|

| By Jon Markman |

Enthusiasm for digital advertisements is back, big time. This is what investors need to know.

Last week, executives at Meta Platforms (META), Alphabet (GOOGL) and Snap (SNAP) announced that brands are ramping up spending for digital ads at the fastest pace in two years.

The slowdown is over, yet the real story is the growth of new ad categories.

You have the chance to buy two stocks to participate.

It is important to understand the larger secular trend. Digital ads are the natural evolution of a bigger shift to where people are spending their time.

As social media, streaming services and news hubs evolved, consumers started to spend more time online. This trend is accelerating, even as overall spending for ads contracted during the past two years. Advertisers need to be online to reach these consumers.

Traditional advertising is hit and miss at best.

Since the 1950s mad men, advertising agencies told clients to throw money at print, television, radio, billboards and direct mail to build brand awareness. Measuring the effectiveness of this scattershot strategy required a healthy amount of faith. The opposite is true for digital-driven campaigns.

Results are measurable with digital campaigns. So-called clicks and conversions with the ad can be tracked in real time. And extensive A/B testing with a series of ad campaigns allow for better optimization and return on investment calculations.

These benefits have never been in doubt. Consequently, digital ad spending has been steadily stealing share from legacy ad campaigns.

Digital ad placements in the United States should reach $224.5 billion during 2024, 76.5% of the projected total ad spending of $293.5 billion.

By 2027, those campaigns should comprise 82.4% of spending, according to a report from eMarketer.

This trend was on full display last week as large tech platforms reported impressive ad sales growth.

Meta set the stage with Q1 revenues of $36.5 billion, up 27% year over year … the strongest expansion since 2021.

Executives at Alphabet said on Thursday that Q1 ad revenue jumped 13% from the prior year to $61.7 billion.

Then on Friday, Snap execs noted that ad revenue hit $1.2 billion, up 21% year over year.

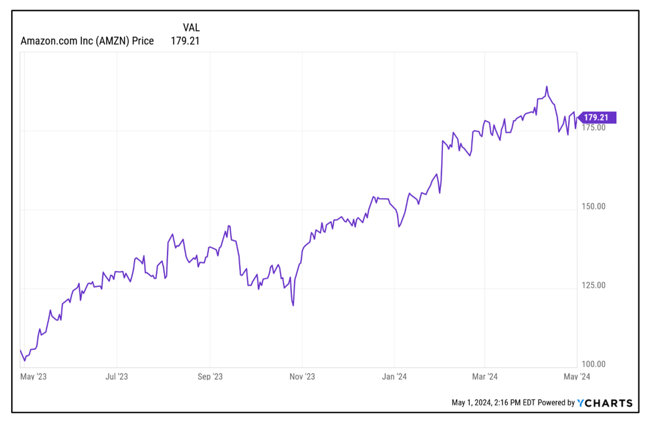

As impressive as these numbers were, the biggest tell for digital ads came Tuesday when Amazon.com (AMZN) released its Q1 results. Amazon has become a major player in digital ads, with large product offerings in the fastest-growing categories.

Sure enough, advertising services saw sales growth of 24% year over year to $11.8 billion during the quarter.

Connected TV (CTV) and retail media networks (RMNs) reach consumers inside streaming media platforms and on retail shopping hubs.

Big CTV players include Netflix (NFLX), Disney (DIS) and Amazon Prime. The biggest retail sites are Amazon.com (AMZN), Walmart.com and HomeDepot.com. This market is expected to reach $30 billion in 2024.

The fact that Walmart (WMT) and Home Depot (HD) have significant and profitable digital advertising business is not the story, though. Digital ads have become background noise in the larger digital experience.

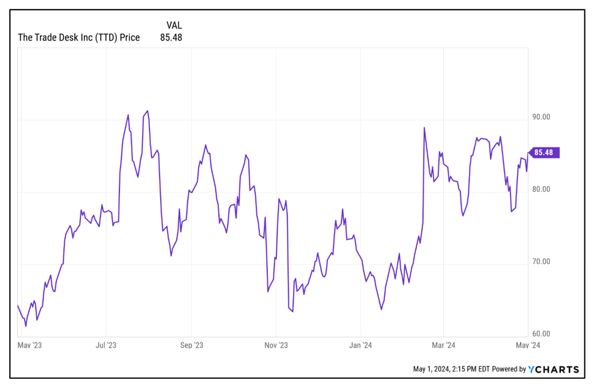

The Trade Desk (TTD) operates a digital platform to connect ad buyers to ad inventory across everything from CTV and RMNs to simple website display banners.

The Los Gatos, California-based company has become the biggest player for ad placement on properties not owned by Meta and Alphabet … and that business is booming.

Executives announced in February that spending on the Trade Desk platform reached $9.6 billion during Q4, up 23% year over year.

Revenue was $606 million, also up 23%.

Adjusted profits reached $284 million, a gain of 47%.

At a share price of $85.48, the stock could easily trade up to $115 given the strength for digital ads, a gain of 36% from current levels.

Digital ads have become an important business segment at Amazon. During the past quarter, Amazon Prime started displaying ads inside its CTV platform. Prime reaches more than 100 million people in the U.S.

At $179.21, shares could reach $200 following these financial results, a gain of 12% from current levels.

Both of these two dominators in this fast-growing digital ad space — Trade Desk and Amazon — are ideal to play the trend.

The bottom line is digital ads are back on track.

All the best,

Jon D. Markman

P.S. The digital transformation we’re seeing in everything from digital advertising to artificial intelligence is happening faster than most on Wall Street can keep up with. I urge you to join Dr. Martin Weiss on Tuesday to see the latest digital transformation that is beating the market. Sign up for free here.