|

| By Sean Brodrick |

What’s the best-performing large-cap energy stock so far this year?

You’d probably think something in oil and gas, right? Nope. It’s uranium producer Cameco (CCJ).

And as I’ll show you, uranium is EXACTLY where you should be investing now if you want to power up your profit potential for the rest of the year and beyond.

Cameco was recently up 59% so far this year. Compare that to recent gains of 11% for Shell (SHEL), 8.16% for BP (BP), 1% for Exxon Mobil (XOM) or a LOSS of 8% for Chevron (CVX).

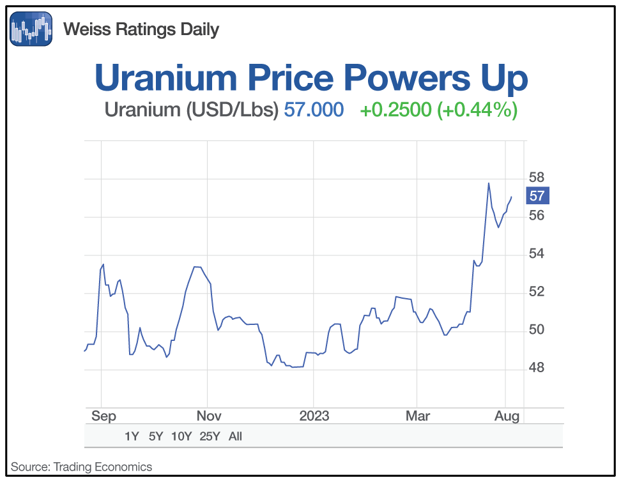

Why is Cameco leaving these oil and gas heavyweights in the dust? The uranium producer is drawing power from this chart, which shows the price action in the yellow energy metal …

Zzzza-ap! This one-year chart shows uranium prices hit a 14-month high in June, pulled back a bit and are now going up to test that overhead resistance.

The fundamentals behind the chart action are easy to see, if only Wall Street analysts would open their eyes. But too many are focused on the wrong thing, ignoring the powerful forces lining up to push uranium higher.

On the demand side, we see growing global demand, as nuclear power becomes the obvious backup choice for “green” energy like solar and wind.

In 2021, global demand for uranium from nuclear reactors was estimated at 62,500 metric tons. By 2030, that’s forecast to rise to 79,400 metric tons, and by 2040, 112,300 metric tons.

On the supply side, the squeeze is on.

The recent coup in Niger threatens supply coming from the world’s seventh-largest uranium producer. Niger’s neighbors don’t like the coup and may take military action.

At the same time, the U.S. and the European Union are both working on laws to cut or halt imports of Russian uranium and uranium enrichment services. And that matters because the U.S. buys billions of dollars’ worth of uranium from Russia. In 2022, America bought 32.1 million pounds from foreign suppliers.

You can see how this could create a yawning chasm between supply and demand. U.S. uranium producers are trying to rise to the challenge. In fact,

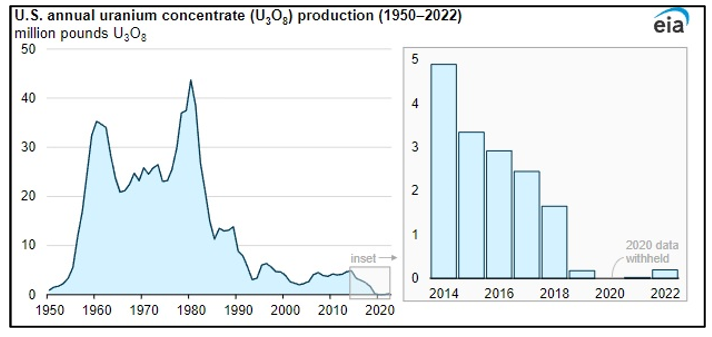

uranium production in the lower 48 United States was up 10 times in 2022 after hitting an all-time low in 2021.

So, problem over, right? Nope. That means that U.S. production has gone from 20,000 pounds of uranium to 200,000 pounds. And again, we import 32.1 million pounds of uranium a year.

Fun fact: The U.S. used to be the world’s biggest uranium producer. But that was decades ago. This chart from the Energy Information Administration shows just how far U.S. uranium production has fallen over the years …

The chart on the left shows long-term production. The chart on the right shows the recent “bump.” Sure, uranium production jumped by 10 times, but the bar was set really low. The fact is, the price of uranium was so cheap for so long, there was little incentive to build new mines.

That brings us to Cameco. The company is the biggest uranium miner in the Western world. Most of its operations are in Canada’s Athabasca Basin, though it also does in-situ recovery in the U.S. and Kazakhstan.

The company recently issued earnings results that many on Wall Street found disappointing. Quarterly revenue, which came in at $482 million, was down 14% relative to the same period last year.

Hidden in that dark cloud is a silver lining: Cameco raised its consolidated revenue outlook for 2023. The company expects to sell higher volumes of uranium this year.

And it’s not just Cameco. There aren’t a lot of Western uranium producers, and demand is surging. I believe any of them that can manage to walk down the hallway without tripping over the wallpaper will do very, very well this year.

Uranium started a new bull market in 2021. It’s only just now starting to garner attention, and it has YEARS to run.

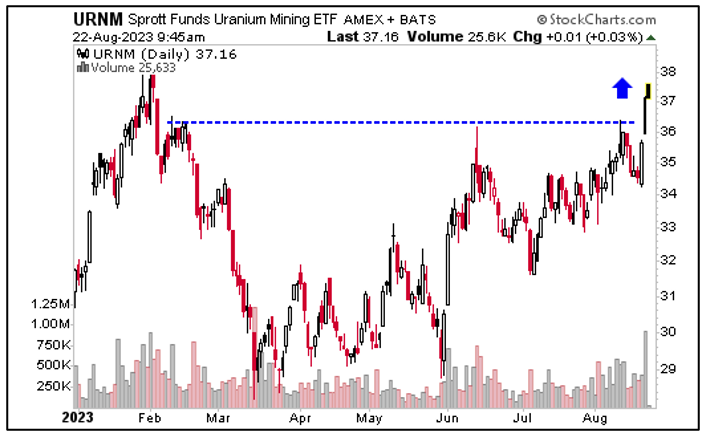

An easy way to play ALL the major uranium producers is through one of the nuclear-leveraged exchange-traded funds. My pick would be the Sprott Uranium Miners ETF (URNM).

It has an expense ratio of 0.85%, and owns Cameco, along with KazAtomProm, which is Kazakhstan's national uranium company, the Sprott Physical Uranium Trust (SRUUF), NexGen Energy (NXE.TO), Denison Mines (DNN) and more. Some of these are difficult for U.S. investors to buy, so this fund gives you exposure you couldn’t get otherwise. Here’s a chart …

Click here to see full-sized image.

That sure looks like a breakout to me. And on high volume, too.

So! You want to power up your portfolio this year? Consider URNM or some of the individual stocks it holds.

Nuclear power is booming, and uranium demand is just now shifting into overdrive. Your profits could do likewise.

That’s all for today. I’ll have more for you soon.

All the best,

Sean