|

| By Sean Brodrick |

We’ve just had the hottest June ever, followed by the hottest July ever. The outlook for August is so hot it threatens to bake much of the nation somewhere between extra crispy and atomic-buffalo wing.

The temperature of the water off the coast where I live recently got to 101°F. Heck, maybe soon we’ll catch poached fish! The heat index for the air in Miami is awful — it hit 106°F, as I write this.

I guess I shouldn’t complain about South Florida. You’ve probably heard about Arizona being so hot — its AVERAGE temperature this July was 102.7°F — that when people fall in a parking lot, doctors have to treat them for burns. The asphalt is that scorching.

A whopping 84 million Americans are experiencing triple-digit temperatures.

The heat isn’t just melting the South. In Chicago, it’s been so hot for so long that the foundations of buildings are shifting as the heated-up Earth expands.

Well, I can’t do anything about the heat. But I know a company that is going to make a lot of money keeping America — and the world — cooler. And it’s a great summer pick for your portfolio.

What’s more, this company is going to be the recipient of tax breaks and incentives in a bunch of spending programs already passed through Congress.

I’m talking about …

- The $740 billion Inflation Reduction Act, which targeted green energy and climate spending.

- The Infrastructure Investment and Jobs Act, which is pumping $1.2 trillion into the economy. It’s mainly focused on transportation, but it also targets energy efficiency, among other things.

- Even the $280 billion CHIPS and Science Act, which encourages new factories in America, could be a boost for this company. All those new factories — and U.S. factory construction has doubled recently — will need climate control after all.

Now, I already added this sizzling summer pick to the Resource Trader Portfolio, and my members are racking up open gains. Today, as a summer treat, I thought I might give you a taste of what my premium members get.

Cooling This Out-of-Control Summer the Right Way

The stock I’m talking about is Carrier Global (CARR). Carrier is a $47.8 billion company, spun off from United Technologies back in 2020. And it’s one of America’s premier makers of air conditioning.

Heating, ventilating and air conditioning is one of Carrier’s three segments. The other two are Refrigeration and Fire & Security.

Carrier reported earnings last week, and results were very good.

Earnings of 79 cents a share beat estimates by 2 cents. Revenue rose 15% year over year to $5.99 billion, also beating estimates. And order backlogs are up 30%.

The company also raised its forecast for full-year earnings to a range of $2.55 to $2.65 per share, from $2.50 to $2.60 previously.

In its earnings announcement, Carrier pointed out that around 50% of its HVAC and Transport Refrigeration sales are related to clean technology.

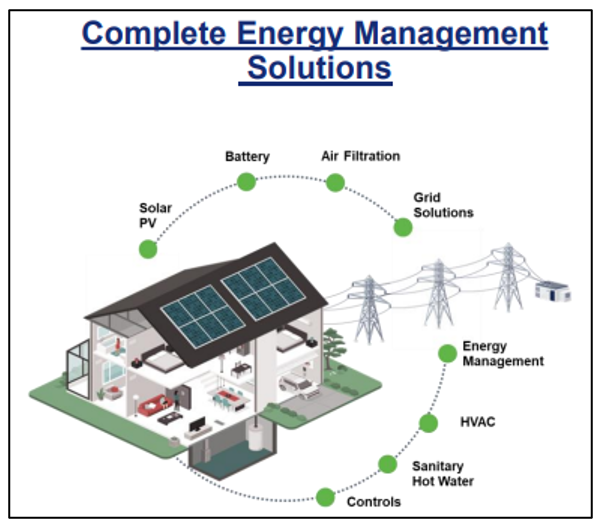

Indeed, Carrier is part of all sorts of green energy and environmental solutions.

This slide is from the company’s presentation …

I believe that will boost Carrier’s earnings going forward more than the market is pricing in.

And then there are all those government spending programs I mentioned.

For example, the Inflation Reduction Act extends and expands tax credits for energy-efficient home improvements including heat pumps, central air conditioning systems and furnaces. These tax credits run through 2032.

The Infrastructure Act is investing billions in energy efficiency. And spending on new factories more than doubled in the past year. That means a lot more demand for industrial strength air conditioning and climate control.

Carrier isn’t stopping at America’s shores, either …

It recently acquired German-based Viessmann Climate Solutions. This gives it exposure to Europe’s push for home climate efficiency. It also has exposure to the Asia Pacific region through Toshiba Carrier, which it wholly acquired in 2022.

Selling Off Parts

Carrier is going to sell its Kidde-Fenwal industrial fire suppression and detection business. Carrier inherited a lot of Kidde-Fenwal shares as part of its spin-off from United Technologies.

Kidde-Fenwal is doing well in sales, but it has legal liability due to a fire suppressant foam it manufactured. Carrier doesn’t want that headache, so it’s selling out.

It also plans to sell most of its commercial refrigeration business, but not its trucking refrigeration. That should happen next year, and investors can look forward to that revenue boost.

Carrier sports a decent dividend yield, recently at 1.37%. That payout is projected to grow 13.47% per year for the next three years.

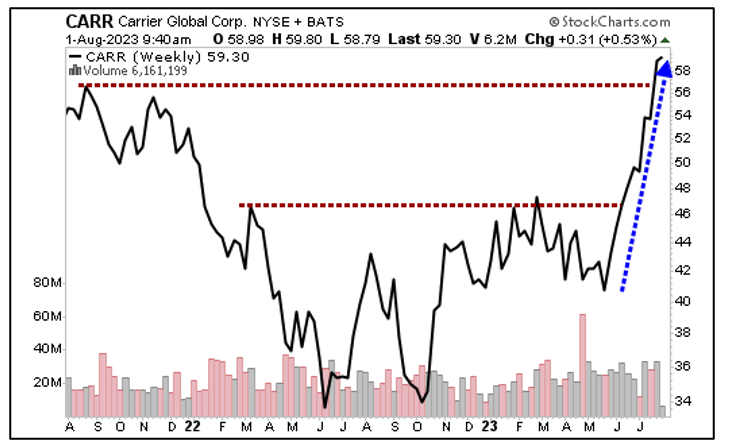

Let’s look at the weekly chart of Carrier …

Click here to see full-sized image.

You can see that Carrier is pushing through one level of overhead resistance after another.

As I said, we already own this one in Resource Trader. Out of respect for those readers, I can’t give you specifics on this trade here.

However, for my exact Carrier recommendations, complete with price, targets, time frame and projections, you can join them by clicking here.

All the best,

Sean