Why Bitcoin's August Chill Might Spark a Red-Hot Q4

|

| By Marija Matic |

Crypto has cooled off after a sizzling July.

But that doesn’t mean we’re done with the heat for good.

After the recent correction — which came after the latest Federal Open Market Committee meeting — most major cryptocurrencies have tested key support levels …

Only to bounce back in quick reversals!

This is why it’s important not to lose the forest for the trees when it comes to price action in crypto. Because rather than signaling a breakdown, this behavior points to a broader consolidation.

In short, we’re seeing a natural — and even healthy — pause after months of strong upward momentum.

Which is a promising sign for what’s to come later this year.

For Every Rally (and Slump), There Is a Season

This slowdown is more than just technical. It’s seasonal.

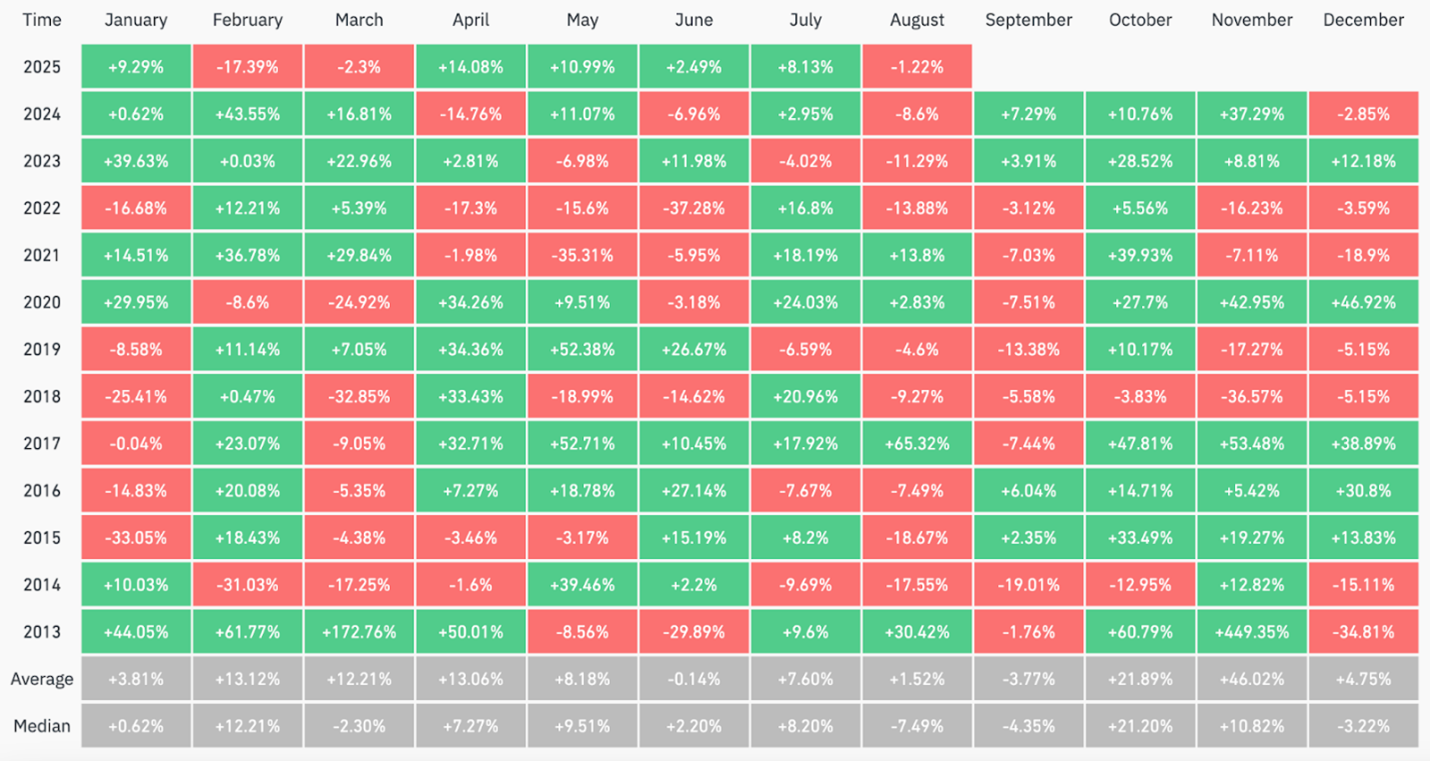

Since 2013, August has historically been one of Bitcoin’s (BTC, “A-”) weakest months, with negative returns in eight of the last 12 years.

The average gain? Just 1.52%.

The median? A -7.49% drop.

It’s no surprise then many traders tread carefully this time of year.

If we take a step back, we realize that August coincides with peak vacation season. And in the resulting dip in engagement, risk appetite and clear conviction, many cryptos lose momentum.

While activity may continue, the tone shifts: Price action tends to be choppier, more indecisive and prone to false moves.

Wake Me Up When Uptober Approaches

But like every season, August’s chill eventually gives way, typically in October.

Over the past six years, Bitcoin has posted green candles every October, with an average return of 20.44% and a median of 19.23%.

These are not small moves. In fact, they’ve often marked the beginning of extended bull runs.

And in 2021 — the final stage of the previous bull cycle — Bitcoin jumped nearly 40% in October alone.

