|

| By Juan Villaverde |

Crypto prices should soon turn lower before they make a meaningful low later this month.

My Crypto Timing Model pinpoints today and tomorrow — Jan. 9-10 — as the first important reversal window of 2026.

However, it shows up as a high forecast.

Meaning, prices are more likely to turn down than up.

Roughly 80% of high forecasts produce highs — and the remaining 20% result in lows. This is known as an inversion.

However, figuring out whether a particular inflection point will be a high or a low requires additional context.

That’s where Central Bank Liquidity analysis comes in.

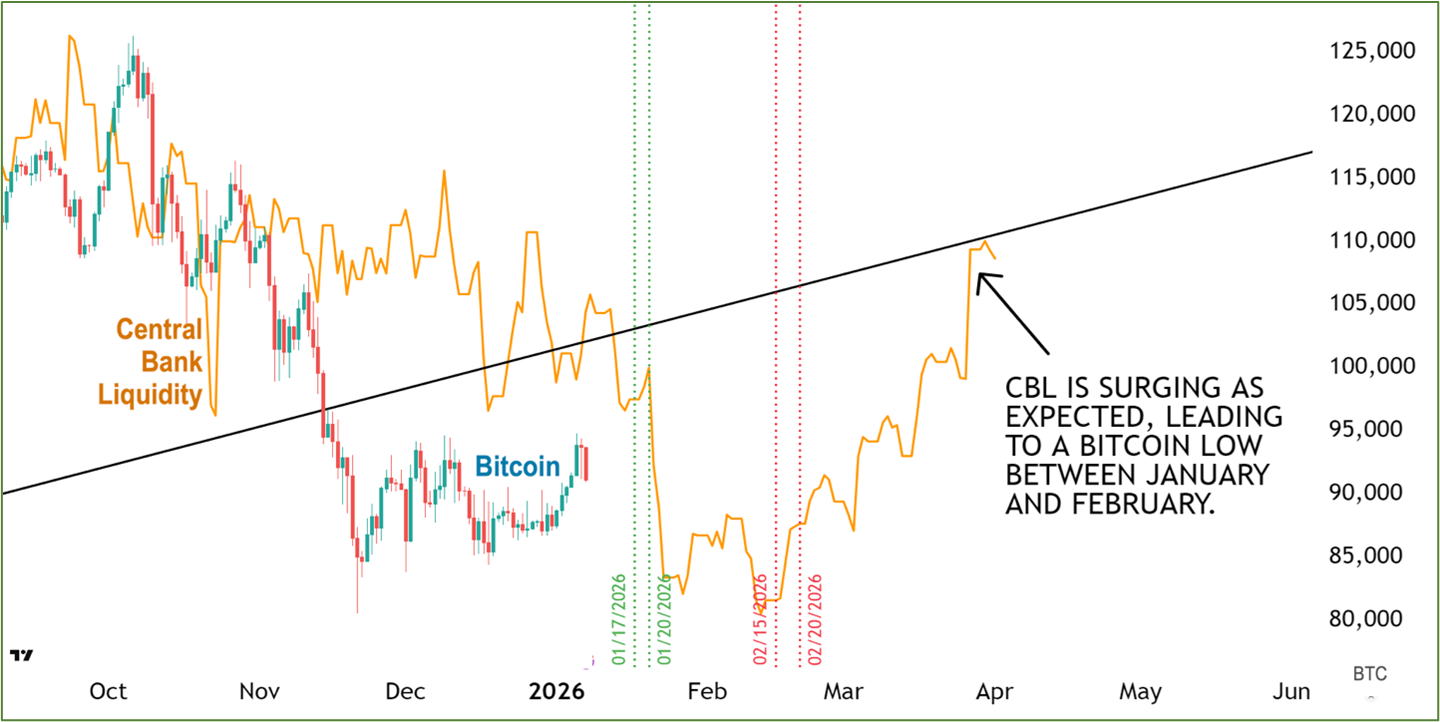

CBL Reveals Direction of Timing Model’s Inflection Points

It’s important to read these forecasts correctly.

They are forecasts in time first. And direction second.

Simply put, they identify inflection points when Bitcoin — and crypto, more broadly — is likely to change direction.

And they’re right about 95% of the time. Though the intensity of the move can vary.

I’ve highlighted above two date ranges my Timing Model says likely contain inflection points.

- The first, marked by green dotted vertical lines, is Jan. 17–20.

- The second, marked by red dotted vertical lines, is Feb. 15–19.

Initially, both forecasts show up as possible highs.

Yet, one will almost certainly be a low.

How do we know that?

Well, notice how CBL turns sharply higher ahead of the red dotted vertical lines.

That strongly suggests the formation of Bitcoin’s next 320-day-cycle low.

The January window also carries some of the highest forecast intensity of the year.

For that reason alone, I’m inclined to think Bitcoin may bottom in late January.

On the other hand, the February window aligns more cleanly with the CBL low.

This suggests the correction could persist until then.

- If crypto turns lower, we could see a sharp but relatively brief sell-off as month-end approaches. That’s bullish, because it suggests the bottom is near.

- But if the rally continues into late January, then the ultimate low is more likely to arrive in February. Which means it may be another 4-5 weeks.

Whether Bitcoin bottoms in January or February doesn’t change the big picture.

Which is that a major low is likely approaching.

And it should hold through at least early April, if not longer.

Once it’s in place, prices should rally for several months afterward.

As for what to buy and when to buy it, you’ll want to be on board to get my Timing Model’s freshest signals in your inbox.

One good way to do that is to fill out the short form on this page at your earliest convenience.

Best,

Juan