|

| By Sean Brodrick |

Gold is heading above $3,000 an ounce in the first half of 2025.

That's more than 20% higher than its current price just under $2,500.

Today, I’ll tell you what you should buy to make the most of it.

First, I must mention I’ve been on the bullish gold train for a while. If you bought your own gold train ticket on Jan. 31, when I suggested you buy the SPDR Gold Shares ETF (GLD), you’d be up about 20.9%.

That’s more than TWICE the performance of the S&P 500 over the same time period.

So, what I’m saying is that, if you missed the previous stop, you can still hop on board. And if you’re already buckled in, sit tight for the rest of the ride.

Now, I enjoy bragging about an opportunity where our readers made money. But I was wrong about one thing. But I was in good company with most of the financial press.

Many of us thought the Federal Open Market Committee would start cutting interest rates sooner than later. Those rate cuts were pushed off as the Fed hemmed and hawed about inflation.

We’ll learn more today when the Consumer Price Index comes out. But if yesterday’s Producer Price Index was any indication, inflation is fading fast.

In fact, July’s PPI came in LOWER than expected. It rose just 0.1% versus an expectation of a 0.2% rise.

That translates into a year-over-year rise of 2.2%, also lower than expectations.

This happened despite energy contributing slightly more than 0.1 percentage point. That’s the most since February. Without energy costs, the headline PPI would have been flat to negative.

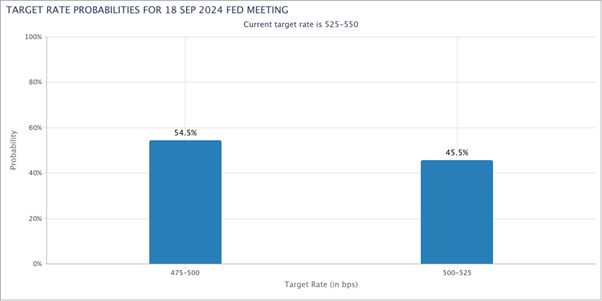

A rate cut is likely on the way. How likely? The market is now pricing in the odds at around 98% in September.

Moreover, markets are now expecting three rate cuts in 2024, taking the Fed Funds rate down to between 4.5% to 4.75%.

Traders expect four more cuts in 2025, taking the Fed Funds rate to 3.5% to 3.75%.

Sure, the market has been wrong before. But inflation has tamed as quickly as a toothless lion.

The Fed is behind the curve, and any more foot-dragging will make it look ridiculous.

Why This Matters

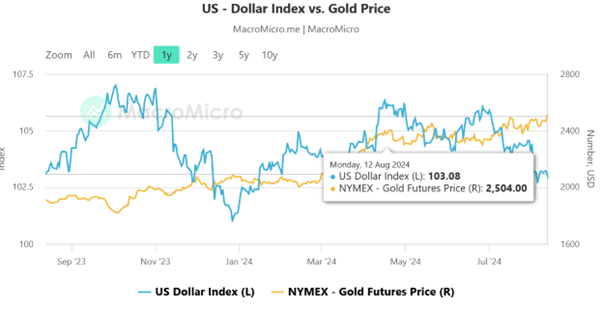

Expectations of rate cuts weigh on the value of the U.S. dollar against other currencies.

The U.S. Dollar Index was recently down nearly 3% from its June highs and looks to go lower.

Because gold is priced in dollars, the yellow metal tends to go higher as the greenback goes lower.

And that’s not all driving gold higher.

I have a long list of gold drivers, along with my hottest picks, in a report I’m sending to my Wealth Megatrends subscribers on Friday. You can claim your copy at the same time they do. First, click here and follow the simple instructions.

But here are a couple more …

Central Banks Are Buying Gold

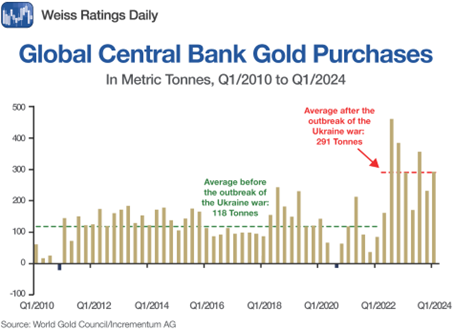

A recent survey of 70 central banks by the World Gold Council revealed the highest level of expected central bank gold buying since the analysis of their gold exposure started six years ago.

And heck, they’re already buying hand over fist.

As you can see, central bank gold purchases really picked up after Russia invaded Ukraine. That’s because gold is seen as the ultimate safe haven during times of geopolitical trouble.

The worries don’t stop with Ukraine. The Middle East is a powder keg. And tensions are ratcheting up between the U.S. and China.

It’s all part of that War Cycle I’ve told you about before. And it tells me that safe-haven demand will continue to support gold prices.

ETF Gold Purchases Soar

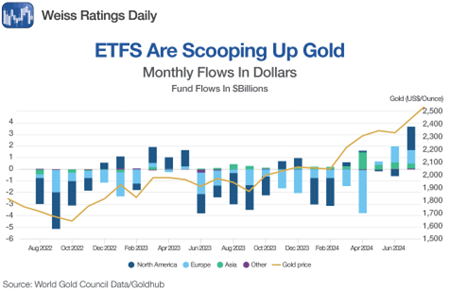

In its latest Gold ETF Flows report for July, analysts at the World Gold Council reported that global gold-backed ETFs added $3.7 billion in bullion investment during the month.

“Notably, all regions reported positive flows this month, with Western gold ETFs contributing the most,” the WGC wrote in its report.

ETFs weigh on gold prices on the way down and boost them on the way up.

If gold prices pick up the way I think they will, then we’ll see even more ETF buying. Which should boost the price of gold even more.

So, where could gold go?

Target: $3,000 an Ounce!

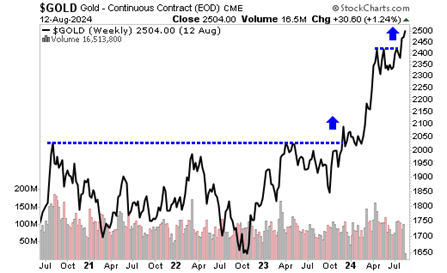

Look at this weekly chart of gold. I’ve made a five-year chart so you can see what really happens when gold breaks out.

Look at that blast-off. Fast forward to today, and after a brief consolidation, gold looks ready to rocket again.

Gold issued a new “buy” signal last week.

My cycles work tells me that gold is headed to $2,931.

Decades of trading these markets tell me that we’ll see an overshoot to $3,000 and beyond.

And I expect that to happen in the first half of 2025.

If gold soars this way, what do you think that will do to select gold mining stocks?

Zoom-zoom-ZOOM!

The GLD, which I mentioned earlier, is an easy way to play this move. If you want exposure to stocks, the VanEck Gold Miners ETF (GDX) owns a basket of leading gold miners. Or you can drill down to individual miners for more risk but potential outperformance.

Gold demand is rising, and gold prices are on the launchpad. Be sure you have your golden ticket before blast-off!

All the best,

Sean Brodrick

P.S. Speaking of investments on the launchpad, did you attend yesterday’s Private Investment Summit? Chris Graebe is exploring a pre-IPO company. One whose space tech is ideally positioned to disrupt Elon Musk’s $200B monopoly. Click here to learn about this potential SpaceX beater. And I suggest laser-focusing on what happens at the 15-minutes and 57-seconds mark.