|

| By Gavin Magor |

According to Benjamin Graham, “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return.”

I love Benjamin Graham’s work, and no, not just because we’re both economists and originally from the U.K.

He was a major proponent of investing with a high amount of focus on safety and rationality … and is considered the father of value investing.

For example, one method of Graham’s investing preference was to look for stocks that had a higher amount of liquid assets on their balance sheets than the total market capitalization of the company, effectively buying the company for nothing.

Graham was a major proponent of not taking cash off the table during times of volatility and instead trying to profit in a wise manner. In general, I strongly agree with this principle.

So far this month, we’ve seen a slight pullback in the market, with the S&P down 3.8% as of this writing.

But should you run for the exits? Is this a new bear market blossoming on the horizon?

Click here to see full-sized image.

From all the data I’ve analyzed, there isn’t anything that has changed, nor that overly concerns me. I view a majority of this recent pullback as some profit-taking and as an opportunity to consider buying strong names at a discount.

Remember, pullbacks are healthy and necessary.

Rationality & Reliability in Our Ratings

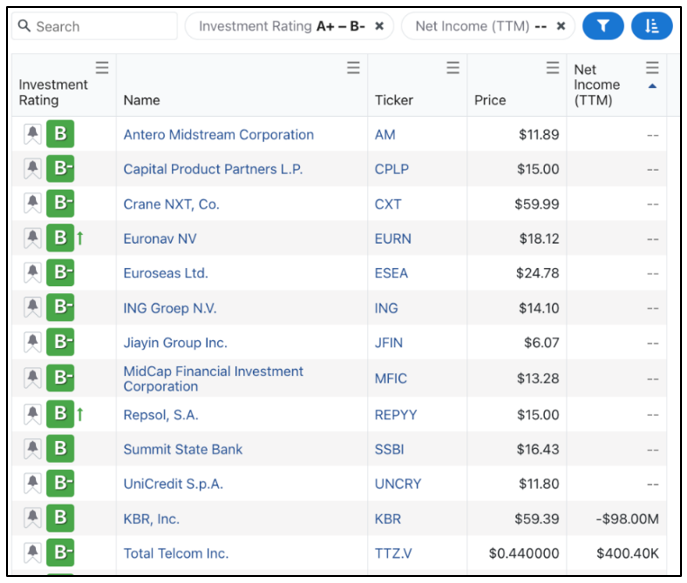

The Weiss stock ratings have been meticulously crafted to place a strong emphasis on safety and for being unbiased.

One thing that speaks volumes to that safety: Out of the 853 stocks in our “Buy” territory with a rating of “A” through “B-,” only one company has negative net income.

That stock is KBR (KBR), and no, that isn’t by mistake …

The company just became slightly unprofitable this quarter. Its rating will remain the same until the trend is confirmed, which ultimately may take a few quarters. We don’t want our ratings to ever be too volatile.

Everyone has their own personal degree of risk tolerance. But for me personally, I prefer to invest in companies that are at the very least making money … and our ratings system agrees with that sentiment.

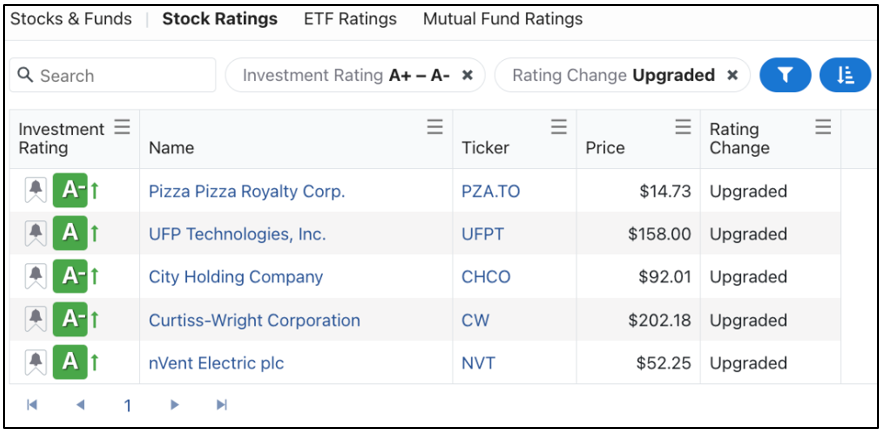

We’re getting a slew of new data daily as more and more earnings reports are released, and our stock ratings are updated daily. But currently, we have five new “A” Weiss Ratings upgrades. Let’s explore …

The “A” List Upgrades

After a few easy filters on our Weiss Stock Ratings page, I found our five recent “A”-rated stocks that have been recently upgraded. Here’s what I found:

“A” -rated companies are those that have an excellent track record for strong performance with minimal risk, and that are currently trading at a price that represents good value.

Whilst I encourage you to explore all of these names, and our entire “Buy” list of stocks for that matter, I want to take a closer look at Curtiss-Wright (CW).

A Success Story That’s Still Flying High

Do you remember the Wright brothers — those aviation pioneers that invented the airplane?

Well, this company’s origins can be traced all the way back to the Wright Company, which was founded by Orville Wright and Wilbur Wright in 1909.

After a large consolidation in 1929, Curtiss Wright was formed. Interestingly enough, during World War II, the company built 142,000 aircraft engines for the U.S. military.

Click here to see full-sized image.

The Wright brothers would probably have been happier with the success of their invention and its impact on global travel than Curtiss-Wright's “A-” Weiss rating and recent upgrade. But I must say I do like the stock and feel its “A-” is highly justified.

The stock's rating has ascended very rapidly from its spot in “C+” territory back in January, and is being heavily carried by strong recent financial data, as show on its Ratings History tab.

Some of the other things that stand out to me about the business are its aggressive growth — acquiring 15 other businesses in the past five years — and that great financial data, which our ratings have highlighted.

The company is trading reasonably at 25 times earnings, has an attractive debt-to-equity ratio of 0.5 and has a healthy return on equity of 17%.

Always be sure to do your own research. But I feel like CW is a name worthy of consideration for helping your portfolio ride through recent market turbulence.

If there’s one more piece of advice from Graham that rings truer now than perhaps ever before, it’s to always act like an investor … not a speculator.

That’s one of the major cornerstones of my All-Weather Portfolio service, which has had success in both good markets and bad. We have capitalized on whatever conditions the market has handed us, banking some nice gains of 68%, 39% and 38%, to name a few, just as Graham would have preached. If you’d like more information on the strategy, click here now.

Whatever you decide, heavily research the stocks you’re considering. And truly understand how they make money.

The Weiss Ratings are here to help you every step of the way.

Cheers!

Gavin Magor