|

| By Gavin Magor |

President Trump’s newly signed “Big Beautiful Bill” injects trillions into the U.S. economy — and investors are already positioning to profit.

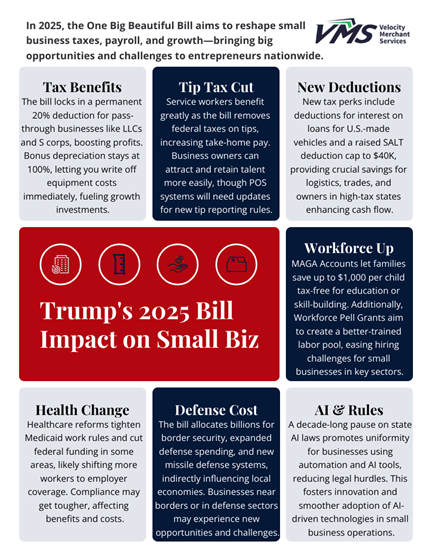

The package boosts defense spending, expands oil production and provides tax breaks for manufacturing and chipmaking.

No matter what your opinion is on this new bill, it does clearly outline which industries will see new money … and which will be squeezed to pay for it.

Fortunately, that’s where the Weiss Ratings can step in and help by pointing to the best ways to play it.

Below are 10 “Buy”-rated stocks with high exposure to the bill’s key priorities:

- RTX (RTX) has beaten Wall Street estimates for 13 straight quarters, and the defense giant is now up over 50% in the past year.

- Leidos Holdings (LDOS) earnings grew nearly 330% over the past 12 months, and the outlook is solid for this defense tech and logistics provider.

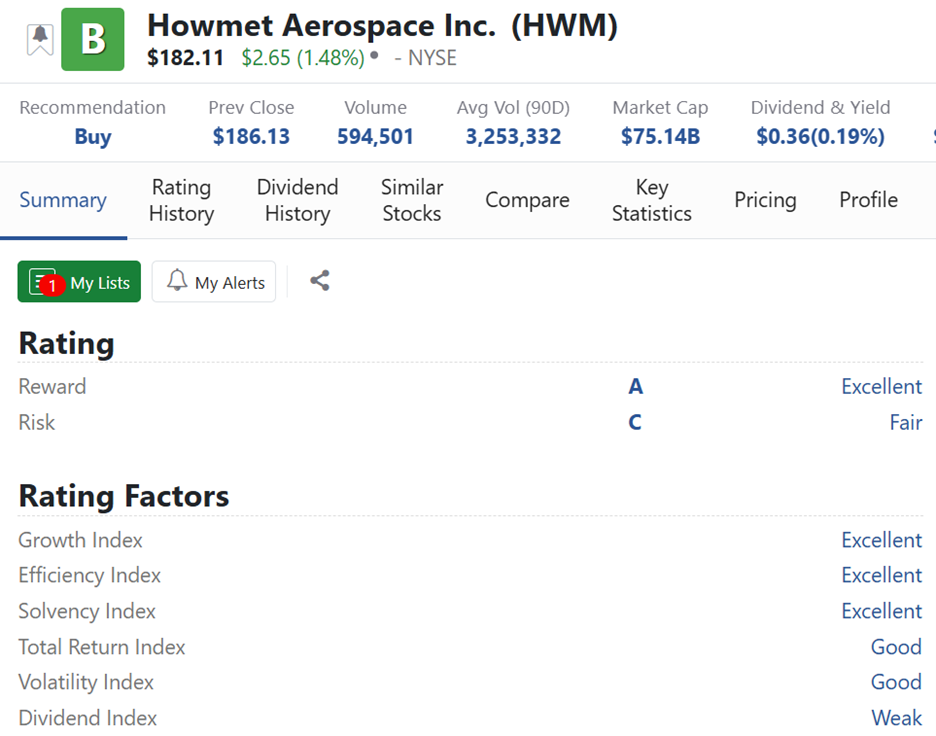

- Howmet Aerospace (HWM) has maintained a “Buy” rating for two straight years, delivering a 270% total return.

- Cheniere Energy (LNG) is well-positioned for more profitable growth from the expected boom in LNG exports.

- Energy Transfer LP (ET) is a U.S. pipeline titan offering a 7.14% dividend and strong growth.

- Williams Companies (WMB) delivers a solid dividend with 35 consecutive years of payments and stands to gain from energy infrastructure incentives.

- Kirby (KEX) saw an upgrade to “Buy” in June due to increased earnings as Gulf barge demand surged.

- Sterling Infrastructure (STRL) hasgained excellent momentum amid excitement over increased construction spending.

- Dover (DOV) earnings exploded in the past year on robust demand for industrial tools and components.

- KLA (KLAC) is one of the few microchip stocks sporting a Weiss “Buy” rating, driven by 100% return on equity.

Some of these are no-brainers.

Defense spending is now set to surpass $1 trillion for the first time in U.S. history.

But not just any defense company will do.

You see, a lot of the defense companies we rate as “Buys” are on the cutting edge of defense technology.

Many of these are developing the technologies — like next-era drones and hypersonics — that will see the most bang for the new BBB bucks.

Energy companies — specifically those in the drilling of fossil fuels — are also major beneficiaries of the BBB.

Cheniere, Energy Transfer and Williams are all domestic producers or transporters.

Manufacturing is a key priority for this administration. So, it shouldn’t be a surprise that the companies behind that are getting a bump right now.

That’s where Sterling, Dover and KLA shine. All distinctly different but all benefit here.

What’s more, all are “Buys” and have been even before this new spending.

So, with the passage of the Big, Beautiful Bill, these could gain momentum.

While you can go and look up each of their ratings …

Only Weiss Ratings Plus Members can see the reasons why. Take Howmet Aerospace, for example.

As you can see, there are several factors that impact its rating. To gain access to this info on every stock we rate, check this out.

Of course, this isn’t the only list of companies we found in a position to rally from policy change.

AI is also a beneficiary of this administration.

I urge you to check out these three little-known stocks that are taking part in “AI’s Second Wind.”

Cheers!

Gavin