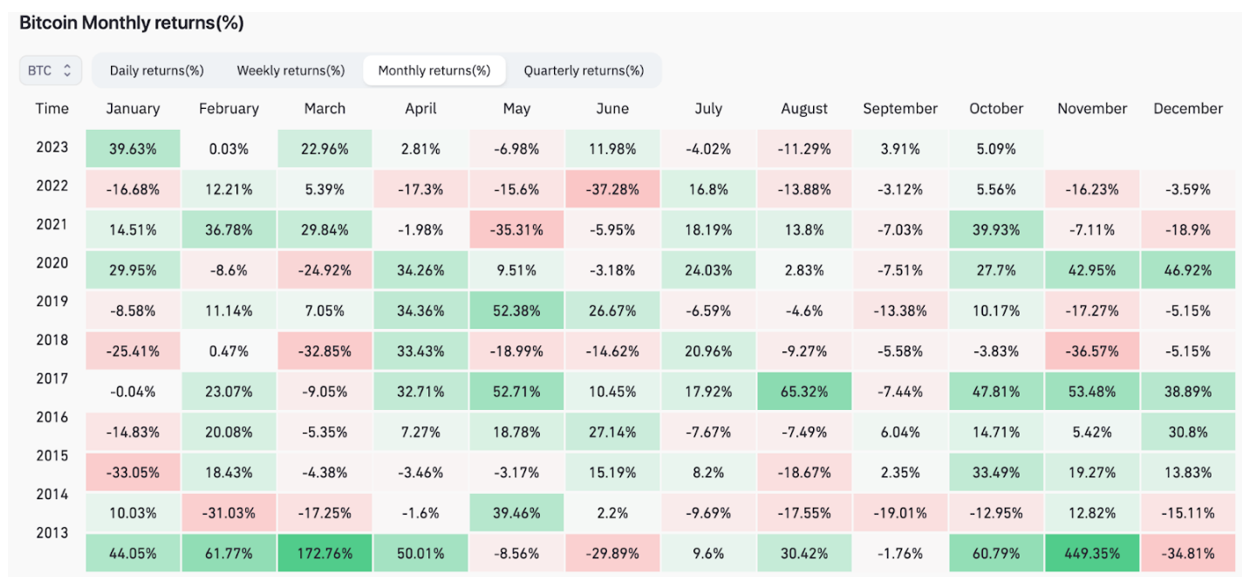

Bitcoin (BTC, “A-”) concluded September with gains of +3.91%. This is atypical, breaking a six-year streak of negative September closures.

Furthermore, both Bitcoin and Ethereum (ETH, “B”) broke free from the confines of their descending trend lines last week, which had constrained them since mid-July.

But while September bucked its historical trend, Uptober seems to be back in full force, with over $89 million of shorts being liquidated in the past 24 hours.

This price action has more behind it than the changing of the month, however. Several ETH Futures ETFs will be launching today, including Bitwise Ethereum Strategy ETF (AETH) and Bitwise Bitcoin and Ether Equal Weight Strategy ETF (BTOP).

The eager anticipation of these ETFs has infused ETH with a sense of optimism, as its performance has outpaced BTC's gains over the past seven days.

A closer look at the daily Ethereum chart reveals a breakthrough from the descending resistance, fueling optimism and setting a potential target at $1,900:

At the same time, BTC has smashed its own descending resistance and is now trading above $28,000:

Should the bullish momentum persist, BTC's initial significant target would be set at $29,500.

During the third quarter, BTC experienced a loss of -11.54%, following its gains of 71.77% in Q1 and 7.19% in Q2. As we commence October with a 5% gain, it reflects the traditional resurgence of optimism often observed in the crypto market during the fourth quarter.

From a historical perspective, Bitcoin has experienced only two negative Octobers in the past decade.

Adding to the anticipation of upward momentum is the upcoming decision regarding the considerably more impactful BTC spot ETF.

However, deadlines for assessing several proposals originally slated for mid-October were postponed, primarily due to an anticipated government shutdown, which was subsequently averted. Consequently, most analysts are now leaning toward January 2024 as the most probable approval date.

The Securities and Exchange Commission will need to reach a final decision by mid-March at the latest.

But irrespective of whether market expectations align with reality, the sheer anticipation of this decision possesses the potential to incite a significant market rally in the coming weeks.

Notable News, Notes & Tweets

- Former FTX CEO Sam “SBF” Bankman-Fried will spend at least 21 days in court as part of his criminal trial, which will begin in earnest on Oct. 4 and last until Nov. 9.

- Binance has urged its European users to convert their euro balances to Tether (USDT, Stablecoin) by Oct. 31, due to the loss of support from its banking partner.

- Coinbase (COIN) crypto exchange obtains a payment license in Singapore.

What’s Next

The crypto ETF arena is witnessing the beginnings of a marketing rivalry that is poised to enhance the ecosystem.

A noteworthy example of this is Vaneck's commitment to allocate 10% of profits from its Ethereum Futures ETF to the Protocol Guild for a minimum of 10 years. This announcement is particularly promising, considering that the Protocol Guild comprises ETH core developers, ultimately benefiting the crypto community.

In tandem with this, the shift from a "fear" sentiment in the previous month to a more "neutral" stance — as indicated by the Crypto Fear and Greed Index — lays the groundwork for a potentially prosperous fourth quarter.

These evolving conditions could set the stage for robust performances driven by ETF approvals and a pre-halving rally, so keep a close eye on your favorite projects as Uptober gets truly underway.

Best,

Marija