Editor’s Note: With the recent news surrounding the firing of OpenAI CEO Sam Altman — and his assent to join Microsoft’s team directly — Jon Markman’s recent Disruptors & Dominators story about Microsoft’s (MSFT) AI gameplan is timelier than ever …

|

| By Jon Markman |

Heavy words like “disruption” are so easily thrown around by investors. However, true disruption is tough, especially in this era of digital transformation.

This statement might seem odd. Moving from the physicality of the analog world was supposed to supercharge innovation by leveling the playing field for smaller, nimbler businesses.

This has not been true, and this is a big opportunity for patient investors.

Clayton Christensen is a professor at Harvard Business School. In his disruptive strategy course at the Ivy League institution, Christensen teaches that there are only three truly disruptive business models.

The Sustaining Innovation model occurs when a company upsells innovative higher-margin products to its best customers.

In the Low-End Disruption model, a company innovates to drive down cost, forcing legacy competitors to retreat upmarket to make higher profit margins.

The New-Market Disruption model takes its name from companies that create and dominate a brand-new market, then slowly make competitors obsolete by eating away at the larger market.

There are many current examples of these models playing out. What is different from past investment cycles is that the innovators are much larger businesses … and for good reason. Computing is changing for the first time since the 1960s, when International Business Machines (IBM) mainframe computers began appearing on-site at large corporations.

Biggest Disruption Since IBM Mainframes

Artificial intelligence is moving the industry from data retrieval to a generative, answers-based model. The 10 blue links of the internet era is succumbing to ChatGPT-like interfaces. AI digital assistants generate solutions based on natural language queries and prompts. It is an exciting time that will only improve as models get better and more powerful computers arrive.

More importantly, it is relatively easy to identify the logical winners. Developing these models is cost-prohibitive for the tiny garage setups of the past.

Executives at Microsoft announced in October that sales during Q3 swelled to $56.5 billion, an increase of 12.8% year over year. The sheer size of these numbers and the growth rate is awe-inspiring. However, the real kicker is the catalyst for the gains.

Corporations are exhibiting generational interest in AI solutions, and chief investment officers are opening their wallets to the benefit of Azure, the cloud computing unit at Microsoft. The importance of this development cannot be overstated.

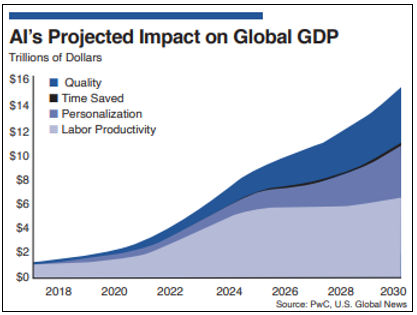

Analysts at McKinsey and Co. estimated in July that AI could become a $15 trillion opportunity.

At the time, the consensus within the larger investment community was that the predictions should be taken with a healthy dose of salt.

That was then …

Microsoft leadership announced in January that the Redmond, Washington-based software firm would invest up to $10 billion in OpenAI, the parent company of ChatGPT.

Within two months, the software DNA of ChatGPT was being infused throughout Microsoft productivity software tools and dispatched to corporate customers in a test program called CoPilot.

CoPilot Model Shocks Investors

The Microsoft 365 productivity suite is a subscription-based suite that includes Word, Excel, PowerPoint, Outlook, Teams and OneDrive, as well as many networking tools. In the post-Windows world, 365 has become the core of Microsoft, responsible in 2022 for $44.9 billion in sales, fully 23% of total revenues.

Redmond executives said in January that integrating generative AI would add value to the 365 experience. Then something remarkable happened.

Subscriptions to 365 are based on the number of licences sold to a corporate customer. These licenses, also called seats, can range from as little as $5 per month all the way up to $35. PC Magazine reported in October that Amazon.com (AMZN) is in the process of licensing 1 million seats … and could pay Microsoft up to $1 billion over a four-and-a-half-year period starting in 2024.

Earlier in the month, a Microsoft press release stated that based on the strength of CoPilot testing at large corporate customers, new subscriptions would be priced at $35 per seat. Investment analysts were shocked.

This business model is going to read familiar.

It is what Christensen called sustaining innovation, whereby an innovator upsells new, higher-margin products to its best customers. This is possible because those patrons are heavily vested in the existing platform. They expect the new products to dramatically enhance it.

The 365 office productivity suite is deployed in 80% of the corporate world. Word, Excel and PowerPoint documents have become the standard of exchange. CoPilot, according to pricing and the test group, is a huge upgrade worthy of a significant premium to existing subscriptions.

The Microsoft implementation of AI is important because it shows that this next wave of disruption is not going to look like past iterations.

Microsoft is leading the way on this. Investing in OpenAI, while also building out its core products to incorporate its technology, shows what the future of disruption will look like.

All the best,

Jon D. Markman

P.S. There’s another area of investment besides AI that can truly be labeled as disruptive. In fact, Weiss Founder Dr. Martin Weiss is hosting an urgent conference about it today at 2 p.m. As a loyal member, it is free for you to attend. The only thing you have to do is click here to reserve your seat.