Why This Risky Bet on Stablecoin Control May Not Pay Off

|

| By Marija Matic |

The Bank of England is making a risky bet. One that may cost more than it bargained for.

Recently, the central bank revealed a proposal to control stablecoins via a holding cap.

Increased centralized control over crypto will never be a popular strategy in the community. And sure enough, the news set off a storm among crypto experts and enthusiasts.

But buried in the backlash is a real warning.

Critics say that this bid for greater control could suffocate innovation … just as the UK tries to position itself as a hub for digital finance.

Why the Bank Is Nervous

On the surface, the Bank of England’s reasoning makes sense.

Stablecoins — digital tokens pegged to fiat currencies — pose a clear challenge to traditional banking.

If people begin parking large sums in digital pounds or dollar-pegged tokens, that money effectively leaves the retail banking system. That reduces the deposits that banks rely on to fund loans.

For regulators, this raises the specter of destabilized bank balance sheets, liquidity shortages and a diminished capacity to extend credit.

The Bank’s Solution

To dispel these concerns, the BoE has come up with a plan: caps on how many stablecoins individuals and institutions could hold.

Retail investors would be able to own between £10,000 and £20,000 in stablecoin ownership.

Companies, on the other hand, could hold up to £10 million.

The rules would apply to so-called systemic stablecoins. That is, ones widely used for payments or likely to become systemically important.

From the central bank’s perspective, the proposed caps are a defensive move designed to slow adoption until the TradFi system can adapt.

Officials even suggest the limits could be “transitional,” while the market adjusts to the rise of digital money.

The Industry Pushback

The backlash from the crypto industry has been swift and sharp.

As the community sees things, the BoE is trying to use a blunt instrument to solve a problem better addressed by risk-based regulation.

Critics argue the measure is heavy-handed, unenforceable and risks making Britain less competitive compared to the U.S. and EU.

They certainly have a point when it comes to enforcement.

Stablecoin issuers cannot realistically monitor who owns what. To do so would require the UK to roll out invasive infrastructure.

This would be much more than the basic “know your customer” steps centralized exchanges walk you through. We’re talking measures as invasive as biometric IDs linked to wallets — an approach that raises deep privacy concerns and would be costly to implement.

And even then, it wouldn’t stop people from holding multiple or alternative wallets.

It would be a band-aid solution as true enforcement remains extremely difficult.

Tom Duff Gordon of Coinbase put it bluntly: The plan is “bad for UK savers, bad for the City and bad for sterling.”

He’s not wrong.

After all, limits on stablecoin holdings would cut off savers from higher-yielding web3 alternatives and discourage crypto and fintech firms from building in London.

Not to mention, it risks sidelining the pound in a world where digital currencies are becoming the default rails for global money flows.

The criticism stings because, globally, the UK risks looking like an outlier.

The regulatory tides have firmly shifted over in the U.S. with Congress’ recent passing of the GENIUS Act. Rather than keep stablecoins on the outs, this legislation integrates them even further into the financial system … without capping ownership.

In the EU, the MiCA framework sets out comprehensive rules for stablecoin issuers while also avoiding arbitrary limits.

In both cases, the focus is on transparency, reserve quality and consumer protection. Not on restricting demand.

That’s because regulators in both the U.S. and EU understand something the BoE has overlooked: Stablecoins have grown too big to restrain.

A Market Too Big to Ignore

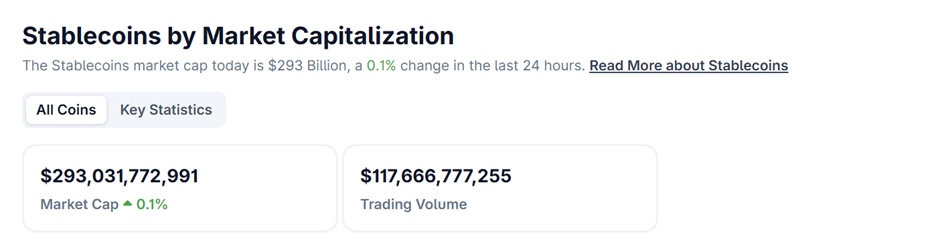

Stablecoins are not some niche corner of crypto anymore. They represent a market with over $293 billion in capitalization and an astonishing $117 billion in daily trading volume.

That trading volume rivals major fiat currencies in terms of transactional use!

And that popularity is founded in practicality.

Stablecoins have now become the connective tissue between TradFi and DeFi to enable instant, low-cost, cross-border payments.

It's no wonder why traders like them. But savers and long-term investors have their own uses for stablecoins.

Primarily because they hold their value. Stablecoins offer a way to hold digital cash without exposure to crypto volatility.

But there’s more ...

Unlike with fiat currency, stablecoins allow holders to lend their crypto to DeFi protocols in return for yields several times higher than standard savings accounts.

In fact, I’ve helped my Crypto Yield Hunter Members target a few opportunities like this. As of writing, they are currently earning over 10% on their stablecoin holdings.

That makes stablecoins not just a digital cash alternative, but also a productive asset. One that can work for traders and savers in ways banks almost never allow.

For businesses, the attraction is different but just as powerful.

Stablecoins unlock efficiencies in settlement and treasury management. This means firms can move money globally at lower cost and with near-instant finality.

Restricting their use could mean restricting the UK’s role in the next wave of financial innovation.

That could be a strategic misstep for a country that prides itself on being a financial center. And one that could see even established business leave in search for friendlier regulation.

Disruption Doesn’t Equal Instability

The Bank of England is right about one thing: Stablecoins are disruptive.

If widely adopted, they could meaningfully change how money circulates, who controls it and how financial stability is managed.

But disruption does not automatically mean instability.

Think back to the arrival of money market funds in the 20th century. That, too, disrupted the economy. Rather than buckle under change, banks and regulators were able to adapt.

The rise of stablecoins should be seen in a similar light. They are a signal that we need to modernize financial infrastructure — not to place arbitrary speed limits on it.

The Real Risk: Falling Behind

In short, the proposed caps reveal the BoE’s deep unease with stablecoins. And it could send the message that Britain is more interested in control than innovation.

If the U.S. and EU push forward with more open, flexible frameworks, the UK could find itself playing catch-up in a sector it has repeatedly claimed it wants to lead.

As investors, we’ll need to watch carefully to determine whether the UK chooses to shape stablecoin growth productively … or if it will fence it in until opportunity has passed.

Best,

Marija Matić