|

| By Marija Matic |

With the total crypto market cap surpassing $4 trillion for the first time today, the 2025 bull cycle is in full swing.

As investors look beyond Bitcoin's (BTC, “A-”) dominance and eye broader opportunities, the art of crypto rotation — that is, how capital shifts between assets based on timing, momentum and narratives — has become a critical strategy to maximize returns.

Bitcoin has had an exceptional run, climbing to all-time highs above $122,000 just last week.

But market dynamics have already begun to shift.

Ethereum (ETH, “A-”) and other altcoins have started to show signs of strength. And with that, they’ve set the stage for a broader rotation phase.

And for those who understand how to pivot early and strategically, this could be the difference between capturing modest gains … and experiencing exponential returns.

Bitcoin Dominance Peaked. Now What?

To grasp the scale of what’s unfolding, consider this …

Bitcoin's share of the total crypto market cap climbed from 40% in November 2022 to a commanding 65% by June 2025.

In other words, Bitcoin alone accounted for nearly two-thirds of all crypto value.

But that trend is reversing.

Over the past 30 days, Bitcoin dominance has dropped nearly 7% — the largest decline since late 2022.

This pullback is largely driven by Ethereum’s resurgence. The No. 2 crypto by market cap is up 56% in the same period, compared to Bitcoin’s 14%.

Historically, this kind of altcoin outperformance has preceded broader market rotations.

TL;DR: We're entering a phase where capital is flowing from Bitcoin into Ethereum and top performing altcoins.

This is driven by a mix of technical breakouts, fundamental catalysts and narrative momentum.

What's Leading the Charge?

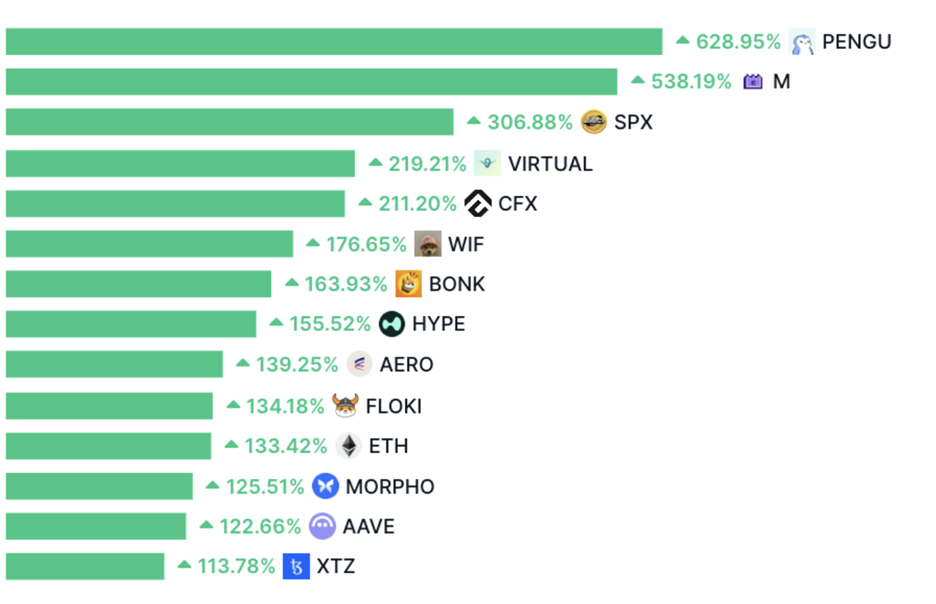

A breakdown of the top 100 performers over the past 90 days reveals something telling: While memecoins still dominate attention, there's substantial strength in high-quality altcoins too.

Notable outperformers include ETH and established DeFi protocols like Hyperliquid (HYPE, “D”) — which is not available in the U.S. — Aerodrome (AERO, “D-”) and Aave (AAVE, “C+”):

All of these have posted 100%+ gains, suggesting that both speculative and institutional-grade assets are attracting capital.

This is healthy. It means the rotation isn’t limited to fringe plays. Instead, it’s unfolding across the risk spectrum.

