|

| By Karen Riccio |

We all have unique timelines, goals and visions of what a comfortable retirement would look like.

And I think we can all agree that none of that includes outliving our money. However, with life expectancy around the ripe, old age of 79, staying financially fit until “death do you part” sounds easier said than done.

No one wants to spend their final years waiting at the mailbox for your next Social Security check to buy a lottery ticket.

That’s how I define retirement hell. Don’t fret, though. Today, I’m showing you the five things you should not do to help you steer clear of that dreadful place and get closer to a retirement that’s more like heaven on Earth.

1. Saving Too Little, Too Late

There are all sorts of online calculators for figuring out how much money you will need to retire and live the same quality of life as you do today.

But according to the Employee Benefit Research Institute, 67% of all American workers believe they are way behind schedule in the savings department, so I suggest you don’t waste your time plugging in a bunch of random numbers.

If you’re just starting your career, tuck away as much money as soon as you can. The amount could be as little as $50/month, even less, just so you get the needle moving in the right direction.

Let’s say you open an account with $1,000 and add $50/month for 40 years at an exceptionally low 2% rate of interest. You will have contributed $24,000 and earned $13,480 in interest for a total of $38,780.

Note: You can use Bankrate’s calculator to run your own numbers.

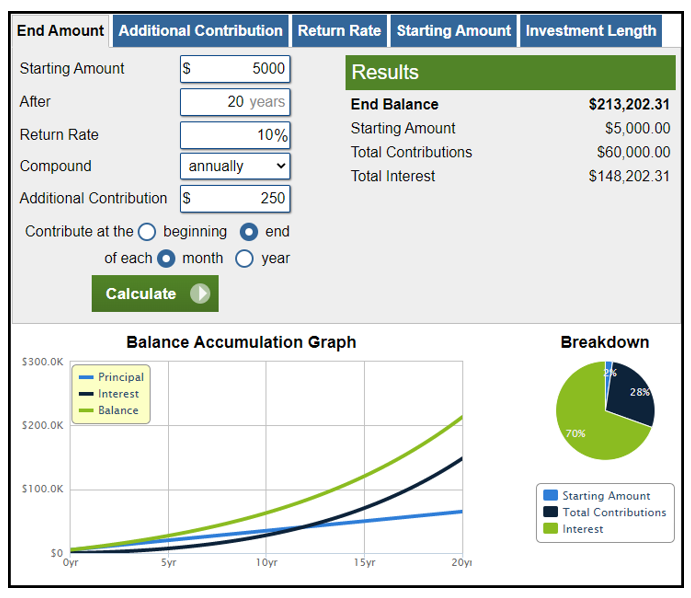

Now, the next example shows the beauty of compounded interest. It assumes you open a Roth IRA with $5,000. If you contribute $250/monthly over 20 years at a 10% compounded growth rate (the average for stock market gains for more than a century), it will be worth $213,202.31. That’s with just $60,000 in contributions.

Check out calculator.net here.

Click here to see full-sized image.

By saving — and investing — as early in your life as possible, retiring in your “happy place” can be a dream come true.

2. Spending Too Much, Too Late

Today, the average age of first marriage in the U.S. is 30 for women and 32 for men, compared to 20 and 22 in 1960. This means that most couples are much older when they start families and buy homes, minivans and everything else associated with having children.

So late, in fact, that a poll conducted by CESI Debt Solutions found that 56% of American retirees still owed outstanding debts on some of their biggest purchases when they retired.

We reach our peak spending age at 46, just about the same time we should be saving as much as possible. And, if you find yourself in a position where you can either pay for your child’s college tuition or fund your retirement — but not both — now is the time to be selfish. You can’t take out retirement loans.

3. Borrowing from Your 401(k)

Let’s say you aren’t in the majority. You are saving and spending wisely, having tucked away a tidy sum in your 401(k) with quite a few years left until retirement.

You’re quite enamored with the balance and decide it wouldn’t hurt to borrow against it to buy a few goodies, take that dream vacation or put a down payment on a home.

Well, you might want to think twice …

Granted, when you borrow from a 401(k), you pay yourself back with interest over a set period of time, but it’s with after-tax dollars. Plus, many companies won’t allow you to contribute to the plan until the loan is paid off, and you lose out on possible compounded growth on your investments.

Of course, this is much better than simply withdrawing money before age 59.5. Do that and you can expect a big, fat tax bill from the IRS the following year.

4. Taking On Too Much Risk

It’s one thing to be young and in your prime earning years, wanting to dabble in the stock market. So, you invest in long-shot stocks because of their potential.

No harm, no foul as long as you can afford to lose that amount you invest. However, if you are 10-12 years from retirement, risk is something you need to keep on a pretty short leash.

And you definitely don’t want to lose money only to look for ways to make up for lost principle and time. That’s the perfect strategy if you want to work the rest of your life!

5. Relying On Social Security

Another way to ensure that you’ll never retire is to think Social Security benefits will cover your living expenses.

Approximately 70 million Americans collect some Social Security benefits today. And although it may be hard to believe, one-third of seniors rely on Social Security for 90% or more of their income, according to the National Academy of Social Insurance.

By 2035, that number of recipients could soar to 91 million. With a potential $124 trillion shortfall over the next 75 years, we may very well live to see its demise.

Bottom line: We can’t even be sure Social Security will be around in 20 years, much less rely on it for our retirement survival. You are the only one you should rely on.

So, by avoiding the above steps and ensuring that you’re making smart saving decisions, you’ll be well on your way to retirement paradise.

And kudos for already making one of the best decisions, which is joining Weiss Ratings. Consider yourself a few steps ahead of the game.

Until next time,

Karen

P.S. With my colleague Chris Coney’s strategy for going after capital appreciation and yields, you can receive 18% or more when you want to add income to your portfolio. We’ve recorded a special video explaining how. But today is the last day you can access it. Click here now to learn more.