|

| By Sean Brodrick |

Venezuela is many things.

It’s a failed petro-state, a potential source of massive potential future oil production, a test case for the “Donroe Doctrine” and more.

But most analysts can’t grasp a critical fact:

Venezuela shows the War Cycle is in the Danger Zone.

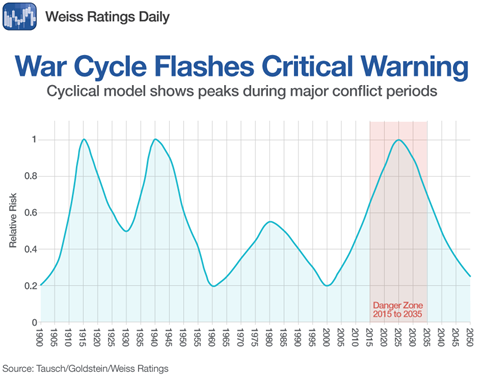

I’ve told you about the War Cycle before.

Wars and geopolitical conflicts follow recurring patterns over long periods.

I’ve explained that the War Cycle is ratcheting higher.

And what happened with Venezuela last week is proof.

In fact, we’re already in “The Danger Zone,” that pink area on the chart.

It shows conflicts should increase from now through 2030 or 2035.

Venezuela is the War Cycle arriving on our doorstep.

President Trump has warned that he may attack Venezuela again, and that “something’s going to have to be done with Mexico.”

Meanwhile, people around President Trump have made veiled — or not-so-veiled — threats against several nearby countries and territories, including Greenland, Cuba and now Colombia.

Laugh it off if you like. Venezuelan despot Nicolas Maduro will have to do his chuckling from inside a U.S. jail cell.

Under Maduro, Venezuela was a wretched hive of scum and villainy, a place where cartels and foreign actors mingled, and even a treasure trove of strategic commodities couldn’t lift the nation out of poverty.

No one will miss Maduro. I know Venezuelans living in Florida who cheered when America’s Delta Force grabbed him.

I don’t know if Venezuela will improve under a new government. Or what that new government could even look like.

But what we should really be thinking about is what happens next … what happens since we’re in The Danger Zone of the War Cycle.

President Trump explained his use of force against Venezuela was part of the “Donroe Doctrine.” That’s based on the Monroe Doctrine.

The Monroe Doctrine is a foundational U.S. foreign‑policy statement from 1823 that declared the Western Hemisphere off‑limits to new European colonization or political control.

At the same time, it pledged that the U.S. would stay out of European wars and internal affairs.

Over the weekend, President Trump explained the Donroe Doctrine this way:

The U.S. claims the right not just to keep other powers out of the Americas, but to dominate the Western Hemisphere directly.

He’s using it to justify removing unfriendly regimes and control key resources, especially oil.

President Trump describes the Donroe Doctrine as having “surpassed” the original Monroe Doctrine.

It openly links it to military action like the Venezuela strike and threats toward Mexico, Colombia, Cuba and Greenland.

Meanwhile, observers say this really translates to “spheres of influence.”

That means Trump has no problem with Russia regaining control of Eastern Europe …

Or China grabbing Taiwan …

As long as they don’t interfere with the U.S. domination of the Americas.

That headline above suggests they won’t.

4 Ways to Profit from the Danger Zone

It doesn’t matter whether you agree with the Donroe Doctrine or not.

You and I don’t get to order jets and ships around.

We can, however, control our portfolios.

And we’d be wise to do that sooner rather than later.