Timing the Shift

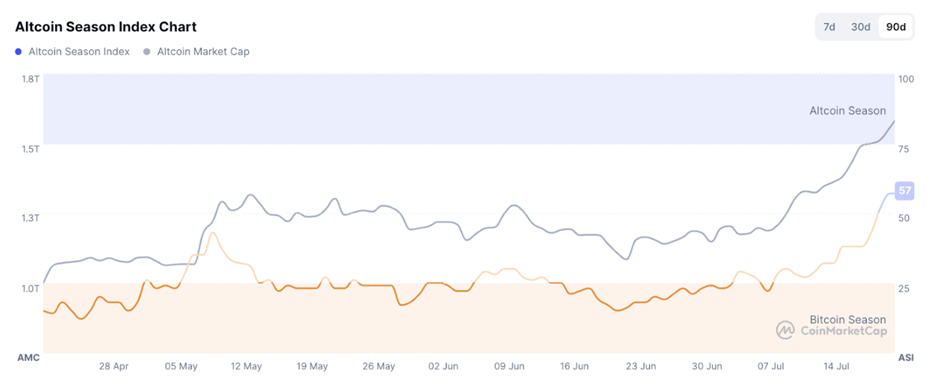

The Altcoin Season Index, which tracks the top 100 altcoins’ performance relative to Bitcoin over the past 90 days, currently reads 57/100.

This signals that we're transitioning out of "Bitcoin Season" and entering an early altcoin rotation phase:

When this index exceeds 75, it typically marks a full-blown altseason — often accompanied by higher risk and diminished upside.

Case in point: In December 2024, the index hit 87/100, and altcoin performance quickly fizzled thereafter.

At 56, we’re in the sweet spot.

We’re early enough to catch meaningful upside, but with sufficient momentum confirmation to justify rotation from Bitcoin.

In plain English, you're not too early (missing BTC’s strong leg), but definitely not too late (chasing exhausted alt pumps).

Technical Breakdown

BTC is currently consolidating between the 0.5 and 0.618 Fibonacci retracement levels, corresponding to $117,000–$121,500.

This is a classic cool-off zone after its 76% rally over the past year.

Historically, this kind of consolidation from Bitcoin sparks capital flow into altcoins.

Think of it this way: When the king rests, the princes rally.

And first on that list is Ethereum. And it recently made a definitive move.

Over the past 30 days, ETH has surged 56%, far outpacing Bitcoin’s 14%.

And the technical picture confirms that strength.

The ETH/BTC ratio, which had been sitting at multi-year lows earlier in 2025, has now broken out into a key resistance zone around 0.032:

That’s a meaningful shift in relative momentum.

While a short-term pause wouldn’t be surprising after such a run, this doesn’t look like a temporary spike.

Ethereum is starting to reassert itself after an extended period of lagging behind Bitcoin.

Historically, when ETH/BTC starts to move with conviction, it often marks the beginning of a broader altcoin rotation.

Ethereum leads … and the rest of the altcoin market follows.

The Solana Situation

Solana (SOL, “B”) — which has taken its place next to ETH and BTC as a market leader this cycle — presents an interesting case.

The SOL/ETH ratio has actually been in a downtrend since April. Which means, in a twist from what we’ve seen until now, ETH has been outperforming SOL during this recent run:

But here's where it gets interesting: SOL’s price has just started to break out and show signs of strength.

It's still too early to say whether SOL or ETH will outperform in the second half of the year.

But one thing is certain: A considerable chunk of those blue-chip-intended allocations will rotate to SOL.

Hence, the question isn't whether SOL will participate in the rotation. It will.

Rather, we’ll have to see whether it can reclaim its position as the primary ETH alternative.

The Rotation Playbook: How Smart Money Moves

The idea of rotation as a clean, sequential trade — that is, from Bitcoin to Ethereum to Alts — is appealing.

But that assumes rotation acts like a waterfall that moves in one direction.

In reality, rotations are more like a series of overlapping flows.

ETH can surge while BTC holds steady …

SOL can catch fire while ETH rallies …

And small-caps can pump while majors consolidate.

This is why sophisticated investors manage capital across multiple layers simultaneously.

This approach helps you avoid chasing the rotation. Instead, you’re set to benefit well ahead of time.

An example looks like …

- Core Positions: Long-term, “never-sell” holdings. This will primarily be Bitcoin.

- Tactical Layer: Momentum-based exposure to top-tier assets, like ETH and SOL.

- Speculative Layer: High-risk capital chasing narratives like memecoins or utility-driven sectors (e.g., AI, RWAs, liquid staking).

The key is knowing which “tap” is flowing the strongest. Then, all you need to do is allocate funds across your portfolio layers accordingly.

Currently, we're seeing:

- Strong institutional inflows into ETH ETFs and treasuries, even as BTC remains a core portfolio component.

- Rotations into Layer- 1 and DeFi blue chips like SOL, Jupiter (JUP, Not Yet Rated) and Ethena (ENA, “B+”) as technical setups align.

- Aggressive speculation in memecoins and newer narratives, supported by strong social momentum.

Now, all that’s left is to set up your portfolio to catch the capital as it rotates.

Best,

Marija Matić