|

The Fed fiddles with central bank digital currencies (CBDCs).

It experiments with FedNow, an instant payment system that they say will achieve a similar goal without blockchain technology. (Fat chance they’ll be able to keep THAT secure!)

And worst of all, it can never seem to kick the habit of abusing its power to manipulate interest rates — first squashing them to near zero for years on end; now jacking them up at the fastest pace in history. Meanwhile …

Rome burns.

And the flames are first appearing in the home mortgage market, where a series of financial failures has just begun.

Sound familiar? It should because …

Whether you invest in crypto or in stocks … and whether you live in the U.S. or overseas, I’m sure you remember what happened the last time the housing market collapsed.

We Warned Investors in 2007.

Now It’s Time to Warn Again.

In early 2007, we said the canary in the coal mine was the imminent failure of banks specialized in subprime mortgages.

Sure enough, in the months that followed, subprime banks went down like dominoes: American Home Mortgage Investment Corp., New Century Financial, Accredited Home Lenders, Countrywide Financial and many more.

But that was just the beginning.

Large money center banks were also deeply entangled in the subprime mortgage mess. What’s worse, they used the mortgages to build a giant pyramid of new, highly speculative instruments, such as collateralized mortgage obligations.

Washington Mutual went under, never to resurface again.

That was shocking enough.

Even more shocking was the list of megabanks that lined up at the steps of the U.S. Treasury Department for giant bailouts.

The date: Oct. 28, 2008.

The names and bailout amounts:

Bank of America — $25 billion;

Citigroup — $25 billion;

JPMorgan Chase — $25 billion;

Wells Fargo — $25 billion;

Morgan Stanley — $10 billion;

Goldman Sachs — $10 billion.

And many more.

But if you think those outsized handouts from the U.S. Treasury were shocking, wait till you see the kind of money the Federal Reserve pumped into the banking system as a whole:

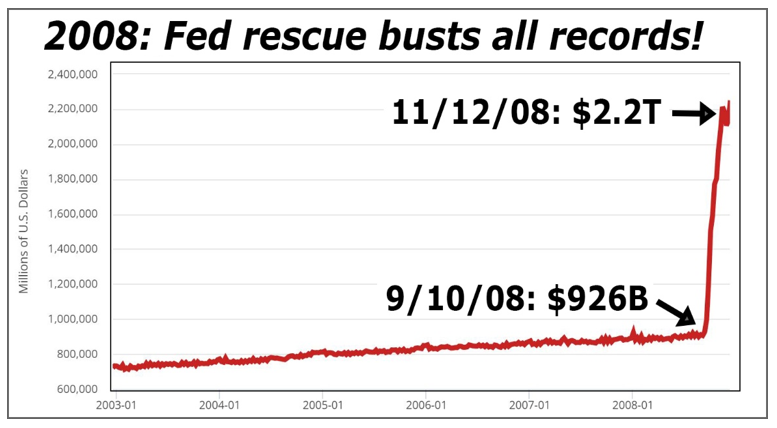

For decades, any money printing by the Fed was strictly in minuscule amounts.

So, on Sept. 10, 2008, the total amount the Fed had ever printed was only $926 billion.

But then, just 63 days later, the total suddenly exploded to $2.2 TRILLION!

It was, by far, the biggest and wildest money-printing binge by the Fed of all time.

Indeed, from the day the Fed was founded nearly a century earlier, it had never done anything even remotely similar before.

And it set the precedent for a long series of money-printing escapades that piled up to nearly $9 trillion this year.

What’s most worrisome, however, is that …

History Is Now Repeating Itself

The names and places may have changed, of course.

Instead of subprime mortgages, they’re called non-qualified mortgages.

And instead of mortgage banks with names like New Century Financial or Countrywide Financial biting the dust, the casualty list is starting with names like First Guaranty Mortgage Corp. and Sprout Mortgage. (Both just went under.)

But the pattern is similar:

• A great wave of real estate speculation fueled by ultracheap money …

• Crazy, unprecedented borrowing by home buyers across the U.S. …

• And next, a massive debt crisis that shakes the world.

Except for two BIG differences:

1. Back in 2008, when the Great Debt Crisis hit, the Fed had not printed more than $8 trillion in new paper dollars like it has today. Like I said, they had never done anything like that before.

2. Back in 2008, when the U.S. real estate market was crumbling and America’s largest banks were going bust, inflation was not running amuck like it is today. Consumer prices were up less than 3% in the year prior. Now, they’re up by nearly TRIPLE that rate.

So, back in 2008, the greatest government rescue of all time was possible.

Will it be possible again?

Don’t count on it ...

Don’t count on the Treasury or the Fed to bail out your bank, your business, the company you work for or the stocks you’ve invested in.

Don’t count on the endgame to be the same this time around.

Take the destiny of your finances firmly into your own hands and build a durable firewall of protection around them.

How?

My team and I are here to give you the tools and guidance to help make that easier.

That’s why I’ve been writing you almost daily about the dangers and what you can do about them.

That’s why I created a special tutorial with step-by-step instructions on how to proceed with care and urgency.

Watch it here now. Because in just two days, it’s going offline.

Good luck and God bless!

Martin