|

| By Sean Brodrick |

I have interviews with two very interesting junior miners for you today. One is in gold, the other is in lithium. Both should be on your radar.

Now, gold miners and lithium miners are both under pressure recently, but the longer-term outlook for both metals is very good. And that’s one indicator that these stocks are dirt cheap.

Interview #1: A Precious Find in Mexico

First, I recently “Zoomed” with Charles Funk, CEO of Heliostar Metals (HSTXF). It’s a gold explorer with a market cap of just $30 million.

I visited Heliostar in the Aleutian Islands back in 2021. That project is ongoing, but on the back burner due to lack of amazing discoveries — you have to find something pretty big to make mining in the Aleutians worth your while — and because the company has ANOTHER project in Mexico that’s turning up some rich grades over long drill distances.

Heliostar’s new project is the Ana Paula Gold Deposit in Mexico. The company picked up the project for $30 million from Argonaut Gold (ARNGF) in March of this year. The project didn’t fit into Argonaut’s plans, as the company was short on funds. That was Heliostar’s opportunity to swoop in and scoop it up. That’s how things often go in the gold exploration biz.

Charles and his team already know that they have 1.4 million ounces of gold in the measured and indicated category, at a grade of 2.16 grams per ton. However, that was when the project was permitted for an open pit mine.

Now, the folks at Heliostar believe they can get more bang for their buck by rescoping Ana Paula as an underground mine. They’re drilling to prove up that thesis and making some rich finds along the way.

I’ll let Charles give you the scoop himself …

Good news continues to roll in for Heliostar. The company’s latest announced drill results include 31.8 grams per ton of gold over 9.5 meters. And that’s part of a larger area of eight grams of gold over 72 meters. So, definitely keep an eye on this one. Keep it on your watch list.

Interview #2: Volt Charges Ahead in Lithium

I also did another interview back in June with a fascinating little lithium explorer/developer operating in Canada. The company is called Volt Lithium (TSX-V: VLT.V). As you can see, its primary listing is in Canada, but it also trades in the U.S. on the OTCQB under the symbol VLTLF.

This is a tiny company — with a $23.5 million market cap — but it’s already hard at work in the oilfields of Alberta, Canada, with a pilot plant extracting lithium from the brine water used in oilfields.

So, it’s not the lithium brine evaporation process that you see in much of South America. Nor is it the hard rock (spodumene) lithium mining you see in Australia and other parts of the world. It’s …

Direct Lithium Extraction

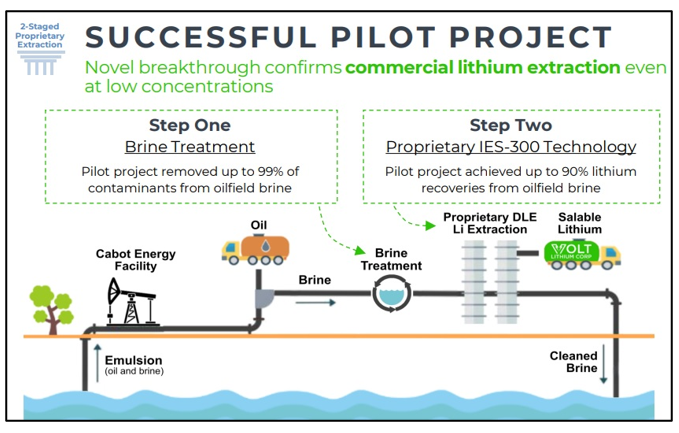

DLE extracts lithium from water used in oilfields. Here’s a slide from the company presentation that explains how the process works.

As I’ve explained before, lithium is one of the most common elements in the universe — one of three elements created in the Big Bang. The problem isn’t finding lithium … the problem is finding it in concentrations that are economical to produce.

The brine water used in the oilfields contains small amounts of lithium. Volt Lithium says its process will recover that economically. It’s a win for the company and a win for oil companies that get extra bonus money they weren’t counting on.

I talked to Alex Wylie, president, CEO and director of Volt Lithium. Wylie told me that companies that use lithium for all sorts of batteries are eager for “certainty of supply,” which gives a small company like Volt a foot in the door.

Volt will build its technology right at the existing central facility at the producing oil field. The company will add tanks, treatment and filtration systems. All the infrastructure to dispose of the fluid on the other side is already in place. This will really speed up the approval process.

And Volt’s proprietary DLE technology has already achieved 90% lithium recoveries at concentrations as low as 34 milligrams per liter, Mr. Wylie explains. This high rate of extraction improves economic viability.

But I’ll let Mr. Wylie tell you more himself …

Volt just did another capital raise this month, so it should be cashed up for now. Now, it’s a matter of building its plant and proving it can operate profitably.

The company will declare commercial production when it can produce 1,000 metric tons per year of lithium. That can be scaled up. The second stage will bring production to 7,500 tons per year. Full-scale production of 20,000 tons per year could be reached in 2026 or 2027.

Now, DLE isn’t new. It’s Volt’s specific process that is new. There is another company doing DLE lithium extraction, Standard Lithium (SLI). That’s a $595 million market cap company listed on a major U.S. exchange, and its DLE project is piggybacked on a bromine project in Arkansas.

We discuss SLI in the video because it’s somewhat similar and I’m familiar with it. SLI says it can enter commercial production late next year, so the race is on between these two companies.

Volt would like to offer its technology to oil projects all over North America. That’s a long way away and there are a lot of steps for it to prove itself between now and then. Keep it on your watch list.

These are two very interesting companies. They’re also very speculative. Only buy them if you have the stomach for wild ups and downs.

I hope you enjoyed these videos. I’ll be back with more real soon.

All the best,

Sean