Use This Metric to Scout the Next Crypto Stars This Summer

|

| By Marija Matic |

Hold onto your crypto hats, my friends. Because while the recent price dip might have you feeling seasick, it's just a summer squall in the grand crypto voyage.

Bitcoin's (BTC, “A”) surprise plunge below $55,000 on July 4 had some folks reaching for the life rafts. But seasoned crypto sailors know this was a normal pullback.

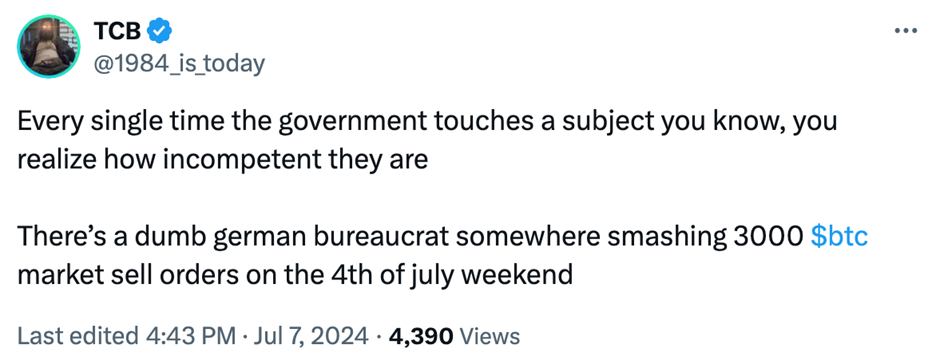

The price drop can be partly blamed on Mt. Gox creditors — a situation I explained last week — as well as Uncle Sam's Teutonic counterparts. The German government's fire sale of Bitcoin through market orders definitely pushed the price south.

They became smarter today though, as they started distributing their stash more equally among the exchanges, as well as giving BTC to experienced market makers who can execute large sales efficiently. But the German government still holds more than $2 billion worth of Bitcoin, which could increase the sell pressure, despite some members of the German Bundestag protesting the sale.

But even with all this tumult, as I said, these choppy waters are to be expected. Pullbacks of 20%-40% are common in every bull market.

And despite the government’s sales, the price of the foremost cryptocurrency has rebounded intraday.

This is because the much anticipated Ethereum (ETH, “A-”) ETF approval could happen in the coming days, and there is a strong demand from certain players.

Summers in crypto tend to be a bit like lazy afternoons on the deck chair, with July occasionally surprising us with a small fireworks display (a pattern my colleague Dr. Bruce Ng pointed out recently). This year could be similar, especially with the Ethereum ETF approval potentially lighting the fire.

Nevertheless, BTC still needs to reclaim $60,600 to return to bullish sentiment.

So, yes, there is downside pressure on Bitcoin thanks to the German government and Mt. Gox creditors. But don't let these short-term jitters distract you from the long game.

And history buffs would likely tell you to forget the summer months anyway. After all, October and November are typically champagne-spraying months for Bitcoin, with October boasting a median gain of a whopping 27.70% since 2013.

While we wait for the weather to cool and Bitcoin to heat up, my attention is on the altcoin market.

Think of it as a treasure trove waiting to be discovered. That’s because altcoin season — when altcoins outperform Bitcoin — is still ahead of us.

How do we know an altcoin season is on the horizon in the next few months? Look no further than the ETH/BTC chart. Stuck in a downtrend since 2021, with Bitcoin dominating its larger altcoin cousin, a reversal is nigh.

Summer Scouting: Pick the Next Breakout Stars

So, how do you pick the winners in this upcoming altcoin surge?

Well, a slow summer is the perfect time to do your research and assemble your dream altcoin team. Identifying strong performers in a down market — like Toncoin (TON, “B-”) — is a good starting point.

I’ve mentioned TON before. It is supposed to grow alongside the fastest-growing messenger-turned-social network in the world, Telegram. The platform pays content creators in TON by sharing ad revenue with them.

Utility coins like TON have the resilience to weather the current storm. And they are likely to shine even brighter when the market rallies.

But there's more to scouting a potential winner than just past performance. Liquidity, or trading volume, is another key indicator of a strong performer in stormy waters.

Here's a list of the top 10 most actively traded coins in the past 24 hours, courtesy of CoinGecko.

1. BTC daily volume $31.54 billion (market cap rank No. 1)

2. ETH daily volume $16.28 billion (market cap rank No. 2)

3. Solana (SOL, “B”) daily volume $2.87 billion (market cap rank No. 5)

4. Ripple (XRP, “B-”) daily volume $1.34 billion (market cap rank No. 8)

5. Notcoin (NOT, Not Yet Rated) daily volume $1.33 billion (market cap rank No. 50)

6. Pepe (PEPE, Not Yet Rated) daily volume $1.23 billion (market cap rank No. 27)

7. BNB (BNB, “C+”) daily volume $1.12 billion (market cap rank No. 4)

8. Dogecoin (DOGE, “C+”) daily volume $0.96 billion (market cap rank No. 10)

9. Dogwifhat (WIF, “E+”) daily volume $0.76 billion (market cap rank No. 53)

10. TON daily volume $0.54 billion (market cap rank No. 9)

Look closer at that list, and you'll see some interesting outliers.

NOT and WIF, for example, are ranked way outside the top 30 in terms of market cap. Yet their trading volumes are massive.

This suggests the memecoin supercycle is far from over.

WIF, NOT and PEPE are all strong contenders to watch, as memecoins with significant trading activity. Even their high volatility can be a friend, as seasoned traders have discovered in recent weeks. Price movements of these memecoins are becoming increasingly predictable, creating opportunities for swing traders.

Of course, it's not all fun and games with assets in this volatile sector.

While memecoins can be exciting, remember that smaller coins with high churn rates are much riskier propositions.

If memecoin trading is calling you, a focus on the established memecoins with more "sticky" liquidity — like the ones we mentioned earlier — is one way to mitigate your risk exposure.

Outside of the memecoin craze, there are plenty of altcoins with real-world applications that deserve a place on your radar. In fact, my colleague Mark Gough recently highlighted the use cases for decentralized identity projects and revealed the five he found most impressive.

Some of these workhorses, often overshadowed by the flashy and overpriced VC-backed projects, may offer genuine long-term potential. The recent market correction is presenting a great entry point for some of them.

The altcoin market is on the cusp of a major breakout. By understanding the signs, identifying undervalued projects and prioritizing coins with real utility, good volume and token accrual model, savvy investors can position themselves to profit from the coming altcoin surge.

Best,

Marija Matić