4 New ‘A’-Rated Weiss Stocks to Put on Your Radar

|

| By Gavin Magor |

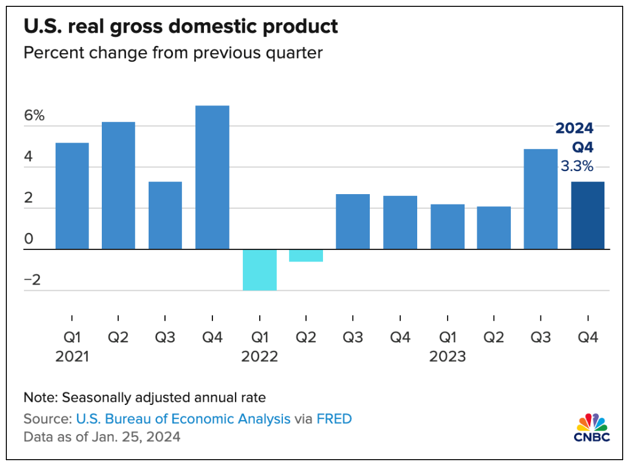

The economy appears to be heading towards door No. 3.

Door No. 1 was a weakening overall economy and lower inflation. Door No. 2 was a stronger economy and higher inflation.

Door No 3 is a strengthening overall economy, increasing GDP and lower inflation rates.

Last Thursday’s Q4 2023 GDP Report revealed just that, and investors have every reason to be happy about it.

GDP, a measure of all the goods and services produced in the country, increased at a 3.3% rate, handily beating estimates of 2%.

Core prices for personal consumption expenditures rose 2% for the Q4 2023 period, and the headline rate was 1.7%.

Other big economic news included the initial jobless claims number coming in at 214,000, an increase of 25,000 from the previous week.

Make no question, this economy is being propelled by resilient consumer spending and a still quite strong labor market.

I have been saying this for months … I believe investors should at least be “cautiously optimistic.”

Sure, inflation is still staggeringly high, and it’s still burning consumers’ wallets. But it IS coming down. And we DO still have a strong economy.

The broad market is also continuing to plug along higher, keeping up its strong momentum towards the end of last year.

Stocks Notching All-Time Highs

The headlines last week were all about how the big indexes have closed at all-time highs that were not seen since late 2021.

Always stay nimble, but the equity markets are hot. Of course, one of the best places for investors to look for some new opportunities is on the Weiss Ratings Stock Screener Page.

We’re still in the early stages of earnings season. But so far, many results have been quite positive … hence the all-time highs.

I’m in this business to help investors. That’s why I want to turn your attention today to some of the Weiss Ratings newest upgrades into “A” territory.

And if you’re not familiar with our territory, a “B” rating is considered a “Buy,” whilst an “A” is also considered a “Buy,” but with what we view as even better prospects.

4 New ‘A’-Rated Weiss Stocks Flying High

After heading to the Weiss Ratings Stock Screener and typing in the parameters of “Rating of “A” to “A-” and a “Ratings Change” of “Upgraded,” four new stocks populated:

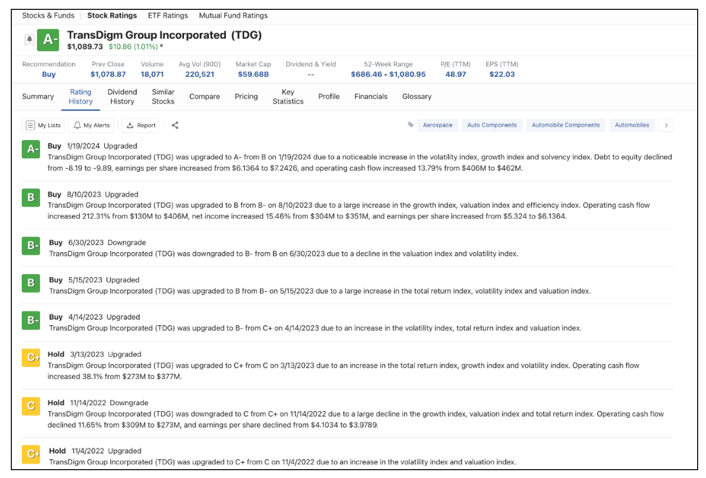

These are all quality “A” names that I strongly believe you should look into. But I want to especially focus on TransDigm Group (TDG).

It was upgraded on Jan. 19 due to an increase in its indexes, an increase in EPS and an increase in operating cash flow from $406 million to $462 million.

The company designs, produces and supplies aircraft components in the U.S. and internationally. Pun intended, its stock is flying high … up 175% over the past five years. In fact, it’s up 53% over just the past year alone.

Whilst airline stocks in general have had a very bumpy recovered from a brutal pandemic plunge, there are still some great plays within the industry.

Sure, American Airlines (AAL) reported some very strong earnings last week. But I believe there are even better plays. TransDigm is one of these.

Here’s a full breakdown of TDG’s ratings history over the past few years:

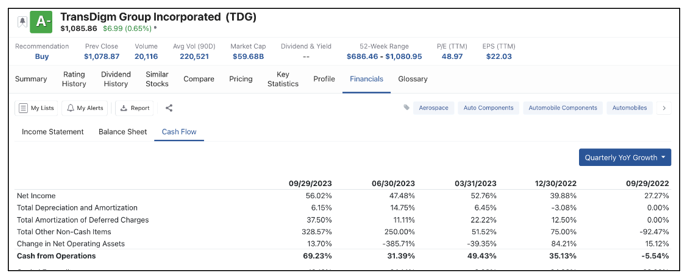

Aside from its “A” rating, there are some favorable macro trends such as recovering air traffic and rising defense budget spending around the globe.

Financially — and unsurprisingly given its high rating — it appears to be in a very strong position. It has been able to generate strong cash flow and profitability.

No matter what the market brings us, having the Weiss Ratings to help with your important financial decisions is what I view as a very smart move.

In addition to stocks, we cover banks, mutual funds, ETFs, cryptocurrencies and insurers. It can all be found on the Weiss Ratings site.

Cheers!

Gavin Magor

With PJ Amirata