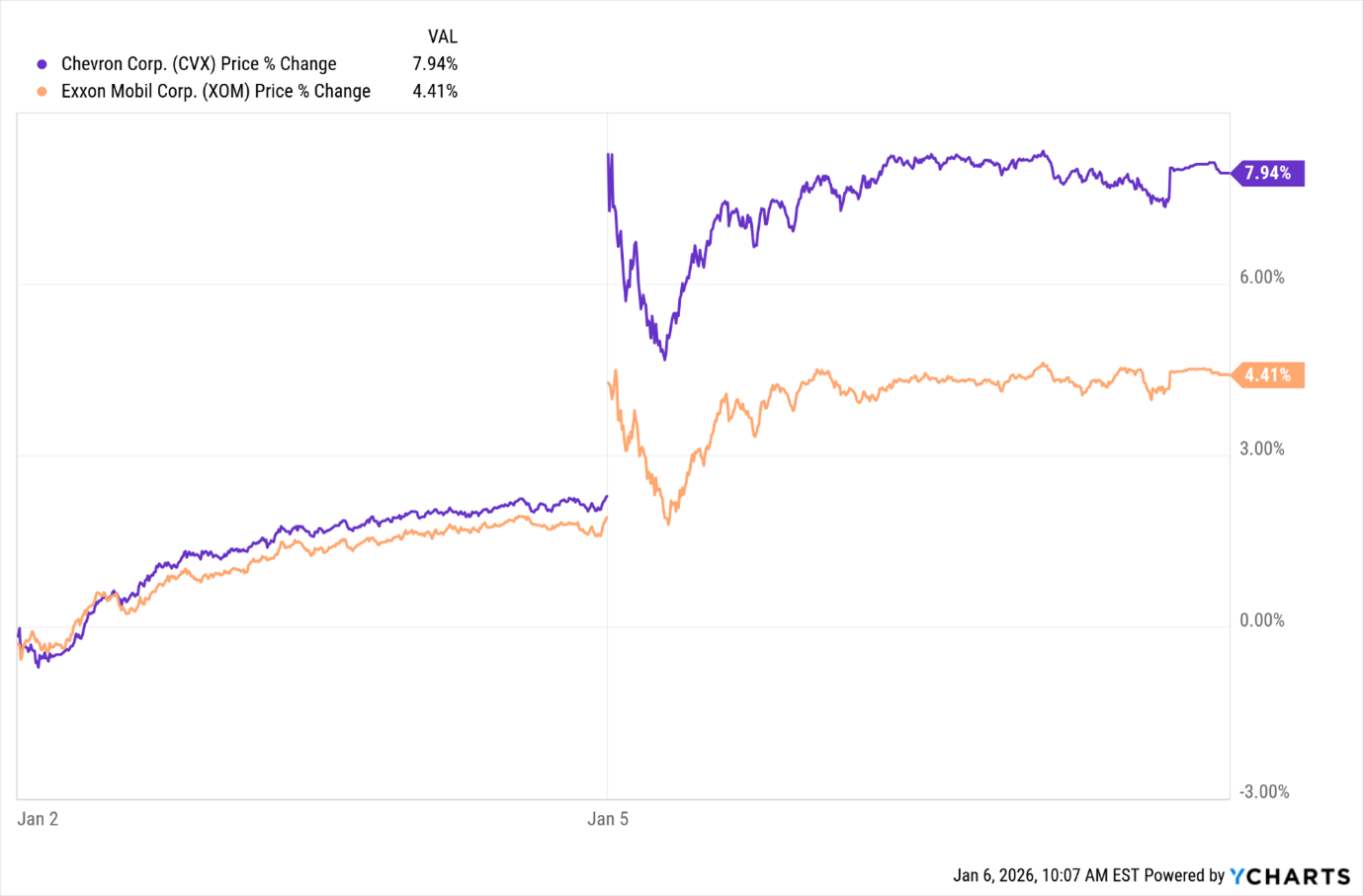

Clearly, Trump’s capture of Maduro is bullish for major U.S. oil companies. Especially those that lost properties and operations when Venezuela nationalized them in 1976.

Chevron (CVX) is a big winner, though Exxon Mobil (XOM) and others are already popping.

Just remember that it will take many years to bring Venezuelan oil assets online.

The country’s infrastructure was ruined by years of mismanagement and looting.

Other winners include the next-gen defense stocks I’ve recommended in Supercycle Investor and Wealth Megatrends.

Those are blasting higher.

The Not-So-Surprise War Cycle Winner

What’s happening with Venezuela is bullish for the war cycle.

It’s not a surprise that oil is going higher.

But what’s also popping right on cue are minerals that are critical to the U.S. war effort.

Members of my Resource Trader and Wealth Megatrends publications saw their critical minerals stocks pop Monday.

We’ve been waiting for this moment.

And should the war drums somehow go silent, the calls from our government for the rare elements these companies produce will only get louder.

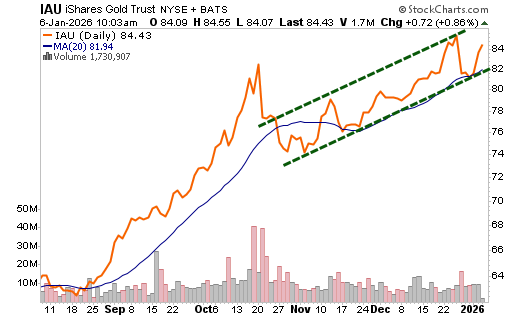

Geopolitical unrest is also good for gold and silver.

Both of those precious metals jumped on Monday. All my publications hold positions in precious metals.

We recently saw precious metals take a breather after a big run-up.

Will the next ramp-up of the War Cycle be enough to jumpstart the next rally?

Let’s look at a chart of gold, as tracked by the iShares Gold Trust (IAU), which holds physical metal …

Despite gold’s sharp pullback last week, the yellow metal didn’t even break its 20-day moving average, a dividing line between short-term bullish and bearish moves.

As long as gold (and the IAU) stay above the November low, it’s still bullish. VERY bullish.

In October 2024, I gave you a target price for gold at $6,902 per ounce.

If anything, I may have been too conservative. Gold is running hotter now than in its last bull market.

By my count, I mentioned the IAU eight times in 2025. If you’d acted on my April mention, you’d be up about 42%, compared to 22.7% for the S&P 500.

I hope you bought gold last year.

If you didn’t, don’t grumble. Buy it!

Better yet, watch my brand-new prediction to get the best way to play this monster rally.

There will be big corrections along the way, sure. But gold is going much higher.

And the ramping up of the War Cycle is one of the things ensuring that.

All the best,

Sean

P.S. As I hinted above, I uncovered a way to help investors make 469 times more than just owning gold.