We need a siren.

Or perhaps a trumpet, loud bagpipes … anything that can get investors' attention, because over the past week all I’ve seen are distractions, and traders need a wakeup call.

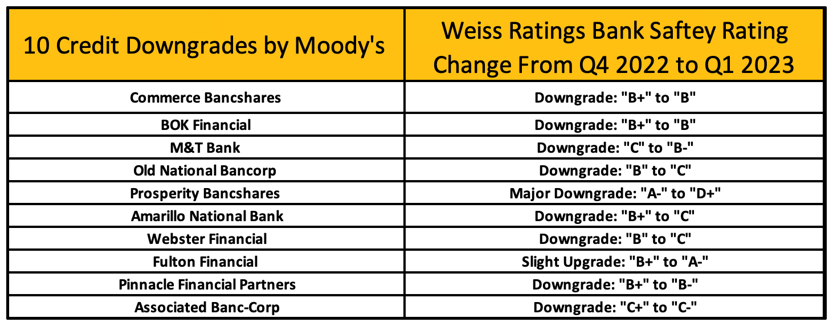

Last week’s broader market sell-off was sparked by Fitch Ratings’ downgrade of U.S. debt from “AAA” to “AA+” for only the second time in history. And this week, Moody’s, another large ratings agency, downgraded the credit ratings of 10 major banks.

The bulls had to finally take a backseat, but we don’t expect this trend to last very long. As of this past Wednesday’s lows, the market has already rebounded 122 basis points as of writing. Markets fell for what we view as unsound reasons … and perhaps some profit-taking.

While there are many ratings agencies for you to make your judgements, and perhaps we’re a little biased, the Weiss ratings are our first financial ratings choice.

We respect and value the hard work of others in our industry. But, we’d like to point out that Weiss Ratings had already downgraded the safety rating of nine out of the 10 banks that Moody’s downgraded the credit of this week, in our last quarterly Q1 2023 Bank Ratings that were published earlier this summer.

Check this out:

We don’t want to toot our own horns too loud, but we do want to use this as an example of the power, reliability and speed of the Weiss ratings. Not just our bank ratings … that goes for all ratings.

And it’s why we want to use this opportunity to use the Weiss ratings to find some strong dividend-paying stocks.

Why? Well, there are …

4 Reasons to Dive into Dividend Payers

- Tax advantages: Qualified dividends are taxed at a much lower rate than ordinary income.

- A cushion for volatility: Dividends provide a very nice cushion against overall portfolio performance in both good times and bad.

- A better tool for evaluating a stock: Using a dividend over a more traditional method of stock evaluation, such as P/E ratio for example, can be more reliable.

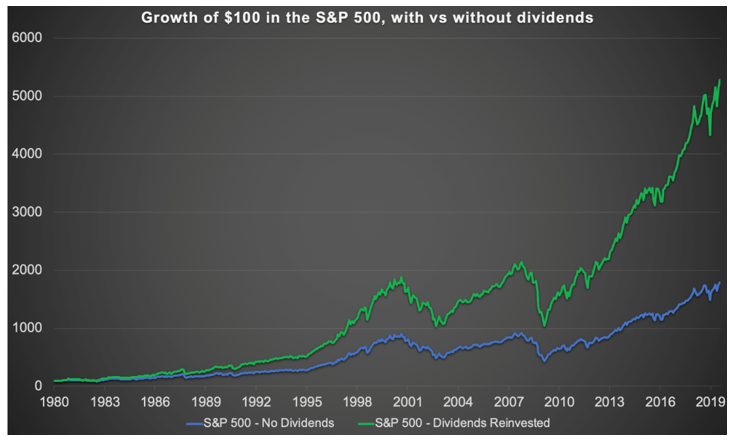

- Portfolio growth: This may be the last on this list, but it is certainly not least. Great fortunes have been made simply by harnessing the power of dividend stocks. Don’t just take my word for it. It’s a fact that from 1980 to 2019, 75% of S&P 500 returns came from dividends:

Click here to see full-sized image.

