|

| By Gavin Magor |

In these pages, we often discuss stocks, ETFs even cryptos that are best positioned to grow in every market.

But we don’t frequently confront a problem many investors have too often — what to do with funds in accounts that don’t offer a wide selection of investment options.

Namely, I’m talking about 401(k)s and other retirement plans. If you have the freedom to open a self-directed retirement account, great!

But many savers have a significant amount of their retirement funds tied up in accounts and plans that limit the types of investments they can hold.

Often, there is just a small list of available mutual funds you can buy in these accounts. They range in their goals:

- Target-dated funds

- Market cap specific funds

- Geographic funds (Europe, Asia, etc.)

- Income funds

- Growth funds

Even if your selection of funds lines up with your investment goals and plans, you might like to know more than just the basics.

Fortunately, Weiss Ratings has you covered. Here are three tools to get you started …

Mutual Fund Tool No. 1: Fund Screener

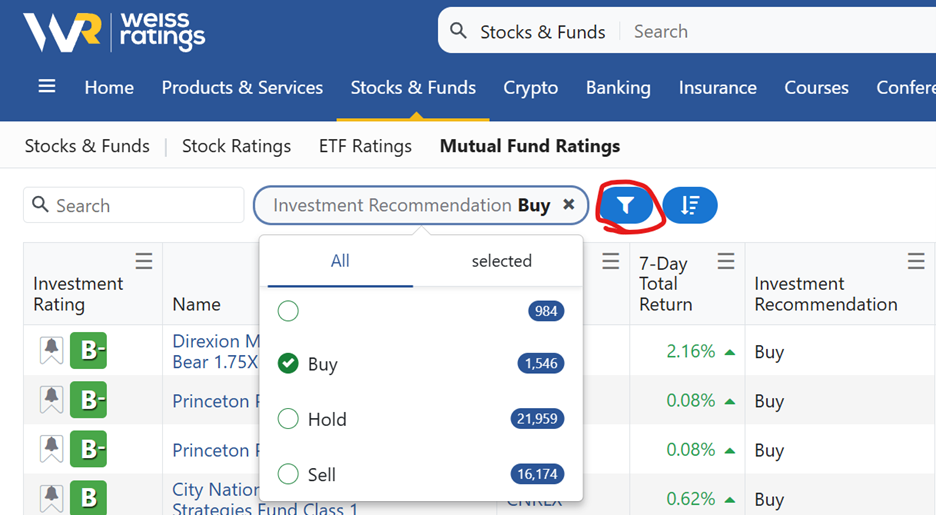

We rate a very large amount of mutual funds — 25,312 to be precise.

Only 1,546 of those are within our “Buy” range at the moment.

So, let’s start there. Here is how you can screen for our “Buy”-rated mutual funds.

Click on the “Stocks & Funds” tab, then “Mutual Fund Ratings.”

From there, click the filter button highlighted below. Then, simply scroll down to the “Weiss Ratings” filter at the bottom and select “Investment Recommendation.”

There you can select “Buy” as seen here:

These are all the mutual funds we rate in the “Buy” range, which mean they have a rating of “B-” or above.

This is where we recommend you start. If you have the option to buy some of these — and they line up with your investment goals — in your retirement account, they should be on your list.

