|

| By Sean Brodrick |

Goldman Sachs just lowered its forecast for oil prices wa-a-a-ay down. Goldman now thinks the U.S. oil benchmark, West Texas Intermediate crude, recently trading at $61, will be priced at $58 by December and $51 by Dec. 2026.

Major international agencies are lining up to follow suit.

If you’re an investor holding oil stocks, it’s a scary time. Let me tell you how to turn that fear into profit. And I’ll do it in three charts.

Remember, OPEC+ — the oil-producing nations led by Saudi Arabia and Russia — were already adding new oil production that weighed on prices.

This year, OPEC+ should add 400,000 barrels per day of production, and the International Energy Agency forecasts a surplus of 600,000 barrels per day.

Now, a 1-2 combo of sky-high tariffs and Elon Musk’s DOGE cuts to vital government services is weighing on global and U.S. growth forecasts.

Goldman Sachs raised its forecast for a U.S. recession for the second time in a week, putting the odds at 45%. Other big banks and institutions are also raising estimates. A recession generally equals lower oil prices.

If anything, these banks and institutions are too conservative. According to a survey of CEOs, 69% expect a recession this year.

Recession and tariff fears sent oil prices sliding down 24% from a high of $80.04 on Jan. 16, to a recent price just above $61.

At the same time, oil stocks plummeted. So, you can understand why investors are disgusted.

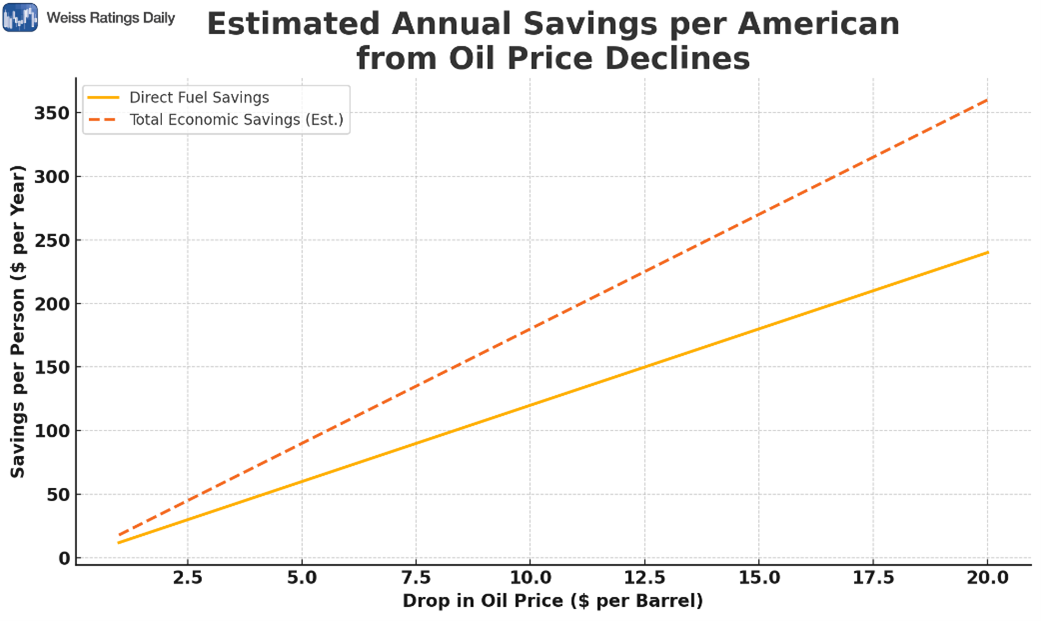

Now for the upside: Every $1 drop in the price of a barrel of oil saves U.S. consumers roughly $1.5 billion over a year. If oil prices stay around $60, that turns into annual collective savings of $9 billion.

This has a knock-on effect, because as fuel costs drop, some companies can lower prices for their customers or increase profits.

5 Industry Winners from Lower Oil Prices

Likely winners from low oil prices include:

- Trucking and freight, thanks to lower diesel prices.

