A Little-Known Tax Shelter for Crypto, Gold & Real Estate

|

| By Nilus Mattive |

I regularly preach the idea of building a portfolio with true diversification, meaning one that goes beyond just stocks and bonds.

And I also regularly preach the idea of using every legal means to reduce your tax burden, both now and in the future.

So, it’s no surprise that a few readers have recently been asking if there’s any way to do both at the same time.

My answer? Yes, by using a special type of account mostly favored by the ultra-wealthy.

It’s called a self-directed IRA (SDIRA).

And if you’re interested in getting tax-free gains from things like real estate, gold bullion and crypto, you should seriously consider opening one.

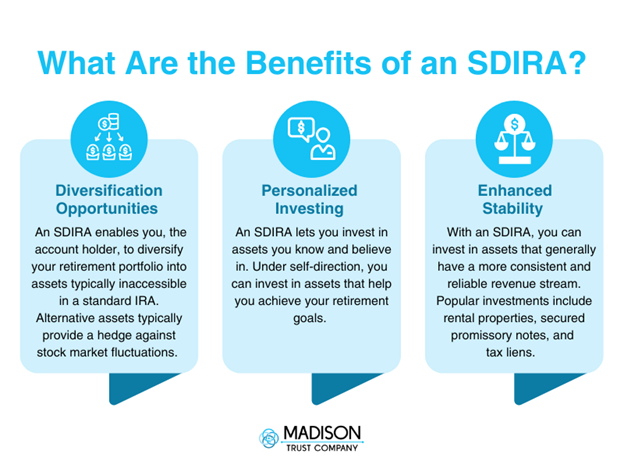

SDIRAs take everything you know and love about regular IRAs — both traditional and Roth versions — but allow you to go beyond the plain vanilla choices offered by typical Wall Street firms.

That’s because SDIRAs are not held at traditional brokerage houses.

Instead, they are administered by other IRS-approved institutions.

Why No One Talks About SDIRAs

Only 5% of all the money invested in IRAs is currently held in SDIRAs.

And based on the numbers I’ve seen, less than 1% of all the IRA accounts in the U.S. are Roth SDIRAs … probably because so few people even know they exist.

Wall Street certainly has zero incentive to tell you about them.

After all, they make plenty of money in commissions and fees shoveling the same old assets down everyone’s throats.

The IRS doesn’t exactly advertise these accounts, either.

In fact, a 2020 study done by the U.S. Government Accountability Office, or GAO, recommended that the IRS provide better information to investors about them!

Yet wealthy investors love SDIRAs.

Why?

Because as one GAO study put it:

“We found that taxpayers with IRA values greater than $5 million had likely accumulated these larger IRA balances by investing in unconventional assets unavailable to most investors.”

That’s exactly what SDIRAs are designed for.

They allow you to invest in property … things like real estate, physical gold (including certain bullion coins like American Gold Eagles) and even livestock.

Cryptos like Bitcoin, which are currently considered property by the IRS, are also fair game for SDIRAs.

Important Disclaimer

Broadly speaking, the only prohibited investments are collectibles, life insurance and stock in subchapter S-corporations.

Just realize that there are also some very strict rules for SDIRAs.

One common pitfall, for example, is engaging in what the IRS calls a “self-dealing” transaction — like buying an apartment inside an SDIRA and renting it out to your children.

Break a rule like that, and you could end up having to immediately remove the asset from the SDIRA, triggering a massive tax bill for the year when the transgression first took place.

There could be other tax implications to consider as well.

For example, you can’t use losses incurred in an SDIRA to offset gains that happen elsewhere.

That means you might lose some of the tax advantages of putting certain real estate inside the account.

It’s wise to consult with an attorney or tax expert before you proceed.

Speaking of which … all SDIRAs need to be administered by an approved company willing to handle the paperwork on your behalf.

How to Find the Right SDIRA Provider

Finding the right SDIRA provider is a personal decision and will depend on what features are most important to you.

