|

| By Marija Matic |

If you’re holding standard stablecoins — like USD Coin (USDC) or Tether (USDT) — you’re missing out on easy passive income.

In a time where traditional savings accounts barely beat inflation, a new class of "yield-bearing stablecoins" turns idle balances into productive assets.

Pegged 1-to-1 to the U.S. dollar, these stablecoins are designed to grow in value automatically.

No staking, no lending. No intervention needed.

Just pure yield earned while you sleep, work and just enjoy your day.

Even better, yield-bearing stablecoins are:

- Spendable

- Composable

- Usable as collateral

- Accepted by merchants and payment platforms, mainly via cards

In short, these assets blur the lines between cash and capital. And by holding them, you can earn while remaining liquid.

Where the Yield Comes From

In DeFi, not all yield is equal.

Sustainable yields, supported by real external economic activity is the gold standard. That’s because it can be sustained, as opposed to hype-fueled activity.

And the former is exactly what yieldcoins offer. Here’s how the leading models work:

1. Real-World Assets (RWAs) & U.S. Treasuries

These projects act as a bridge between DeFi and global interest rates. And they give you traditional rates, delivered by on-chain rails.

An example is Ondo Finance. It’s one of the leading RWA projects, and its products take familiar, traditional assets and wrap them in a digital token so they can be traded 24/7 globally.

One of those products is its yield-bearing stablecoin, USDY.

USDY is backed by short-term U.S. Treasuries and bank demand deposits. As those government bonds mature and pay interest, the value flows directly into the token’s reserves — causing USDY’s price to steadily appreciate over time.

At the time of writing, it offers between 4-5% APY.

This is about as close as DeFi gets to institutional-grade dollar exposure.

2. Protocol Revenue & Hybrid Yield

These yield-bearing stablecoins allow you to earn from an entire financial ecosystem.

Take Sky Protocol (SKY, “C”), for example. Once known as MakerDAO, this crypto underwent a full-scale evolution.

The biggest upgrade? A focus on generating real revenue.

And its stablecoin, sUSDS, allows you to earn yield from that real revenue, including …

- Interest on a large Treasury bill portfolio

- Stability fees from overcollateralized crypto loans

- Liquidation penalties and protocol income

In simple terms: Holding sUSDS gives you a share of the protocol’s total profits, automatically compounded into the token’s value.

3. Delta-Neutral Trading Strategies

This "market-neutral" approach doesn’t care about cycles, technical levels or the never-ending push-and-pull between bulls and bears.

Instead, it can help you earn yield from stablecoins no matter what the market is up to.

For an example, look at Ethena’s (ENA, “B+”) stablecoin, sUSDe.

The Ethena platform runs a classic basis trade:

- The protocol holds staked ETH (earning yield)

- At the same time, it opens an equal short position in ETH futures

Because most traders want to be long, they pay funding fees to short positions. sUSDe captures both the staking rewards and those funding payments.

In doing so, it aims to generate yield regardless of market direction.

In all these cases, the yield isn't sent to you as a separate "claimable" reward. Instead, it is embedded into the token’s price.

If you buy 1,000 coins at $1.00 and the protocol earns 5% yield over a year, your 1,000 coins don't become 1,050 coins. Instead, you still have 1,000 coins, but each one is now worth $1.05.

No clicks. No friction.

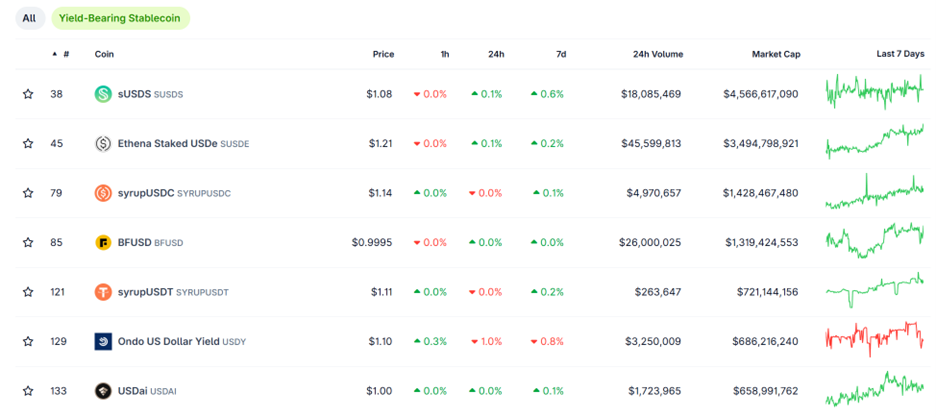

The Current Yieldcoin Leaderboard

As of writing, these are the top yieldcoins. I’ve reorganized them below from lowest risk exposure to highest.

Institutional Yieldcoins: Lowest Risk

Sky Protocol’s sUSDS: 4.00%APY, available on Curve, on the Ethereum network.

Ondo Finance’s USDY: 3.75% APY, available on Orca, on the Solana network.

Strategy Tier Yieldcoins: Medium Moderate Risk

Maple Finance' SyrupUSDC: 5.4%APY, available on Orca (Solana), Uniswap v4 (Ethereum), Aerodrome (Base)

Maple Finance’s SyrupUSDT: 5.0% APY, available primarily on Uniswap v4 (Ethereum)

Ethena’s sUSDe: 4.26%APY, available on Fluid, Uniswap v4, Pendle (Ethereum)

Expert & Alpha Tier: Moderate Risk

Staked USDai (sUSDai): 9.54% APY, plus an additional 4.5% bonus expected in January 2026. Available on Fluid and Curve on the Arbitrum network.

Huma Finance’s PST: 9% APY, available on Jupiter and Orca on the Solana network.

Why Wait? Start Earning Now

Regardless of whether you’re a diamond hands HODLer …

Or a quick trade degen looking for the next moonshot …

You need liquidity on the blockchain, ready to go.

Rather than have that capital sit idle while you wait for your next opportunity to act, make sure it’s working just as hard as you are.

If safety is your priority, USDY and sUSDS are best-in-class yieldcoins.

If you’re chasing higher returns, PST and sUSDai offer interesting risk-adjusted upside.

Just remember to confirm any local jurisdictional restrictions, as some of these opportunities aren’t available everywhere. And be sure to size positions according to your risk tolerance.

Because one thing is clear: Holding zero-yield dollars in 2025 is no longer a neutral call.

It’s a decision to underperform.

Best,

Marija Matić