Q4: Bitcoin’s Best Quarter

While the momentum usually returns in October, it’s November that has historically delivered even more dramatic gains.

With a 12-year average return of 46.02% and a median of 10.82%, it’s often the acceleration phase after October’s ignition.

Last year? November saw a 37.29% rally.

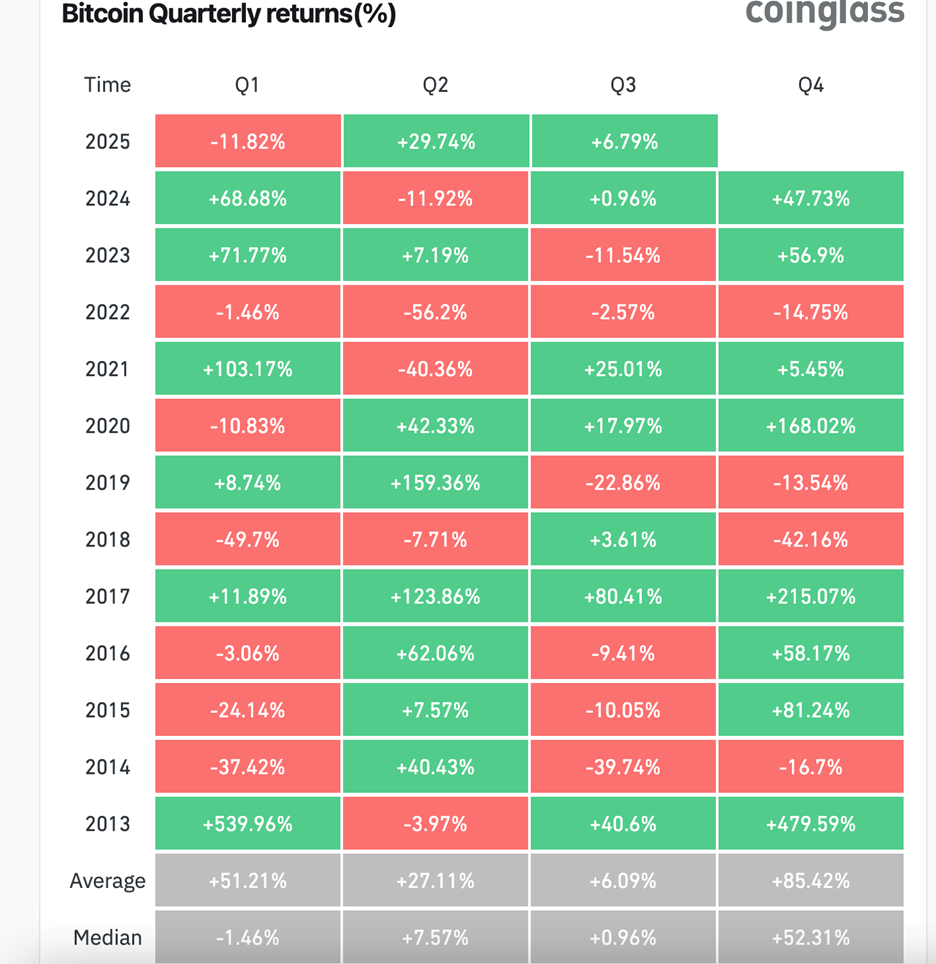

Together, performance in these two months have historically made Q4 Bitcoin’s strongest quarter.

Based on CoinGlass data, it boasts an impressive average return of +85.42% and a median of +52.31%.

That kind of seasonality is hard to ignore:

A Bullish Setup Beneath the Surface This Season

As the summer winds down, Bitcoin will slowly approach this powerful seasonal window. And it might do so under unusually restrictive macro conditions — a real test for any risk asset.

Still, Bitcoin has already shown its strength in 2025.

The second quarter of this year delivered a 29.74% gain, despite high Federal Reserve interest rates and the most intense trade war tensions.

U.S. tariffs hit 145% in April, with China retaliating at 125%. No rate cuts and no easing means Bitcoin soared on raw strength alone.

In fact, 2025 saw Bitcoin’s strongest Q2 performance since 2020!

That kind of resilience sends a clear message: When the right catalysts align, Bitcoin’s bull market can power through even the most hostile macro environment.

As we move closer to Q4, the setup is becoming increasingly interesting. Traders typically return from summer in early September, and momentum often builds from there into year-end.

The Fed Wildcard

Meanwhile, the Fed is facing growing internal divisions.

Some officials are now floating the idea of rate cuts as early as September if labor market softness persists. The chance of easing is now at 87.8%.

Goldman Sachs has echoed that sentiment, suggesting the Fed could act sooner than markets currently expect.

If that dovish pivot aligns with Bitcoin’s seasonal sweet spot, it could create a powerful mix: a resilient market, a potential shift in monetary policy and favorable historical timing.

It’s a setup that bulls will be watching closely.

And it’s one that savvy investors will prepare for ahead of time. That means finding solid entry opportunities into the assets on your watchlist.

If you — like most of us — can’t stay glued to your computer, I suggest setting up alerts through Weiss Ratings.

Just search your favorite crypto on Weiss Ratings website. Then, on that asset’s rating page, you’ll find the My Alert button at the top, right under the rating and real-time price.

Click on that, and you’ll get automatic alerts when our ratings update or when the asset price changes by a custom percentage.

Best,

Marija Matić