|

| By Gavin Magor |

What goes up must come down … but often what goes down props itself right back up again.

That’s how I would describe the technology sector’s performance over the past few years. During the pandemic, we saw a waterfall of cash gush into the tech space, only to see rising interest rates, major supply-chain issues and major pandemic-trend reversals abruptly crush its staggering momentum.

In 2022, energy was the surprising sector to outperform, and so far in 2023, technology has rapidly regained its control from recent years back and taken the spotlight. In fact, so far this year, tech has been the best-performing sector:

Click here to see full-sized image.

Do I take this outperformance with a grain of salt? Like many things, yes, I do because of the lack of breadth and the fact that tech’s strong year-to-date performance has been driven by mega-cap stocks like Apple (AAPL), Microsoft (MSFT) and NVIDIA (NVDA).

Remember, the Nasdaq is a weighted market cap index, meaning the performance of these types of stocks impacts its performance a great deal higher. And a big driver for these names has been the mega-hype of artificial intelligence.

Do I think the rest of the technology market — especially highly-rated Weiss Ratings tech stocks — can play catch up and perform well this year? Absolutely.

And if your portfolio is lacking technology exposure, I truly believe you may be missing out on gains for the remainder of the year. And one way to help your research if you’re looking for quality names is with the ...

Top-Rated

IT Names

Today, I want to look at upgrades in the Weiss Ratings for Information Technology stocks. I’m very passionate when it comes to the ratings here at Weiss, but especially so when it comes to names in a sector that is doing well, such as with technology currently.

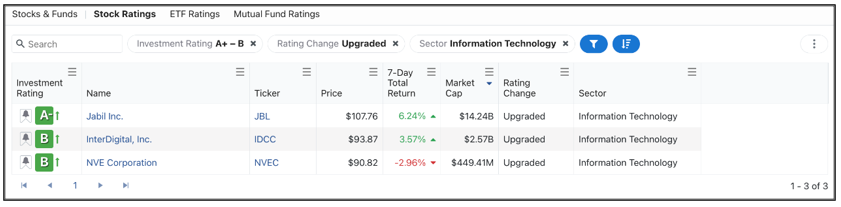

My criteria on the Weiss Ratings stock screener is “Information Technology” … specifically, stocks belonging to that sector that were recently upgraded in the “B” or higher range. Here’s what populated:

Click here to see full-sized image.

Out of the 12,985 stocks currently rated in our database, only three companies populated to match my search criteria. I encourage you to look at these names in detail. And, of course, conduct your own research.

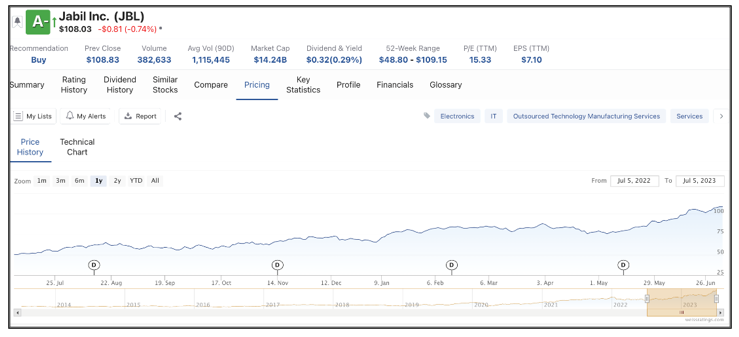

The one name that is in the “A” range, Jabil (JBL), is actually up a blistering 114% over the past year, and I was easily able to confirm that using the Weiss Rating’s “Pricing” tab — under “Price History” — presents you with other highly relevant information about your chosen stock.

Click here to see full-sized image.

Jabil has been in the “buy” range since September 2022. Plus, these are just a few of the features offered, so be sure to look around — especially at the “Key Statistics” tab for technology stocks and their valuation. Sometimes, technology names can be trading at very expensive multiples, meaning they could possibly be overvalued.

Whatever your personal investing goals are, I do highly encourage you to consider adding strong technology names to your portfolio this summer.

And if you’re looking for an even easier way to get tech exposure with lots of guidance and a track record packed with triple-digit and quadruple-digit gains, be sure to check out my colleague and tech stock wizard Jon Markman’s Weiss Technology Portfolio. In it, he has and will soon be recommending AI-focused stocks that seem poised to dominate in future years.

In the past, Jon Markman nailed his prediction of four major tech megatrends that would eventually dominate our world of mobile computing, big data and now AI. In that process, he was able to create new fortunes with his recommendations. If you’d like more information, be sure to click here now.

With technology in general, we can and have achieved the unimaginable. And here at Weiss Ratings, we’ve been able to amass some massive gains from these incredible tech companies, all thanks to our research and ratings.

These are exciting times, and the investing opportunities are grand.

Cheers!

Gavin Magor