Editor’s note: Spoiler alert — one of these is an income strategy that’s produced an impressive 97.4% win-rate over the past eight years … and 100% win-rate for nearly three straight years! Tomorrow, April 1 (no foolin’!), I’m revealing all the details at a special Weiss event. Click here now to register for it.

|

| By Nilus Mattive |

Early in my career, I interviewed at all kinds of places on Wall Street — including lots of the big names like Jefferies, Bernstein and Morgan Stanley.

But my most memorable experience was at a place that ended up resembling Jordan Belfort’s place in “The Wolf of Wall Street.”

I’ll never forget the guy I met. He was exactly what you imagine — right down to the tanned face, pinstripe suit and flashy jewelry.

He wasted no time explaining what the job entailed.

Here’s a really brief version of how I remember it:

“Okay. You get in early and read The Wall Street Journal to get up to speed on what’s happening in the markets.

“Then you start making phone calls. We mostly target the U.K. first since they speak English and it’s later in the day there.

“You pitch the ideas we give you. And you keep doing that all day.”

Would my own security analysis factor into this? Would we base our recommendations on fundamental developments? I started asking some of these questions and sharing my own thoughts on investing.

Rather than address any of that, my interviewer started talking about a current employee’s rise to fame …

“Two years ago, he was hopping the subway turnstiles to get on the train. Dropped out of high school. Didn’t know a thing about investing.

“Today he’s one of our best producers. Just bought a condo on the Upper East Side, has money coming out of his ears and is engaged to a very attractive girl now.

“All you have to do is follow the approach I just told you about and you can be there, too.”

I said no thanks.

The Wall Street “boiler rooms” of the 1990s and early 2000s have now been replaced by Reddit and Instagram posts. Today, the irony is that the bigger-name firms continue to take money out of Main Street investors’ pockets on a daily basis.

Sure, their methods are more subtle than pitching you shady investments. But that doesn’t mean the financial outcome is any better.

We don’t even need to talk about Bernie Madoff-type Ponzi schemes or AI-driven trading bots.

Instead, just consider the following four ways Wall Street “steals” from regular investors day in and day out …

No. 1: Investment Fees

The average financial adviser charges 1% a year to manage your money.

That means the typical investor who uses a professional adviser could be handing over $1,000 a year on a $100,000 portfolio before one single penny is earned from the lump sum.

Put another way, it means that same investor has to beat a benchmark’s return by one percentage point a year just to break even.

Do some advisers provide great information for their fees?

Absolutely. Some are worth far MORE than 1% a year, in fact!

But a lot of others aren’t.

No. 2: Out-of-Whack Expense Ratios

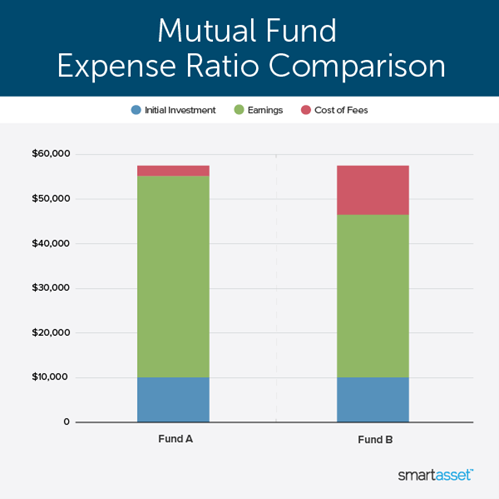

The typical actively managed mutual fund carries an annual expense ratio of 1.1%.

So, whether or not you use an adviser, you could be losing more of your money just to pay for a mutual fund’s marketing materials, managers and other operating costs.

On top of an annual expense ratio, many mutual funds also slap on plenty of other fees — for getting in or out.

They may even level additional fees for every year you stay in.

Obviously, a lot of investors are getting wise and switching to low-cost index funds and ETFs.

However, there are still billions in unnecessary, unjustified fund management fees going into Wall Street’s coffers every single year.

And in many cases, the advisers earning 1% a year are steering their clients into “house” funds … compounding the problems on top of each other.

