|

| By Sean Brodrick |

Democrats and Republicans are negotiating over raising the federal debt ceiling, trying to avoid default.

And that default could happen as soon as June 1, according to Treasury Secretary Janet Yellen. Unfortunately, the two sides seem further apart now than when they started.

This is not like previous debt ceiling face-offs because there is a group in Congress with outsized power — a “chaos caucus” that’s happy to see the U.S. go into default because it suits their political ends.

I see that reaction from some Weiss Members, as well: “Let the U.S. default, then we’ll pick up the pieces.” Let me show you why that would be a bad idea. A lot of these risks are generally accepted if a U.S. debt default occurs.

So, here are …

7 Ways Default

Could Hurt You

1. U.S. Treasurys will get downgraded. And since Treasurys are generally regarded as risk-free, this warps the risk curve for everything benchmarked against them. This includes corporate bonds.

2. The Treasury downgrade means interest rates will rise for the government, worsening America’s debt problems. The last time the U.S. skated on the edge of default, it increased government borrowing costs by more than $1 billion. This was back in 2011. To be sure, after the initial downgrade and sell-off, U.S. Treasurys went on to rally. There are no guarantees of any predicted outcome.

3. A U.S. debt downgrade also means tighter/more expensive credit for consumers and businesses. Even the highest-rated U.S. corporate bonds are likely to be affected because companies aren’t rated more highly than the sovereign debt of their home country (because the country can always tax the company).

4. If America isn’t willing to cover its debts, there could be a crisis of confidence in the U.S. dollar. Global investors may also sell dollar-denominated assets.

5. That would worsen a U.S. stock sell-off that would probably already be going on. Nearly all assets look riskier, and investors seek safe harbors (like gold).

6. Companies that hold Treasurys can suffer hits to both revenue and balance sheets. This is what’s behind the recent wave of bank failures. It doesn’t have to end at banks. If a company depends on interest payments as a source of revenue, there could be a problem with cash flow.

7. Many companies also use Treasurys as collateral. Suddenly, that collateral is worth a lot less. That leads to margin calls. If it’s bad enough, it can happen on a global scale.

Those are some of the potential short-term problems caused by a federal debt default. Longer term, the U.S. might lose its long-privileged economic standing, which could, in turn, trigger a decline in America’s geopolitical influence.

So, if anyone tells you that they’re fine with a debt default because we’ll pick up the pieces afterward, keep in mind that this person is not thinking through how much it’s going to cost them — you or any of us. A U.S. debt default is not a desirable outcome.

I do think the odds of a U.S. debt default are higher than they were last time we had this hullaballoo. While I think it will be solved eventually, there could be a lot of pain between now and then.

Personally, I’m taking some cash out of the bank ahead of June 1 and putting it in my safe. Because a freeze-up of the financial system is one of the worst-case scenarios. I already have gold and silver bars and coins in case things get really bad.

Buy Some Shiny Insurance

Investors should consider something that’s historically a safe haven in a financial crisis: gold.

If you’d like to know which gold-leveraged companies I particularly like in this environment, click here.

Members of my service, Resource Trader, are well positioned for a potential run-up in the price of the precious metal.

Gold could be very volatile, and it will probably sell off once a deal is reached. But pullbacks could be limited, as there are other powerful and cyclical forces pushing it higher.

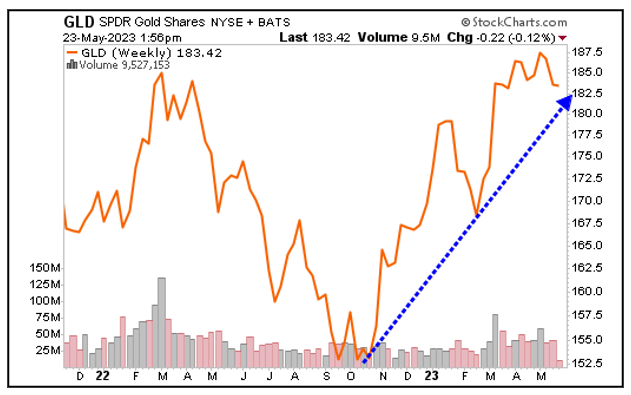

An easy way to buy gold is through the SPDR Gold Shares (GLD), which tracks a basket of gold. This means you don’t have to worry about storing physical gold yourself.

The GLD is comparatively cheap, with an expense ratio that sits at 0.4%, well below the category average of 0.69%. And as fears of default loom, the GLD is zigzagging higher:

Click here to see full-sized image.

I expect we’ll see a deal on the debt eventually. But just how much pain is caused to the financial system and regular Americans on the way to that deal remains to be seen.

Buckle up, it’s going to be a wild ride. And gold can help cushion some of the bumps.

Best wishes,

Sean