|

| By Gavin Magor |

Here’s a whopping percentage for you … 33,611.18%.

That’s how much you’d be up if you invested in one share of Apple (AAPL) stock back on Sept. 27, 2004 when Weiss Ratings first gave it a “Buy” rating, assuming you re-invested your dividends.

Thinking back to that time, I remember being gifted my first iPod — remember those?!

Prior to that gift, I loved my Walkman CD player, but there's no question my new iPod was a superior upgrade, especially with it being smaller in size and less of a nuisance for my workouts, and the fact that I could download songs on the internet and upload them. At the time, that feat seemed like magic.

After growing up and having to head to the store to buy 8-tracks, cassettes and records, it felt like the entire music industry was now in the palm of my hands.

Fast forward to today, and iPods now seem like ancient history with the staggering growth of iPhones, which have wiped out the iPod market over the past decade or so.

Click here to see full-sized image.

Sure, the iPod was a lovely gift, and a very useful one, but if I’d been given Apple shares at the time at the same dollar amount … I could practically almost buy a record label!

This was nearly 20 years ago, and to think how such a popular item like the iPod has become so obsolete gives me hope for the technological advancements 20 years from now.

No one has a crystal ball, and I am still extremely grateful for that wonderful gift, but I point this out because it goes to show the value of the Weiss Stock Ratings.

Should you expect a return of that magnitude with every “Buy” upgrade? Certainly not, especially considering that Apple is in an upper echelon of its own, but I can passionately say that when a stock gets upgraded to “Buy,” I think it’s worthy of your attention.

And as a reminder, the Weiss Ratings are free and 100% unbiased.

On that note ...

New Week, New Upgrades

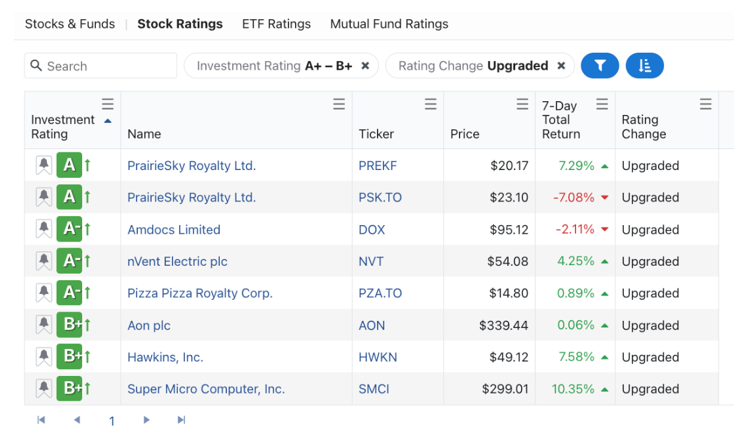

On the Weiss Ratings site, I filtered for Investment Ratings of “A+” to “B+” with a recent ratings change of “Upgraded.” This can easily be done using the filter features directly to the right of the search bar under “Stocks & Funds.”

Click here to see full-sized image.

You may recognize some of these names. I certainly do, as my All-Weather Portfolio Members have been able to grab 68% gains on Super Micro Computer (SMCI) this year. The San Jose, California-based tech company has been powering profits the entire year, up 550% over the last 12 months alone.

Take a look …

Click here to see full-sized image.

Amdocs (DOX), rated “A-”, has been in the “Buy” range in our system for around a year-and-a-half now, and I also have been doing more in-depth research on that strong name in tech.

These are just a few names and some of our most recent upgrades, but be sure to explore our entire Weiss Ratings site.

It’s not just stocks we rate, but we also diligently cover insurance companies, cryptocurrencies, mutual funds, ETFs and credit unions, free for your convenience.

Whatever sector, size, industry, rating, etc. you’re looking for, I’m nearly certain our filter features can make it possible, not to mention convenient.

I can’t say I have any idea where that old iPod ended up, but it now brings back some fond memories, and perhaps a decent investment story, as well.

Cheers!

Gavin Magor