Dividends have a highly underrated compounding ability that has a snowball effect over time.

We’ve done the heavy dividend digging with our stock safety ratings, aiming to give all investors a greater sense of peace of mind when doing their equity research. So, please ...

Use the Weiss Ratings to Target Dividend-Paying Names

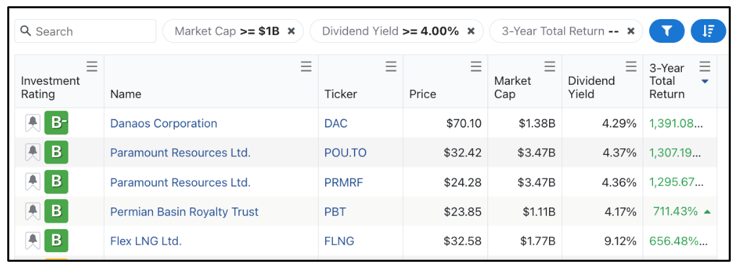

I love seeing that beautiful green “B” and “A” rating next to our strongest-rated names. To us, it means quality. In the below image from our stock ratings page, we filtered the stocks for:

- A market cap above $1 billion.

- A dividend yield higher than 4%.

- Sorted by highest three-year total return.

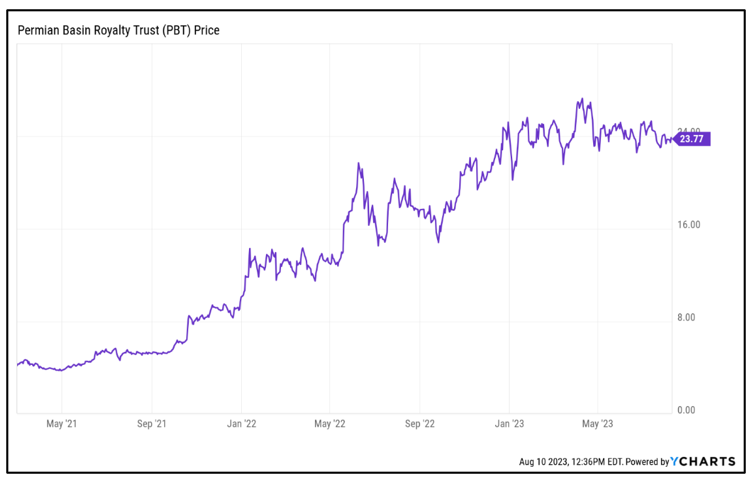

You can look at all these names, but we especially like Permian Basin Royalty Trust (PBT). And it’s not just because All-Weather Portfolio Members were able to collect its dividend and end up with a nice 13% gain in only a few months of holding it.

PBT is an oil and natural gas royalty trust that is headquartered in Dallas. Its dividend is currently yielding 4.16%, which is excellent. And it pays what has become especially rare in today’s market … a monthly dividend, as opposed to the far more common quarterly one.

It has a very healthy balance sheet that is providing lots of cash to be able to support that monthly dividend for shareholders.

In March 2021, Weiss Ratings upgraded Permian Basin Royalty Trust from a “Sell” rating to a “Hold,” and since then, shares are up 431%.

Click here to see full-sized image.

This is just one example of many great names in our ratings system. Be sure to explore and see which names may be the perfect fit for your portfolio.

Even Better Than Dividends

We’ve made our point on how powerful dividends are, but they alone can’t completely help you avoid the coming storm. We are calling it “America’s Great Income Emergency.”

There is a strategy — in which dividends do play a role — that does combat this emergency.

In just the past few weeks, it has led to instant payouts of $988 on July 21, $896 on July 14 and $1,159 on June 23.

If you want to target these kinds of immediate payouts, check this out now.

Cheers!

Gavin Magor, Director of Ratings & Research

With

P.J. Amirata, Jr. Analyst