|

| By Sean Brodrick |

Wall Street might finally, FINALLY be waking up to the fact that gold is in a bull market.

And while I wanted Wall Street to hold off recognizing gold’s bull market as long as possible — the better for us to load up on more positions — the recognition signals a new phase for one of the best ways to play this bull run.

When I say Wall Street is late to the party, I’m talking about the fact that gold’s month-end fixing price in London on Aug. 29 marked its seventh new monthly record of the year.

The London Fix came in at $3,429 per troy ounce, about 3.9% higher than the end of July.

However, gold ended last month still nearly $70 shy of April’s all-time spot peak around $3,500.

This is another opportunity.

Most of Wall Street won’t wake up to the gold bull UNTIL the yellow metal closes above the April high.

And I’ve got three great ways for you to play this bull run.

Why Gold Is Heating Up

Buyers are swarming around gold as the market prices in a Fed rate cut at the next meeting, and more beyond that.

Lower yields make gold more attractive. And that means the market is anticipating gold prices will go …

“Higher,” Rich Checkan, president and COO of Asset Strategies International, told Kitco News:

“Market participants are as certain as they can be that the Federal Open Market Committee (FOMC) will cut rates at their September meeting, so I expect the gold price to continue higher from here.”

“In addition, President Trump’s war with Lisa Cook will continue to send market participants out of U.S. dollars and into gold as a safe haven.”

Central Bank Shift

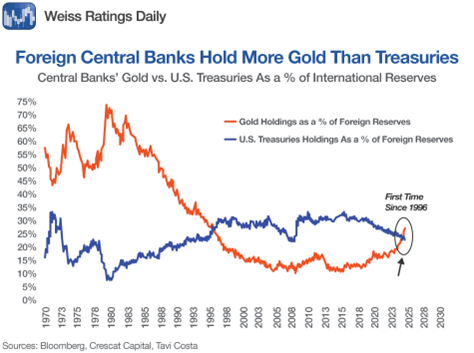

According to recent data from the U.S. Treasury Department, foreign central banks and official institutions held $2.26 trillion in Treasury securities at the end of July 2025.

At the same time, central banks held around 3,600 metric tonnes of gold, worth over $3.6 trillion.

In percentage terms, world central banks’ holdings of gold surged to 27% of foreign reserves. That’s the highest share in 29 years.

Meanwhile, Crescat Capital reports that foreign holdings of U.S. Treasuries as a percent of reserves fell to around 23%, the lowest since the 2008 Financial Crisis.

Why are central banks ditching the dollar to load up on gold?

Central banks are pursuing de-dollarization due to America’s weaponization of the dollar through sanctions.

Gold exists outside the conventional banking system and cannot be frozen or sanctioned in the way that foreign currency reserves can.

At the same time, President Trump’s mercurial tariff shifts, his attacks on the independence of the U.S. Federal Reserve and the deteriorating fiscal outlook all make gold shine compared to the U.S. dollar …

Not to mention gold’s safe-haven status in troubled times.

In fact, in a poll taken a couple of months ago, 60% of central banks said they planned to shift MORE reserves out of the U.S. dollar.

It’s obvious where those reserves are shifting, and that’s to gold.

The Easiest Way to Play the Gold Bull Run

That’s an investable story. And if that’s all you want to do, you can buy the iShares Gold Trust (IAU).

However, there’s a BETTER story in precious metals right now.

I’m talking about gold miners.

The fact that these companies are sitting on literal gold mines should not be lost on investors.

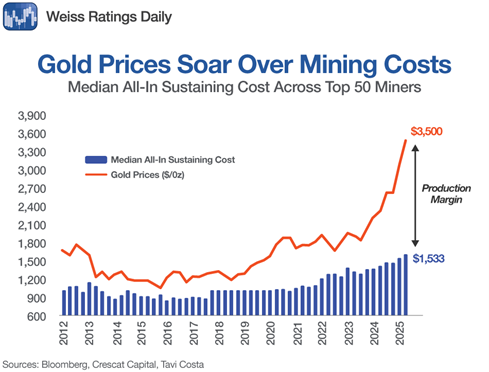

Gold prices are soaring well above mining costs …

And that means the profit margins for select miners are widening like the Grand Canyon.

After all, if it costs a company $1,500 to mine an ounce of gold, and the price of gold goes from $2,400 to $3,400 while costs remain the same, then the company’s profit margin per ounce goes from $900 to $1,900.

That’s a 111% increase in the profit margin! Nice!

2 More Ways to Ride the Gold Bull

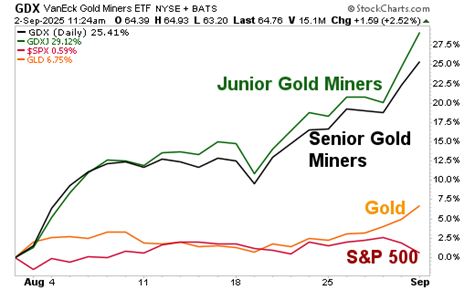

The two easiest ways to invest in gold miners are the VanEck Gold Miners ETF (GDX) and the VanEck Junior Gold Miners ETF (GDXJ).

As you can see, they are leaving gold in the dust.

Over the past month, while gold gained 6.7%, the GDX gained 25.4% and the GDXJ gained 29%.

The GDX is showing nearly four times the percentage gain as gold itself!

Meanwhile, the latest downturn in stocks has made the S&P 500 flat for the month.

This should also make it clear that investing in gold and miners can help hedge against a potential downturn in the stock market.

Central banks buying gold hand over fist is a very bullish case for the yellow metal.

The widening profit margins in miners make them even more bullish than gold.

I believe there is a long, long way to go. It won’t be a straight line — getting through $3,500 could be a back-and-forth battle for gold.

But forces are lining up for the wildest bull market in metals of my lifetime.

If you want the specific individual gold stocks you’ll want to own ahead of this bull market, watch this to the end.

All the best,

Sean