Of course, we can dig further. Here’s a second tool to help …

Mutual Fund Tool No. 2: Fund Analysis

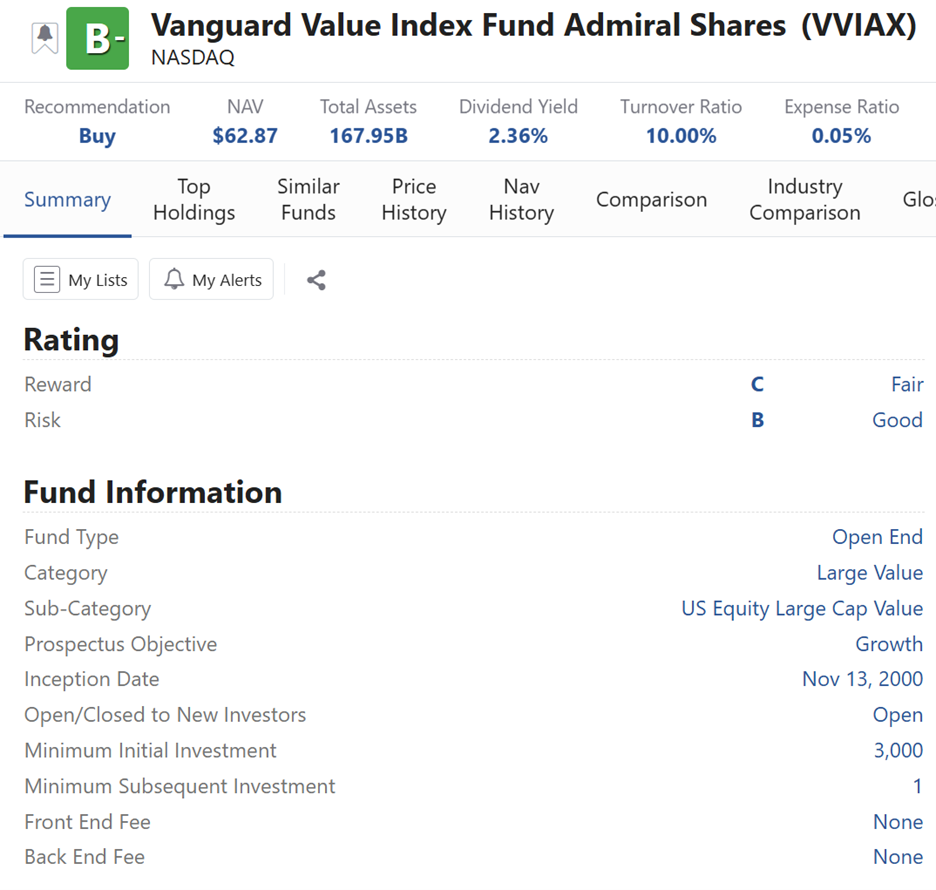

From the screen we just showed you, the largest fund that qualified was Vanguard Value Index Fund Admiral Shares (VVIAX).

Many plan providers offer Vanguard mutual funds. So, this one may be open to you right now.

If so, here’s how you can see if it is right for you.

Once you click on the fund you are interested in — again, we’ll use VVIAX as an example — you will be taken to its “Summary” page:

Right away, you can see some important information. You see that it has $168 billion in total assets, an expense ratio of just 0.05% and pays 2.36% in dividends per year.

Below that, you see that we rate it a “C” for Reward and “B” for risk. That indicates that it targets slower growth, yet more stable, investments.

I urge you to check out the full summary page here. Also on the page is the fund’s top holdings, its performance over various time frames that range from seven days to five years … and its “Investment Strategy” summary.

We have one more tool we want to make sure you have in your arsenal when deciding on how to invest your 401(k) savings …

Mutual Fund Tool No. 3: Fund Comparison

In the above image, you can see a tab named “Comparison.” Click on that.

This will take you to a page that lets you directly compare up to four mutual funds side by side.

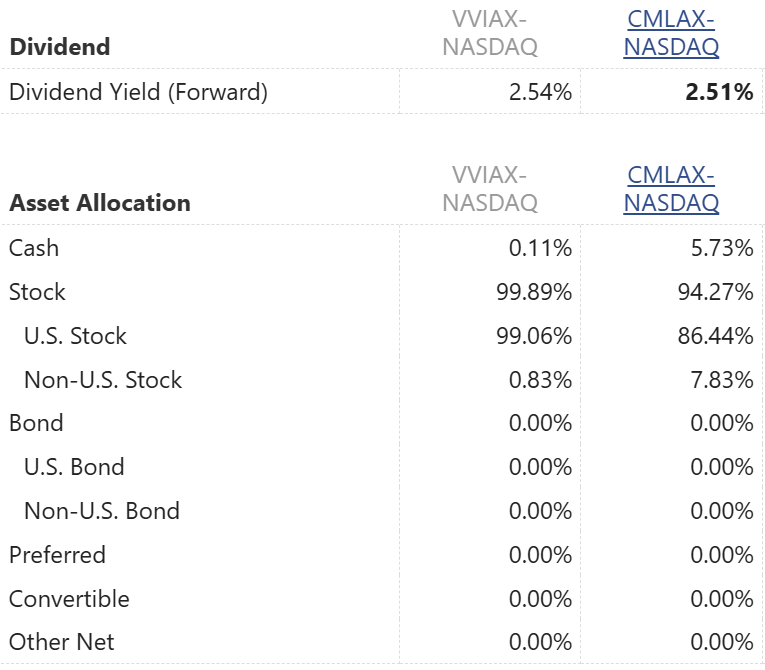

For our example, let’s take another large U.S.-focused value fund: the American Funds American Mutual Fund Class 529-A (CMLAX).

Simply enter that ticker symbol after selecting “Click to Compare.”

Right away, you can see how the two funds stack up against each other:

VVIAX is a “Buy.” CMLAX is a “Hold.” That’s instantly visible.

Then, further down the page, you can see that they share a similar forward dividend yield, but CMLAX has some international exposure that VVIAX doesn’t.

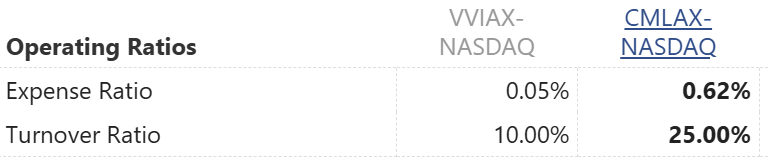

There are many more sections that let you compare their performances, prices, net asset values and more. But one to always look at when comparing funds is the expense ratio:

As you can see, VVIAX looks better than CMLAX nearly across the board. If these were the two funds I was offered, I’d know which one to choose!

So, if you have funds tied up in a restrictive retirement account that only offers a handful of mutual funds to choose from, you should start with these tools to decide what’s best for your savings.

Cheers!

Gavin

P.S. Of course, not all retirement accounts are so restrictive. In fact, many self-directed IRAs now allow you to invest in other assets like gold and crypto.

If you have one of these accounts or are even just looking to diversify your other investments, I recommend you watch this brand-new briefing: “245x Better Than Bitcoin.”