|

| By Gavin Magor |

Some of the best things I love about the Weiss Ratings all start with the letter “S”: safety, stability and sanity.

The market is undergoing some intense volatility, making now an even more paramount time to be relying on names that have earned the badge of safety from Weiss Ratings.

A major driver for this volatility is stemming from historically high interest rates spurred by a bond sell-off, major political changes and a Fed that is becoming a major market-mover.

If you know my investing style, you’d attest to the fact that I highly value safety and stability, with a high emphasis on defense against large market swings.

In fact, I’m a major believer in the old adage, “Defense wins championships.”I’m talking about defense akin to the likes of the 1985 Chicago Bears and 1997 Michigan Wolverines football teams.

It’s exactly why in down markets, you need downside protection. And it’s also why in rising markets, you need to be ready to take advantage.

On that note, let’s explore some of the rising “Buy”-rated Weiss upgrades.

10 “Buy”-Rated Stocks Rising in Our System

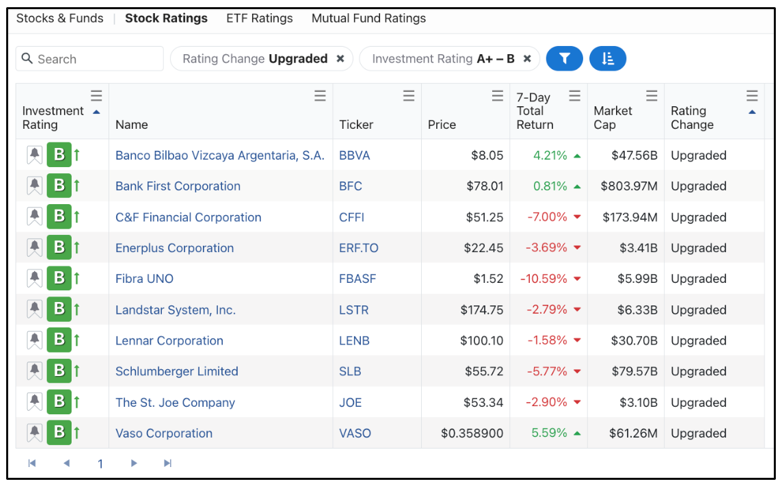

After an easy filtering on our Weiss Ratings stock page for “Upgraded” stocks that are “Buy”-rated, here’s what populated:

Be sure to check this page at least a few times per week as our stock ratings are updated daily.

Now, you may already be familiar with some of the names above, but one name that I have had my eyes on for some time — since it’s been a “Buy” or “Hold” in our system since July 2021 — is Schlumberger (SLB).

Several things about the stock stand out to me right off the bat:

- Market Leader: It’s the world’s largest oil field services company.

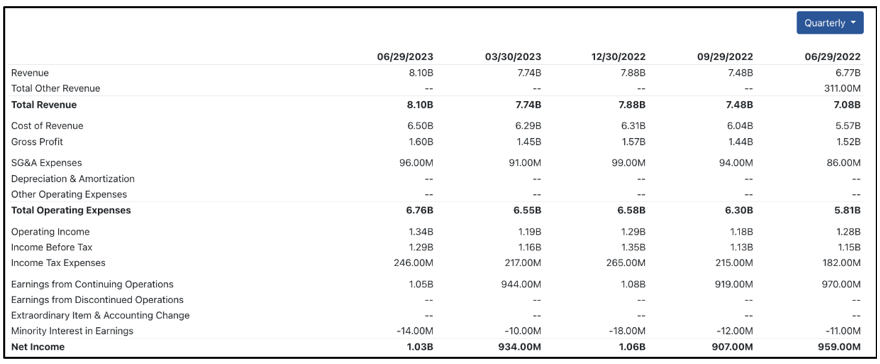

- Strong Record of Profits: A quick look at this stock’s Weiss Ratings financials page, and you’d clearly be able to see that the stock has achieved consistent earnings and revenue growth.

- Valuation: Although it’s priced more like a “technology-focused oil services company,” I believe its current valuation is still reasonable.

Click here to see full-sized image.

That said, there are a multitude of reasons for a ratings upgrade. Our system crunches vast amounts of data on a daily basis — aka the heavy lifting — so that your investment decisions can be made easier.

We’re looking at the microeconomic things, such as two companies competing in the same market and seeing how that’s impacting financials. We also incorporate a macroeconomic lens, as well, which is paramount in a current market that’s being impacted by geopolitical chaos, rising interest rates and staggering inflation (to name a few).

SLB, Possibly Not Your Cup of Tea

Perhaps SLB isn’t right for your investing needs, and you feel like it’s overvalued or you simply want to buy a more established company in energy.

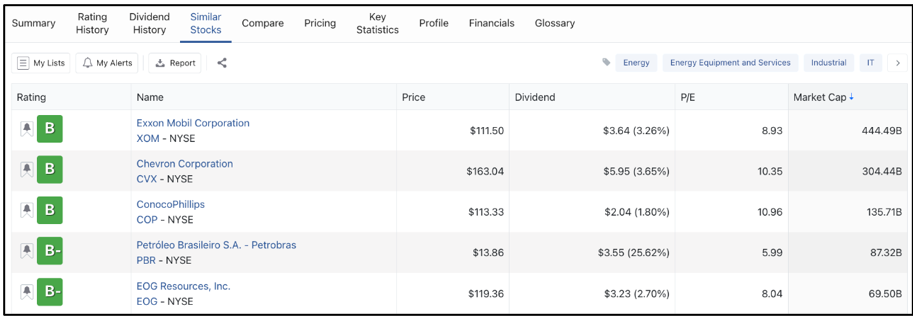

Remember, everyone’s investing needs and wants are different. That’s OK. But on our stock screener page, you can compare it to other highly rated names.

Let’s take a look at Schlumberger's similar stocks page:

I’m almost positive you’ve heard of some of these highly ranked names. Exxon Mobil (XOM) is still the 14th largest stock by market cap at $434 billion. Chevron (CVX), another “B”-rated name, is the 25th largest company ranked by market cap.

At any rate, the similar stocks feature is a great way to find other highly ranked names in our system. And if it has that beautiful green square with a “B” or “A” rating to the left, you better believe it’s worthy of your attention.

I encourage you to explore our site. But even more importantly, I urge you to attend an urgent sit-down next week that I’m having with Weiss Ratings founder, Dr. Martin Weiss …

Major Technology Boost to Stock-Picking System

Our Weiss team has been working on a new technology-based stock-picking system for the past several years, and I am extremely happy to report that we are set to announce its highly anticipated release next week.

It’s a strategy that has been intensively backtested and would have turned $100,000 into $2.9 million. It even has a new AI performance booster to help bolster high returns.

Spots are very limited, so please try not to share the link with too many others. But if you’d like to attend next week’s event, at 2 p.m. Eastern, this coming Tuesday, Oct. 10, click here.

I look forward to your investing success with the power of the Weiss Ratings. And hopefully, I’ll see you at next week’s historic event!

Cheers!

Gavin Magor