|

| By Jordan Chussler |

On Monday, Amazon.com’s (AMZN) long-awaited 20-for-1 stock split finally happened.

When the market closed, shares were down 0.3%. At the time of writing, they’re down 1.83%.

With so much hype behind the split, expectations were that it could serve as the impetus that would salvage an otherwise abysmal year for the e-commerce giant that’s seen Amazon stock drop by nearly 28% year to date (YTD).

So, why wasn’t this much-publicized event the rocket fuel that returned Bezos fanboys and Amazon shareholders to the moon?

For one, the tech sector — and growth stocks in general — continue to correct. Of the S&P 500’s 11 sectors, only two have performed more poorly than the technology sector’s YTD loss of 19.06%.

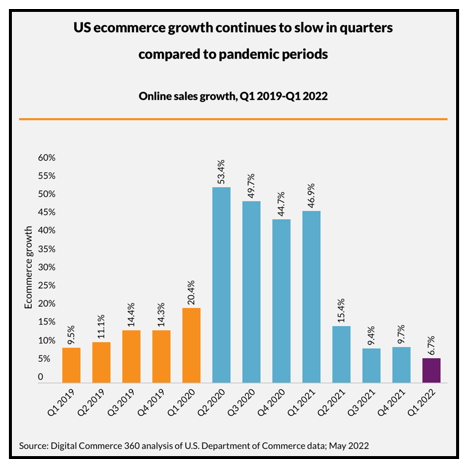

Second, as the pandemic continues to wane, e-commerce sales are declining and in-store purchasing is rising. Q1 of 2022 marked the lowest growth in online sales in the past 13 quarters.

The impact was evidenced in Amazon’s Q1 earnings report. Revenues of $116.4 billion — significant by many companies’ standards — represented the slowest growth for the company in two decades.

Third, in 2021, the company spent lavishly on new warehouse space, which caught up to the bottom line in 2022. According to CFO Brian Olsavsky, “Excess capacity cost the company about $2 billion in incremental costs.”

Cumulatively, the result was AMZN dropping 10% — or a net loss of $7.56 per diluted share — after its most recent earnings report, which sent the stock near a two-year low.

Amazon’s cloud-computing sector, Amazon Web Services (AWS), is continuing to thrive and the company is seeing a rapid expansion of its advertising sector.

But like Eric Savitz, associate editor at Barron’s said, “Investors love stock splits because they provide the illusion of getting something for nothing, although logically, they shouldn’t really matter. Cutting a … pizza into 16 slices rather than eight doesn’t create more food.”

For the short- and medium-term, the majority of tech investments are accompanied by elevated levels of risk. Investors should consider this investment vehicle instead.

Inverse ETFs & Hedging Against Decline

Most investors know about the advantages of exchange-traded funds (ETFs). I recently wrote about how abundant they’ve become and the ample opportunities they present in various S&P 500 sectors and industries.

But what about lesser known inverse ETFs, which according to Nasdaq.com, have taken flight as the market’s turned sour?

“Inverse and inverse-leveraged ETFs either create an inverse short position or a leveraged inverse short position in the underlying index through the use of swaps, options, futures contracts and other financial instruments. Due to their compounding effect, investors can enjoy higher returns in a very short time, provided the trend prevails.”

Inverse ETFs are NOT intended to be held long-term; they act as short-term cushions for investors as the underlying indices they’re tied to decline in value.

They come in varieties of single-, double- and triple-inverse ETFs, with each designed to return one time, two times and three times the gains of the underlying benchmark, respectively.

So how can investors take advantage of inverse ETFs when particular sectors are clearly correcting?

Shorting Tech … the Easy Way

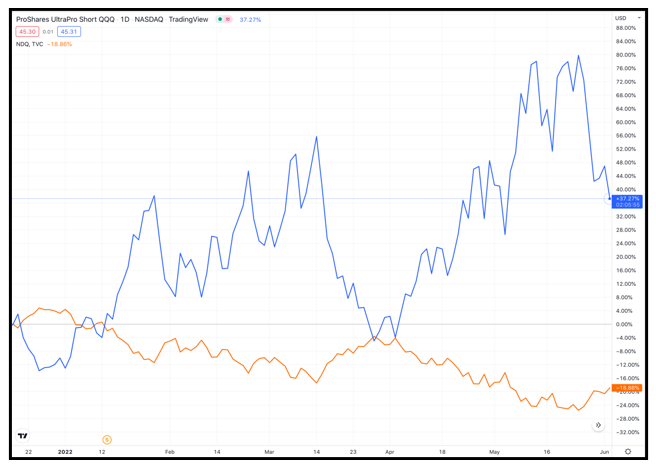

The ProShares UltraPro Short QQQ ETF (SQQQ) is a 3x leveraged inverse ETF that tracks the Nasdaq-100 Index (NDAQ).

It seeks to return -3x the returns of the NDQ, which is composed of the largest companies listed on the Nasdaq and is heavily leveraged to the tech sector.

The NDQ is home to four Big Tech behemoths that have all reached $1 trillion in market capitalization: Alphabet (GOOGL), Amazon, Apple (AAPL) and Microsoft (MSFT).

But those companies — despite their acclaim and massive market share — cannot save the index from its continued downtrend.

Since the start of the year, the Nasdaq-100 is down more than 23% as institutional and retail investors alike continue to abandon tech and migrate funds from growth stocks to value stocks.

My colleague Sean Brodrick has been telling his Wealth Megatrends Members about this since late last year. As a result, their portfolios have been insulated from Big Tech’s sell-off.

Conversely to the NDQ, the SQQQ has risen over 61% YTD.

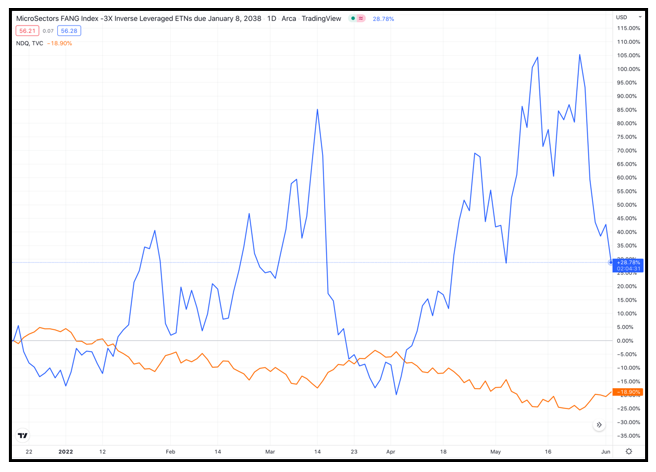

Another option is the MicroSectors FANG+ Index -3X Inverse Leveraged ETN (FNGD). Though an exchange-traded note (ETN) and not an ETF, the underlying fundamentals remain the same.

The FNGD receives a Weiss Rating of “B+,” and while its expense ratio of 0.95% might be unpalatable to some, it’s brought investors enormous returns YTD.

Since the start of 2022, the FNGD is up a staggering 56.78%.

This isn’t to say you should immediately abandon Big Tech and sell your shares of companies in correction territory. There are proven long-term benefits to holding investments in the technology sector.

It should also be noted that inverse ETFs carry higher expense ratios and can lead to considerable losses if investors incorrectly bet on the market’s direction (look no further than how volatile SQQQ and FNGD are in the two charts above).

But if you’re looking for short-term returns in an otherwise volatile and bearish market, consider researching inverse ETFs to fortify your portfolio from losses in the near term.

As always, be sure to conduct your own due diligence before entering any trade.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily