|

| By Sean Brodrick |

Last week, I talked about the overall bullish outlook for metals. In this week’s installment, I want to talk specifically about gold.

There’s a mega-rally in metals — and gold in particular — that’s coming. And with it comes moonshot potential.

So, why invest in gold? I’ll tell you why. It’s real money. In the long run, fiat currency just won’t be worth the paper it’s printed on.

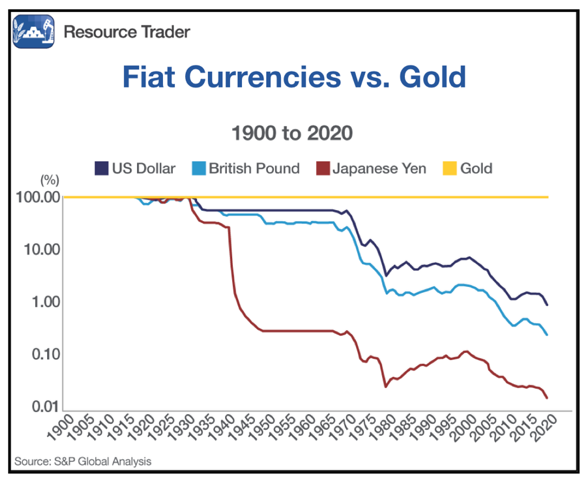

To understand what I mean, look at this chart that shows the value of major world currencies versus gold over the past 120 years:

Click here to see full-sized image.

Through 2020, you’ll see there was a 99% decline in value of the U.S. dollar against gold.

Other reserve currencies, including the British pound and Japanese yen, have done even worse. The yen lost 99.98% of its value against gold in 100 years.

Even with inflation at just 2% each year halves the value of your money in 36 years. The Federal Reserve aims for inflation of around 2% per year. While inflation is falling from the 40-year peak it hit in 2022, it’s unlikely to settle at 2% anytime soon.

Long term, gold tends to hold its value compared to many other types of assets. As such, it can act as a hedge against inflation.

Let’s dive into …

The Forces Driving Up Gold

Force No. 1: Demand is outpacing supply. The World Gold Council recently released its Gold Demand Trends report for Q3 2022. Total gold supply increased marginally, up 1% year over year, to 1,215 metric tons.

At the same time, overall gold demand soared 28% higher, to 1,181 metric tons. And year-to-date gold demand is up 18%.

Throughout 2022, we saw gold supply and demand nearly equal, though bullish forces pushed gold higher.

Now, we have a country with a cultural affinity for gold — China — starting to come out of a COVID-19 lockdown that lasted nearly three years. China is a major force in the gold market and its demand alone could push gold higher.

Force No. 2: The global middle class is growing. This is because of higher-paying tech and service industry jobs.

China is still in the early to middle stages of economic development and it’s not alone. One in every three people in India is now in the middle class, according to a survey quoted by the Times of India. By 2047, the middle class in India is expected to grow rapidly.

And according to a study from the World Data Lab, over half of the people across Asia will be middle class by 2024. Why is this important? Because middle class people have money for luxuries, including gold.

Force No. 3: Government debt is ballooning. Around the world, according to S&P Global, total debt has hit a record $300 TRILLION and keeps growing. This is clearly unsustainable.

Thanks to inflation, the cost of servicing debt is rising significantly. We may be approaching the point where some governments can’t afford the interest on their debts. When that happens, the manure could hit the fan in a hurry.

Many gold bugs think governments will devalue their fiat currencies. After all, if the debt is denominated in U.S. dollars, and that dollar’s value is cut in half, then the size of the debt gets cut in half.

A massive devaluation would take the value contained in paper money and running it through a shredder. And when it does, buddy, you'll want to own gold because you can't print gold.

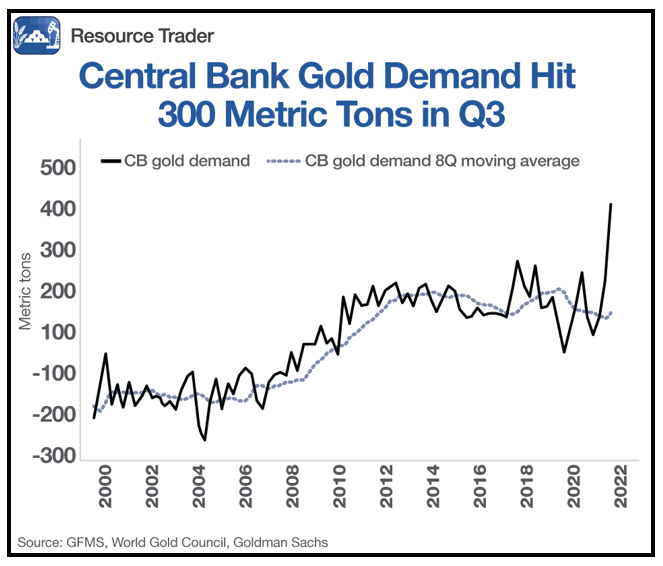

Force No. 4: Central banks are buying. China isn’t the only central bank buying gold. Here’s a chart from Goldman Sachs and the World Gold Council showing what happened with central banks’ gold purchases through Q3 2022:

Click here to see full-sized image.

You can see that central bank demand for gold is soaring. In fact, central bank purchases of gold hit a 55-year high in Q3.

According to the World Gold Council, central banks bought a record 399 tons of gold worth around $20 billion in Q3 2022. That puts demand for the precious metal back to pre-pandemic levels.

Along with China, the largest buyers were the central banks of Turkey, Uzbekistan, Qatar and India.

Force No. 5: The world hits peak gold. Gold is not a renewable resource. After you dig it up, all you have left is a big hole in the ground. Over time, guess what that does to gold supply?

Simply put, planet Earth is at peak gold. Peak Gold simply refers to the point when gold production is no longer growing.

In the good ol’ days, global gold production rose, on average, 1.8% per year. That stopped in 2020, when total gold supply fell 4% year over year. Total supply includes gold from recycling and sold out of stockpiles. But mine production slid at the same time, also down 4%.

According to the World Gold Council, we'll likely see mine production fall for years going forward. Even if prices go much higher, because it takes years to start up a new mine. In fact, it can take more than a dozen years to bring a project from open field to producing silver and gold.

Best wishes,

Sean

P.S. The Federal Reserve’s actions should have investors concerned for their financial well-being.

Starting as soon as May 2023, their insidious “Fed Control” powers could go live, which means that any accounts linked with the U.S. banking system could soon be at risk for surveillance of all transactions … or worse.

Investors who want to take action to protect their money should click here for four steps to take now to stay safe and grow their wealth.