|

| By Gavin Magor |

Weiss Ratings’ most resilient “Buy”-rated stocks crushed the market since the last correction and are poised to bounce again.

The best investors hold steady when hysteria sets in. They resist the temptation to sell fundamentally strong companies during short-term sell-offs.

I acknowledge the cold hard reality that overwhelming negative market sentiment can hurt the best of stocks.

Momentum matters — and has mattered since Babylonian grain merchants first noticed that rising prices often kept rising and falling prices kept falling.

However, it also does not mean it’s time to panic-sell, because investors risk cutting off their nose to spite their face.

It is certainly true that stocks don’t rebound evenly — but the best ones often rebound fast.

We Asked for the Best Post-Correction Stocks

At Weiss Ratings, we use data — not emotion — to determine which stocks are likely to weather market storms and which can deliver outperformance in the recovery.

Right now, in the midst of a tariff-fueled downturn, it’s easy to lose sight of this. But recent history tells us what happens next.

So, let’s take a look back.

The S&P 500 sank by over 10% during the last full stock market correction, which lasted nearly 90 days between July 31 and October 27, 2023.

It unnerved investors, sparked bear-territory speculation and tested conviction across the board.

So, we dug into our Weiss Ratings history to find “Buy”-rated stocks that were among the hardest hit during that pullback … yet came roaring back after it ended.

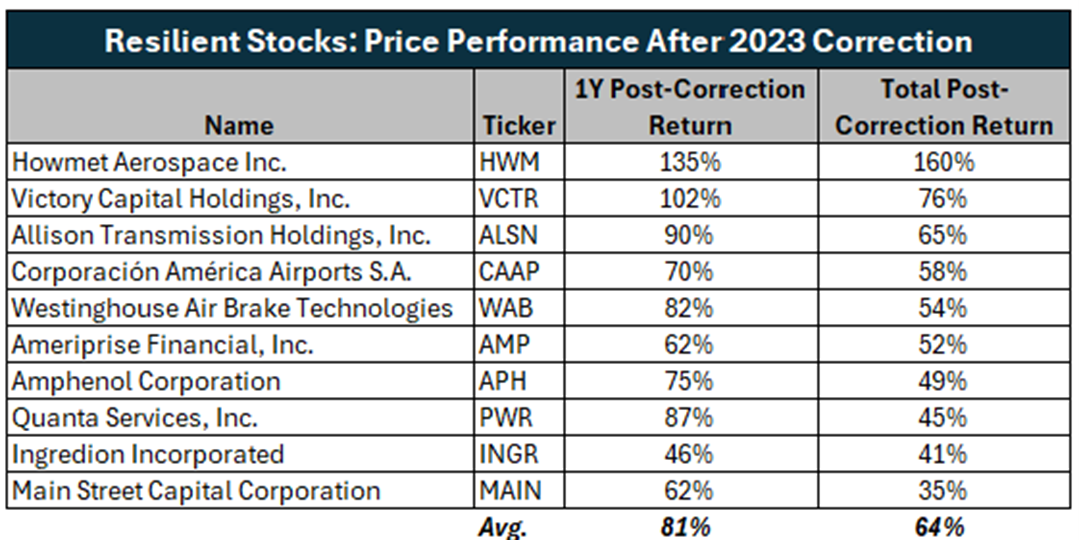

The stocks, pictured in the table below, maintained their “Buy” ratings during and after the downturn.

These stocks each fell by roughly 15% on average during the correction. But they didn’t stay down.

In the 12 months that followed, they delivered an average gain of 81%, nearly doubling the S&P 500’s 41% return in the same period.

Their total return since the end of the 2023 correction now averages 64%, far surpassing the S&P’s 23%.

The current downturn has once again sent these high-quality names crashing, although their fundamentals remain solid.

Some notable highlights include:

- Howmet Aerospace (HWM) posted 53% earnings-per-share growth and is projected to grow another 22% this year.

- Amphenol (APH) grew earnings by 23% last year and EPS is expected to rise another 20% in the next 12 months.

- Victory Capital (VCTR), Corporación América Airports (CAAP) and Ameriprise Financial (AMP) are trading at major discounts to their respective sectors with a 0.40 average P/E-growth ratio (PEG).

Trust the Ratings,

Not the Headlines

History shows that solid stocks bounce back. The above already proved they are solid stocks. If they hold their “Buy” rating again this time, you can expect similar results.

If you keep an eye on how Weiss Ratings assesses each stock, your paper losses will be only that … on paper. But if you stick to the ratings, those can quickly turn back to gains.

The current volatility — driven by tariffs, macro shocks and sentiment swings — has investors on edge.

While rotating into defensive sectors can make sense in moments like this, dropping fundamentally sound stocks is short-sighted.

History shows it’s not the downturn that defines your performance — it’s how you respond to it.

If you own “Buy”-rated stocks that were hit in this pullback, you’re not alone. But you also may be holding the very names most likely to lead the recovery.

Don’t turn a paper loss into a permanent one.

Don’t let fear veto fundamentals.

And above all: Keep trusting the data.

Cheers!

Gavin

P.S. This is why the first step in Nilus Mattive’s recently revealed “60-Second Income” strategy is to go straight to Weiss Ratings for the stocks that underly his strategy. To learn the other two steps, check out his presentation before it’s taken down.