|

| By Sean Brodrick |

In the wee hours of Monday morning, gold spiked to a new record high of $2,152.30, while silver hit a seven-month high.

It was a climax of a two-week rally, and bulls are exhausted … for now. They won’t be for long.

Precious metals will zigzag higher again. You might be thinking about buying gold and silver miners on this pullback, BEFORE the next big rally.

Before you buy, let me give you a stark warning: Many gold miners are going to underperform gold.

In the short term, most producing gold miners can outpace gold. That’s due to leverage — it costs these companies less to mine gold than they can sell it for. And as the price of gold goes up, that gap between cost-of-mining and price received widens.

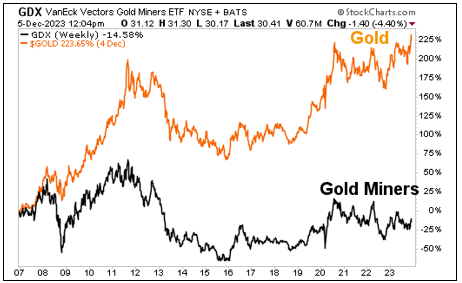

But in the long term, MOST gold miners underperform the metal. You can see it in this chart, which tracks the long-term performance of the most popular gold miner fund — the VanEck Vectors Gold Miners ETF (GDX) — against the performance of gold itself.

Over the past 17 years — as long as the GDX has existed — gold is up more than 223%, while the GDX is down more than 14%. You can also see that even though gold has pushed above its 2020 high, gold miners, as a group, have not.

What explains this? The three factors that I’m going to warn you about today.

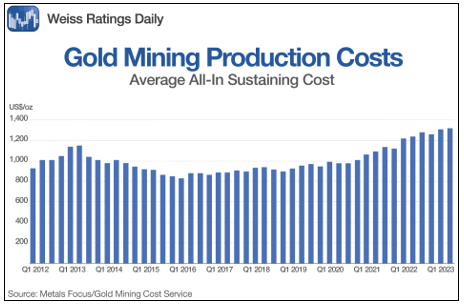

Reason No. 1: Costs Are Rising

In the longer term, inflation chips away at gold miners’ profit margins. The rising cost of diesel, equipment and especially wages all push the cost of mining higher.

The average all-in cost of mining an ounce of gold is now over $1,300 an ounce. Compare that to less than $1,000 an ounce as recently as 2020. Their costs have gone up by a third. No wonder their share prices have dragged.

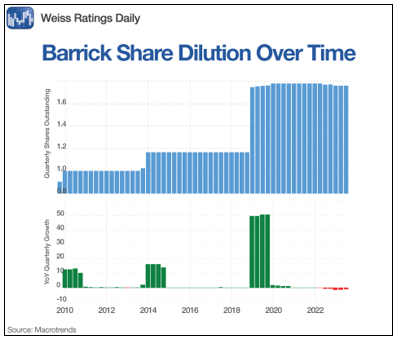

Reason No. 2: Share Dilution

Share dilution is something we associate with gold explorers and developers — companies that don’t have revenue.

But there is plenty of shareholder dilution at big mining companies, as well. This is done partly to raise cash for acquisitions, and I’ll get to why they do that in a minute.

Importantly, shareholder dilution is a massive problem. While a mining company’s production can remain the same, if it creates more shares, then there is less profit per share.

You can see an example of shareholder dilution in Barrick Gold (GOLD).

The blue bars are total shares, and the green/red bars are share issuance and buybacks. Barrick has bought shares back recently, but that doesn’t begin to make up for the massive dilution its shareholders experienced in previous years.

Barrick did this dilution to pay for acquisitions. And it needs to make acquisitions because nowadays, that’s how gold miners get more gold to replenish reserves. They don’t fund big exploration teams. They just buy other companies.

And if they don’t have the cash flow/cash reserves to pay for the takeovers, that leads to more shareholder dilution.

Reason No. 3: Gold Reserves Shrink Over Time

Gold and silver are not renewable resources. Once you mine the ore, it’s gone.

And if you aren’t finding big new deposits — and the big miners mostly aren’t — that leads to this …

You can see the big drop in gold reserves for the top 10 miners. Sure, reserves grew in the past couple of years, but that’s mostly due to acquisitions, which needed to be paid for, and that leads to shareholder dilution.

So What Kind of Miner Should You Buy?

Despite this gloom, I still recommend gold producers. In fact, my Resource Trader subscribers just took gains on three precious metals companies.

Importantly, you need to buy the RIGHT ones. Companies that …

- Control their costs: Not all gold producers are seeing a precipitous rise in costs. It takes some digging, but you can find companies that do an excellent job of cost control.

- Have little to no share dilution: The trick here is to get companies with cash flow and lots of it. So, when they make an acquisition, they don’t have to issue shares to do it.

- Have good reserve replacement: Some miners still add ounces through the drill bit. That can be a very cost-effective way to go if it’s done right. Others make accretive acquisitions that pay for themselves in short order.

All this requires rolling up your sleeves and doing the research. Or subscribing to a publication like Resource Trader, and I’ll tell you what to buy and when to sell it. You can do so by clicking here.

Look, the pullback we’re seeing in gold is likely short term. The new high in gold was brief, but it’s a sign of things to come.

The dollar should head lower as the Fed backs off from future rate hikes, and traders are already pricing in rate CUTS for next year. That’s causing bond yields to fall, which is also positive for gold.

Add in safe-haven demand and the fact that central banks around the world are gobbling up gold at record levels, and it’s easy to see why gold will go higher from here.

When it does, you’ll want to be in the right stocks. Because when gold moves, it can move like lightning. Do your research, and be ready.

All the best,

Sean