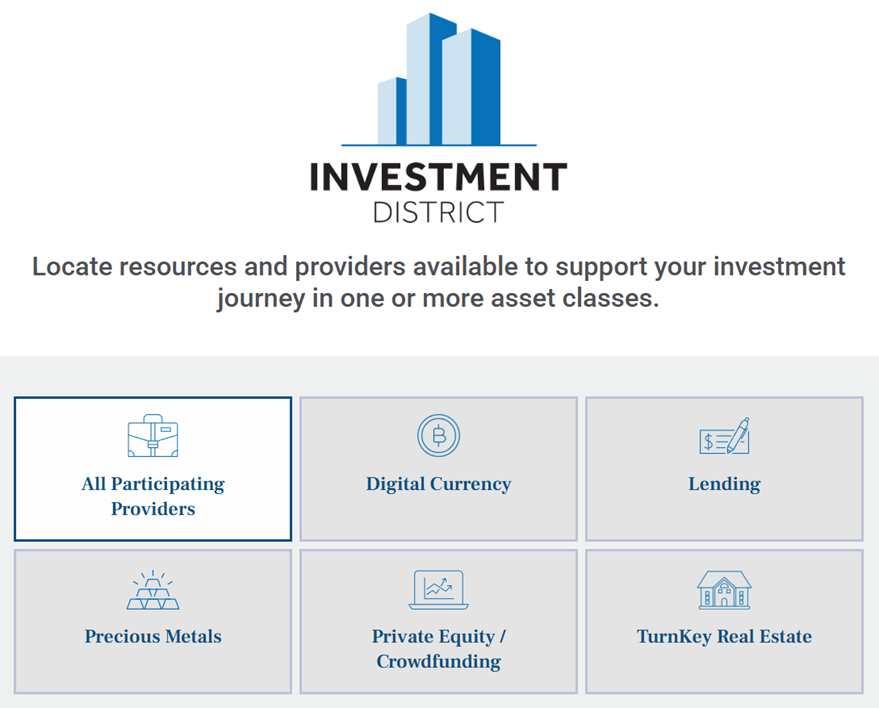

For example, Equity Trust is one of the largest and oldest firms in the SDIRA space, and it’s widely considered a solid all-around choice.

The company has been in business since 1974 and has more than 400,000 customer accounts worth roughly $70 billion in total assets.

While its fees are relatively high, Equity Trust has hundreds of customer service representatives available to help walk people through all the ins and outs of their SDIRAs.

The company also allows you to invest in a wide range of assets — everything from physical real estate to crypto.

It also recently launched an account called the Equity Universal IRA that allows investors to hold both traditional and alternative assets under one umbrella.

Of course, someone especially interested in crypto might also look at a firm like Alto IRA.

The company’s Crypto IRA offers the ability to invest in more than 250 different cryptos and is directly integrated with Coinbase (COIN).

Alto can also handle certain private equity investments. While you can’t transfer any private equity you already own into an Alto account, you can buy PE through it.

Equity Trust and Alto are third-party custodians, which means they handle both the account setup, as well as the buying, selling and storage of assets.

This is similar to the way a regular brokerage account works and is great for a lot of investors who don’t want to get too deep in the weeds or risk making a costly mistake doing things on their own.

However, there are also SDIRA accounts that give their owners even more flexibility through…

“Checkbook Control”

The basic idea is that you can do all the buying and selling of your assets directly through your own bank account.

Broad Financial is one of the better-known companies that provides this type of SDIRA.

Basically, Broad Financial handles the paperwork and helps set up the legal structure of your account, and then you do everything else yourself.

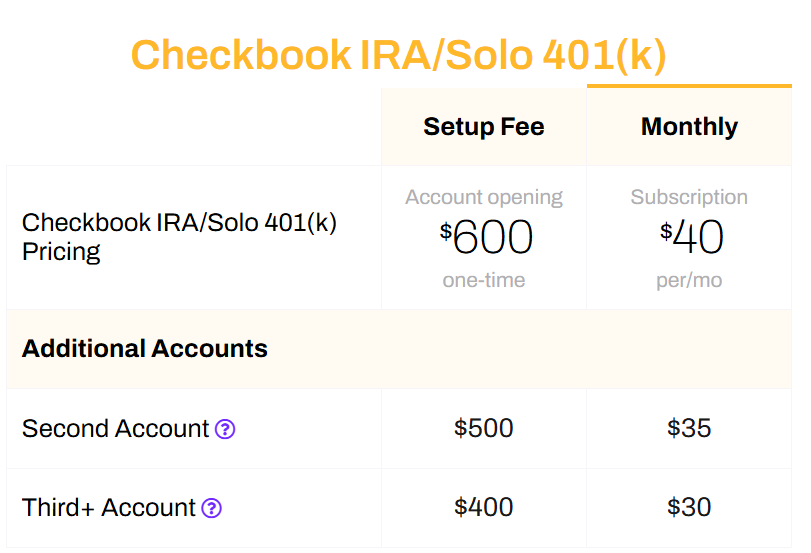

Because the process involves setting up an LLC, the upfront fees are a bit more substantial, including a setup charge that might run as much as $1,500 and then an ongoing annual maintenance fee of $200.

A second, newer option that offers checkbook control SDIRAs is Rocket Dollar.

The company charges $600 to set up that type of account and then a monthly maintenance fee of $40.

Other firms to investigate include Bitcoin IRA and iTrust Capital.

Again, this is just a starting point for you to do further research — which particular company you choose and which type of SDIRA you want will depend on many factors, including your comfort level with doing things on your own.

But if you’re looking to go beyond stocks, bonds and funds, SDIRAs are definitely worth considering.

They’re popular with extremely wealthy investors but available to anyone willing to do a little legwork!

Best wishes,

Nilus Mattive

P.S. You’ll want this kind of flexibility and freedom now more than ever.

Dr. Martin Weiss just issued this warning from his farm in Brazil: “Welcome to the Age of Chaos.”

But don’t worry. He and I came up with six easy steps you can take to protect yourself from this new age.