Editor’s note: Yesterday, the big boss, Dr. Martin Weiss, revealed his new AI-powered stock system.

After a decade of backtesting and livetesting, it’s ready for the prime time.

Those tests concluded that this system — which is completely driven by the unbiased Weiss Ratings, our 7 terabytes of data and a brand-new AI — beats the S&P 500 by 94-to-1 in ANY market.

I urge you to watch him lay out how it works here.

Then come back here to discover how the gold tariff blues can turn your portfolio into a healthy shade of green.

|

| By Sean Brodrick |

It’s not often the market hands you a golden opportunity.

But that’s what you’ve got now.

Will you take it?

I’m talking about gold itself. And I have three must-see charts to prove it to you.

First, the setup …

Late last week, the White House announced 39% tariffs on imports of gold bars.

The tariffs sparked a migration of gold from Europe to the U.S., seeking to beat the tariffs.

That sent prices — which were already marching higher — soaring to a new high on Friday.

That is, until the White House changed its mind.

And gold tanked back down to support.

It won’t stay there long.

Here are three charts showing why …

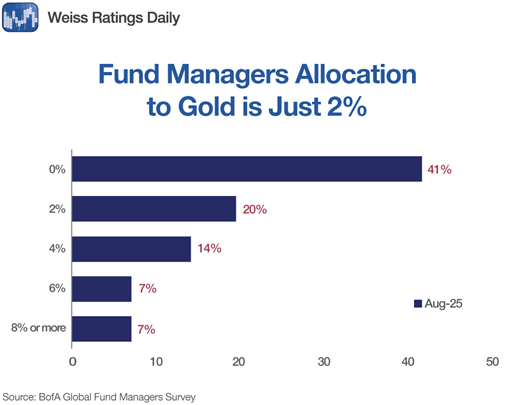

Chart No. 1: Funds Need to Buy-Buy-Buy!

Gold is enjoying strong performance and bullish market drivers.

Yet, most fund managers remain amazingly underallocated to it.

The August 2025 Bank of America survey found average portfolio exposure to gold is about 2.2%.

And a whopping 41% of fund managers have ZERO exposure to gold.

This is even though 13% of fund managers said the yellow metal would outperform over the next five years.

And this is even though I showed you a chart last week revealing that gold DOUBLED the performance of the S&P 500 over the past year.

It sure looks like a lot of fund managers are underperforming.

How do they fix that? Buy gold!

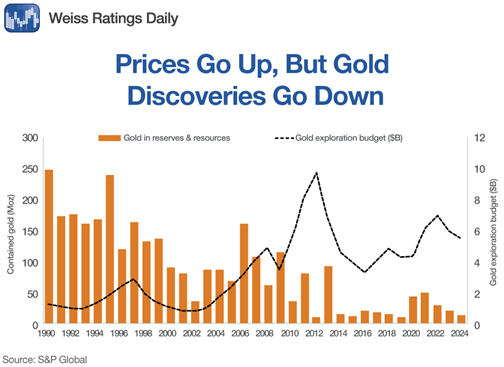

Chart No. 2: Gold Exploration Comes Up Empty-Handed

Even though gold prices broke out to new highs in 2024 — and kept going higher — gold miners have cut back on looking for gold.

Gold exploration budgets declined 7% in 2024 to $5.4 billion, despite record-high gold prices.

That’s down from $7 billion as recently as 2022 … and $10 billion in 2012.

That makes no sense, but it’s true!

You can see that in the chart below …

Exploration budgets dipped last year and are way below the peak hit in 2012.

Meanwhile, new 100,000+ gold discoveries are becoming as scarce as hen’s teeth.

Since gold isn’t a renewable resource, total gold resources are headed down!

Market analysts say this lack of exploration spending reflects a combination of tighter financing, industry risk aversion, elevated costs and strategic shifts favoring safer investments.

Let me translate that for you: The bean counters don’t think it’s worth their while to throw more money at gold exploration … yet.

I can’t say I really blame them.

The last 10-year track record of success in gold exploration is TERRIBLE.

However, I believe the bean counters will change their views as gold prices go higher.

Their alternative is to use the Scrooge McDuck levels of cash flow they’re generating to buy up small gold companies that have found worthy deposits.

That will probably happen, too.

In any case, what happens when you have high demand for something …

And at the same time, you have dwindling demand?

That is resolved by higher prices.

In gold’s case, much higher prices.

Chart No. 3: A Predictable Pattern of Profit

I listen to cycles, and there’s a very predictable pattern of gold rallies and consolidations over the past few years.

We get three to five months of consolidation, followed by a breakout.

Here’s a chart of that …

If the past is any guide at all, we’re near the end of the recent consolidation.

That means a breakout is coming. And it could be BIG!

How big?

My intermediate-term target for gold is $4,100 an ounce.

In the longer term, I continue to target prices above $6,000 an ounce during this bull run.

That’s roughly a 20% up-move from $4,100 to $6,000.

A 20% move higher in the SPDR Gold Shares (GLD), which aims to track gold bullion prices, should be richly rewarding.

But I expect gold miners, as tracked by the VanEck Gold Miners ETF (GDX), to make an even bigger move!

That’s because miners are leveraged to the underlying metal.

As gold goes higher, and their mining costs remain relatively flat, their profit margins widen like the Grand Canyon.

Man, is this going to be a great ride. I hope you’re onboard for what could be a generational wealth-building event.

And now, the gold market’s zigs and zags are handing you a chance to get in on the cheap.

Seize that chance!

If you want my absolute favorite gold (and silver) miners to play this next leg up, check this out.

All the best,

Sean