- Chemicals and manufacturing, because oil is a feedstock for plastics, fertilizers and more.

- Cruise lines, because cruise ships are fuel-guzzlers.

- Airlines, because jet fuel is one of their largest operating costs.

- Retail, because lower gas prices give consumers more disposable income.

To be sure, any fuel savings are balanced against lower revenue due to a recession and higher tariffs. But it shows things may not be as bad as some investors fear.

The Best Cure for Low Oil Prices

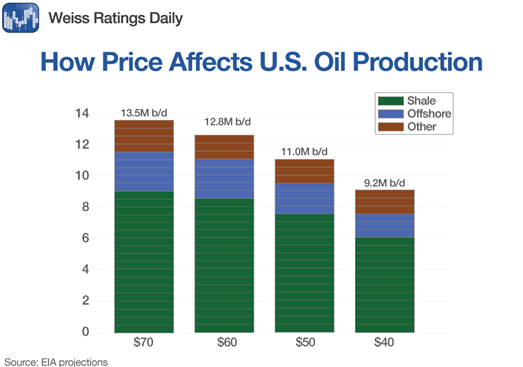

There’s an old saying: “The best cure for low oil prices is low oil prices.” Look at this chart …

The U.S. hit a new oil production record last year. With prices falling, it’s likely we won’t see that record broken any time soon.

A drop from $70 to $60 a barrel removes 700,000 barrels per day of forecast production.

A drop to $50 — which is where Goldman says we’re headed — eliminates a total of 1.5 million barrels per day.

And yes, some experts are saying we’ll see $40 oil. That’s when we see oil production shut down at fields across the country.

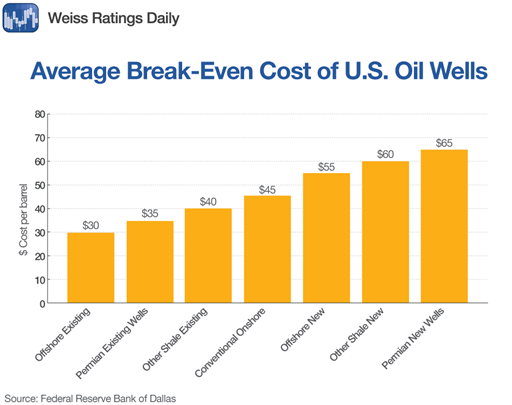

However, not all oil fields are created equal. Some have much higher lifting costs than others. Here’s a chart of where we’ll likely see cuts first.

At $60 oil, no one is going to drill new wells in the Permian basin, or in shale fields generally. At $55, drilling offshore will stop. And on and on.

This chart might make investors nervous, but it’s not that bad. If my readers have taken my advice, they are holding oil producers that are PROFITABLE at $30 a barrel or lower.

Sure, maybe not the big profits you see at $80 oil. But enough to keep paying those fat dividends, which are the kind of oil stocks I like to buy. So, we’re paid to wait.

The better oil producers have cash on hand to buy the companies that go bust during the price bottom. They come out of the recession even stronger!

Every recession ends, and oil producers often see their share prices gush higher ahead of time. So, keep your eyes on that industry.

As an oil investor, would I prefer higher prices? Sure. But I know low oil profits offer plenty of profit potential for me as a consumer and as an investor in other things.

As an American, I would much prefer we DON’T have a recession. But if we’re going to go through hard times, I want to make the best of it. I’m now focused on companies that should see their profits go up as oil prices go down.

You can look for those companies, too. Start with the five industries I listed above, roll up your sleeves and start crunching numbers.

These are scary times. But hard times are followed by better times. And lower oil prices can put the pedal to the metal on profit potential.

All the best,

Sean

P.S. Dividends aren’t the only way to collect income from oil producers … or even the companies that profit more from lower oil.

My colleague’s recent interview about his “60-Second Income” strategy will soon be taken down.

And I’ve seen how he’s helped members collect double-digit yields from oil producers in the past.