Which brings me to …

No. 3: Paying for Underperformance

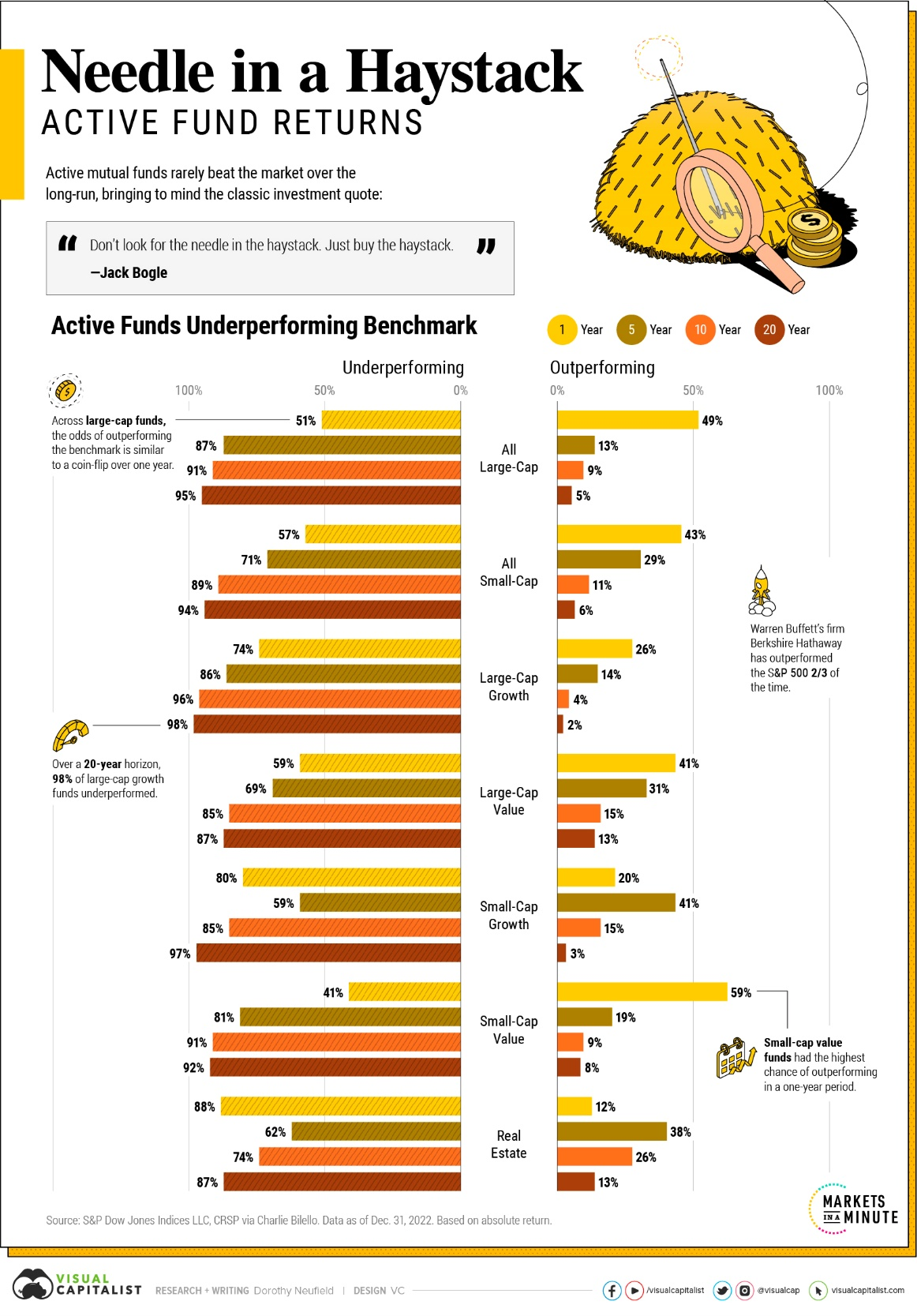

Most actively managed funds are consistent underperformers.

It would be one thing to pay for performance.

In fact, you will often hear Wall Street describe its compensation structure this way …

But the reality is that the majority of actively managed mutual funds (and ETFs) fail to beat their benchmarks.

The number varies year to year, but it usually sits right around 80%.

It’s the same thing with hedge funds, too.

And with hedge funds, you still have to factor in their typical management fees — 2% of assets and 20% of any profits earned!

No wonder the California Public Employees’ Retirement System (CalPERS) decided to pull out all the money it had invested in hedge funds ($4 billion).

That was after they paid $135 million in fees during 2013 and received only 7.1% in returns from their hedge fund investments while the S&P 500 index rose 29.6% that year!

As with financial advisers, there are some great money managers worth every cent they charge. There are also some actively managed funds that are totally worth the fees, too.

Of course, there’s one absolutely huge way that Wall Street is sticking it to regular investors … and given what’s happening right now, it’s a critical thing to understand …

No. 4: Wall Street Keeps the Best Strategies for Itself!

Last year, a lot of people made a lot of money by simply picking momentum stocks and watching them go up.

Now? Not so much.

In fact, as I predicted, we have seen those highfliers start to come back to earth … while the economy is starting to cool off … and market volatility continues to spike.

That makes this the perfect time for more advanced strategies like one I call “60-Second Income.”

It can take market volatility and turn it into cold, hard cash just about any time you want.

Better yet, it works GREAT in choppy markets like we’re seeing right now.

Of course, a financial adviser will almost certainly not tell his clients about this approach.

That’s because Wall Street firms typically use this strategy for their own trading desks … collecting billions in the process.

But since 2022, my research team and I have taken this same technique the big firms use and customized it specifically to help individual investors bring in consistent cash payments no matter what the market is doing.

And the most remarkable part?

These trades have demonstrated a success rate of 97.4% over eight years of history and real-time results.

Even crazier — since August 2022, we haven’t closed a single losing investment using this approach.

I’ll be sharing all the details on this income breakthrough TOMORROW, Tuesday, April 1 at 2 p.m. Eastern.

If you’ve already registered to join me, please watch your inbox tomorrow for an alert before we go live.

Haven’t signed up yet?

All you have to do to attend this free event is click here now.

We’ll automatically reserve your spot and make sure you get a heads-up ahead of the event.

By the way, I don’t just use this technique myself … I’ve even taught my own family members how to use it.

In fact, you’ll hear a lot more about that during tomorrow’s event.

Because in times like these, listening to the conventional Wall Street wisdom isn't just inadequate — it can be downright dangerous.

Best wishes,

Nilus Mattive