2 Surprising Upgrades in Tech’s Worst Year

|

| By Dawn Pennington |

The Nasdaq is having its worst year EVER.

Although in the past it's lost 10% in the first half of a year, 2022 now holds the record with a near-30% year-to-date loss.

The second quarter alone has shown some of the worst share price declines among tech leaders.

Investors didn't care that Tesla (TSLA) reached a trillion-dollar market cap last year.

Shares have seen their worst decline since its IPO back in 2010. At $680 and change, they are getting further away from famed Tesla bull Cathie Wood's prediction that the stock could go to $4,600 by 2026.

Amazon.com (AMZN) was a clear king during the pandemic as people ordered necessities and binged their favorite shows on Amazon Prime Video. But now shares have tumbled 35%.

So much for that recent stock split reversing the downward spiral …

That marks the biggest decline for the company's shares since the third quarter of 2001.

Just in the second quarter, shares of Alphabet (GOOGL) are down 22% and shares of Microsoft (MSFT) are down 17%!

Techs are having their worst year ever. And there's more downside ahead.

But we know that one man's trash is another man's treasure. In investing, someone's loss is another's bargain.

If there were tech treasures amongst the trash, I knew that I would be able to quickly locate a few using the Weiss Ratings stock screener.

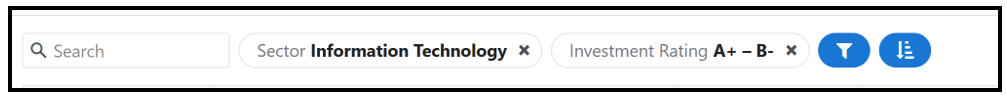

My search parameters were simple: stocks in the information technology sector with a "Buy" rating.

Note: This is different than the Top Tech Stocks list you'll find on the Weiss Ratings homepage, which also has a market cap filter.

My search delivered 52 results. I then clicked on the heading of the ratings column to sort by rating.

There was only one rated a "B+."

Glimmers of Hope

It's been said that cash is king. But you could argue that in 2022, data is king. The vast amount of it makes many tasks computationally intensive and requires proper computing power.

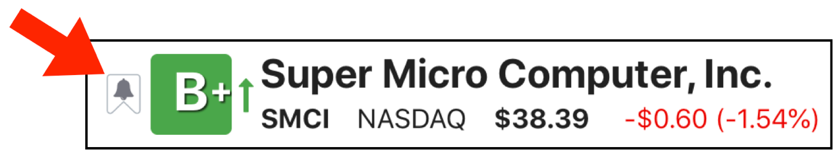

That's where a company like Super Micro Computer (SMCI), a leader in the high-performance server and storage solutions industry, comes in.

Super Micro Computer serves customers in the growing 5G, data center, public/private cloud and artificial intelligence markets.

Plus, SMCI is known for its focus on the environment and continues to pursue green computing with its resource-saving architecture.

Just last week, SMCI was upgraded to a "B+."

Prior to 2016, the company held a solid "Buy" rating. But from 2016 to 2021, it was stuck in the "Hold" range and even dropped to a "Sell" twice.

Since last September, SMCI has proven to be a "Buy" yet again.

However, the broad market might not be convinced:

Shares are down 25% in the past 30 days and 14% year to date.

A quick click onto the "Income Statement" tab shows revenue, income and earnings per share are all continuing to grow.

That's why our proprietary modeling has designated it a "B+."

Obviously, I'd recommend a deep dive into the financials before buying, but right off the bat, the company looks solid.

Here's Another Notable Tech Upgrade

As I looked further into the search results, I noticed that A10 Networks (ATEN) was recently upgraded as well.

A10 enables service providers, cloud providers and enterprises to ensure their 5G networks and multi-cloud application are secure.

You might not know A10, but you probably know some of the companies that rely on its networks to protect their businesses.

The company has over 6,700 customers, 200 patents and operations in 118 countries.

From 2014 through 2020, Weiss rated A10 as a "Sell." But last August, it climbed to a "Buy."

Last week it moved from a "B-" to a "B." Helping matters is the fact that the company saw an operating cash flow increase of 78%.

Shares are down 9% over the past 30 days, but up 20% over the past year.

Both Super Micro Computers and A10 seem to have potential moving forward. I'll be adding both to my watchlist. On the Weiss Ratings website, all you have to do is click on the bell symbol next to the stock's ticker. Then you'll be set up to receive alerts about ratings and price changes going forward.

And here's why they're watch list candidates …

Both companies have two of the highest ratings in the Information Technology sector … their income statements appear to improve every quarter … and it looks like market sentiment is offering a discount.

But maybe the most appealing about both is that they are targeting some of the most disruptive trends in tech right now:

- 5G

- Data centers

- Public/private cloud

- Artificial intelligence

- Network security

These are all trends I've heard Senior Analyst Tony Sagami talk about recently.

Tony is among the few analysts who help investors in both up and down markets. He continues to seek out the new, emerging disruptive industriesand the companies most likely to dominate in each. Finding these companies early could result in life-changing gains.

If you're interested in learning more, click here to watch his newly released presentation on the next sector poised for explosive growth.

To your wealth,

Dawn Pennington

Editorial Director