With Fear This High, It’s Time to Get Greedy

|

| By Juan Villaverde |

Bitcoin (BTC, “A”) just dropped below $70,000 for the first time since November 2024 … and kept falling.

It also broke below its 2021 high of $69,000.

As I write, it’s trading around $67,000.

And the bottom, according to my Crypto Timing Model, is still to come.

This sell-off is notable because it’s driven primarily by leveraged speculators on futures exchanges.

Like most sharp declines, it was largely the result of forced liquidations.

How many heavily leveraged long positions still remain after one of the steepest four-month declines in years?

I don’t know. What I do know is that leveraged players must be flushed out before a durable low can form.

As long as speculators are taking aggressive leveraged bets, the market remains vulnerable to sudden downside moves — exactly like last weekend.

Indeed, the evidence is mounting that this is the final shakeout before stability.

Beyond the forced selling — often the final stage before a cycle bottom — sentiment has reached an extreme rarely seen.

For example, we’ve seen …

- Fake social-media posts accusing Binance of orchestrating the sell-off.

- Infighting within the Bitcoin community over whether quantum computing poses an existential threat. (You can read DeFi expert Marija Matić’s take on that here.)

- Ethereum (ETH, “B+”) founder Vitalik Buterin under fire for comments about Ethereum’s future scaling path.

- MicroStrategy’s Michael Saylor reportedly underwater after years of aggressive Bitcoin accumulation.

- And investment celebrity Michael Burry (immortalized in the feature film, The Big Short), weighing in with warnings of further downside.

Of course, this is all anecdotal.

But collectively, these are signs of the times. Ones that point to sentiment atcapitulation levels …

A necessary precondition for a major cycle low.

From a cycles perspective, Bitcoin’s current 320-day-cycle began roughly 305 days ago.

Given that recent cycles have tended to bottom closer to the 290-day mark, this cycle appears overdue for a low.

The 80-day cycle tells a similar story.

We are currently about 75 days into it. As with the longer cycle, this suggests downside pressure could persist briefly — but a reversal is near.

What about the immediate catalyst for the sell-off? Much of it got blamed on the U.S. government shutdown last week.

But that quickly unraveled when President Trump signed legislation on Tuesday to effectively end the shutdown.

A Major Crypto Bottom Approaches

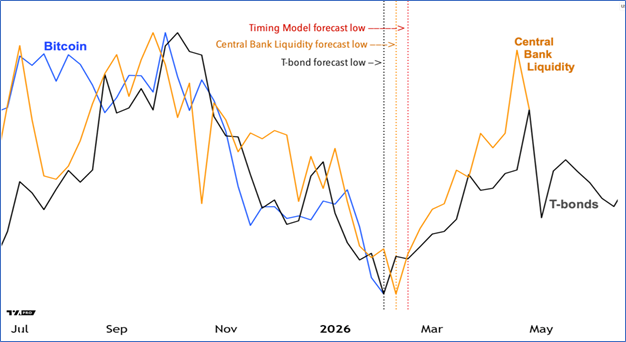

I’ve marked the projected lows using vertical dotted lines — black for bonds, orange for liquidity. The red vertical dotted line is where my forecasting model projected a Bitcoin bottom.

All of them point to an approaching V-shaped bottom.

However, market bottoms are never pleasant. They are often full of fear, pessimism and relentless bad news.

No one feels bullish at the low.

That’s precisely the environment we’re in now.

And it’s another reason I’m confident the low is close. But I would be remiss not to include a word of caution.

V-Shaped Bottoms Can Be Especially Brutal

With this setup, prices are prone to accelerate alarmingly into a low; then reverse sharply higher once the bottom is established.

Indeed, every 320-day-cycle bottom in crypto has taken a similar shape: a sharp, stomach-turning sell-off, followed by a near-vertical rally — either the same day or the next day.

For example …

- November 2022 (FTX collapse): Bitcoin fell more than 14% on Nov. 9, then rallied over 10% on Nov. 10.

- Sept. 11, 2023: Bitcoin dropped about 3%, then rallied more than 6% the following day.

- Aug. 5, 2024: Bitcoin crashed roughly 14%, then rallied over 8% the same day, followed by another 6% gain on Aug. 6.

- April 7, 2025: Bitcoin fell 6% on April 6 and another 5% on April 7, before rallying nearly 9% late on April 7.

That happens because sellers are only fully flushed out at the cycle low, finally allowing a wave of buyers to take control.

Moreover, these initial moves may not seem impressive at first.

Sometimes, they are even mistakenly dismissed as a “dead-cat bounce.”

But for crypto veterans who understand market timing, they can serve as a near-perfect confirmation that a major reversal is underway.

So stay alert. Keep an eye on your portfolio and any potential picks you’ve been waiting to jump into.

A powerful reversal is coming.

We’re not quite there yet. But it’s just weeks — if not days — away.

Best,

Juan Villaverde

P.S. To see how I plan to handle this reversal in my long-term strategy, click here.